🌍 Global Top 20 Container Ports: First Half of 2024 Overview

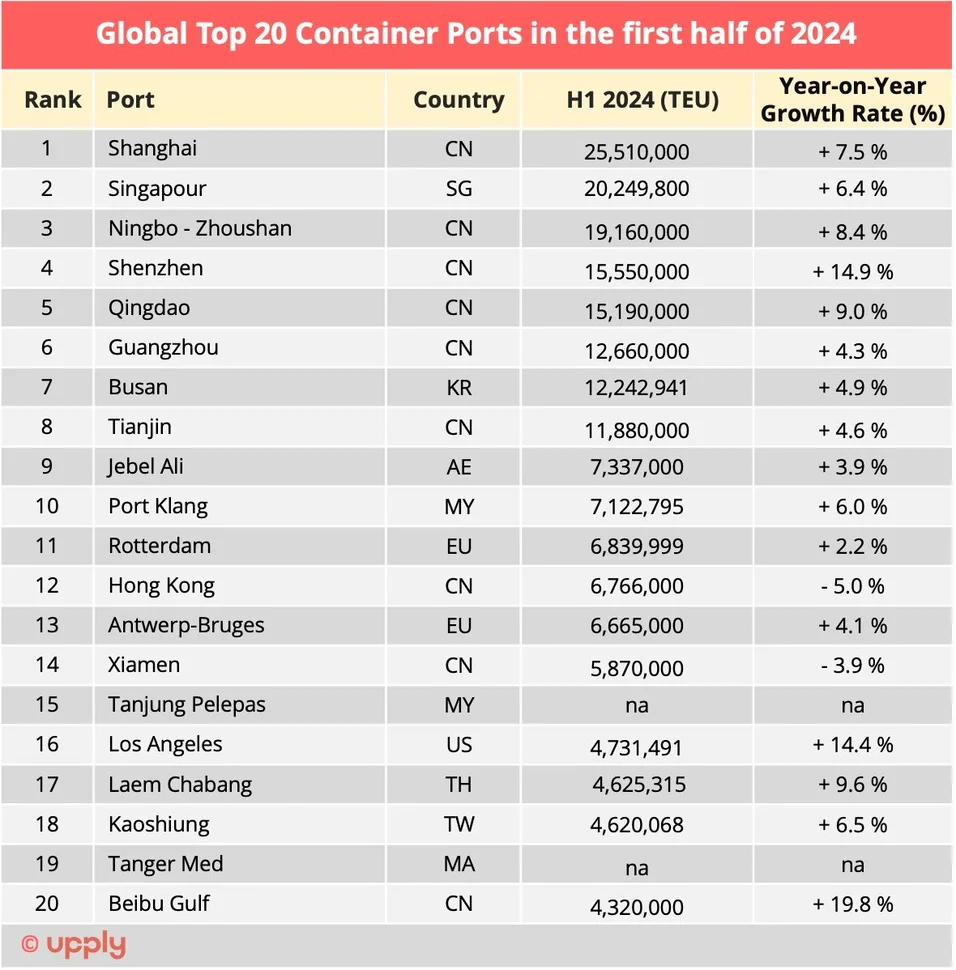

The majority of the world’s top 20 container ports reported positive growth in the first half of 2024. Notably, Chinese ports continued to dominate, occupying four of the top five positions. Shanghai maintained its lead with a 7.5% year-on-year increase, handling 25.5 million TEUs. Singapore followed closely, processing 20.2 million TEUs, reflecting a 6.4% rise .

However, not all ports fared equally. Hong Kong and Xiamen were exceptions, with Hong Kong dropping out of the top 10 due to a 3.9% decline in throughput, and Xiamen experiencing a 3.9% decrease . Conversely, Shenzhen and Los Angeles showcased impressive growth, with Shenzhen leading among Chinese ports and Los Angeles achieving a 14.7% increase when combined with Long Beach .

1/The global Top 20

Data source: Upply

2/ China’s Top 10

Chinese ports continued to assert their dominance in global maritime trade, with a collective throughput of 161.8 million TEUs in the first half of 2024, marking an 8.5% year-on-year increase .

-

Shanghai: Maintained its position as the world’s busiest container port, handling 25.5 million TEUs, a 7.5% increase from the previous year.

-

Ningbo-Zhoushan: Processed 19.2 million TEUs, reflecting an 8.4% growth.

-

Beibu Gulf: Achieved a remarkable 19.8% increase in container volumes, totaling 4.3 million TEUs, benefiting from its strategic location facilitating trade between Western China and Southeast Asia .

These figures underscore China’s pivotal role in global shipping and its continued investment in port infrastructure to accommodate growing trade demands.

Data source: Upply

3/ European Top 10

European ports exhibited moderate growth in the first half of 2024, with cumulative container traffic reaching approximately 65 million TEUs, marking a 5.7% increase from the previous year .

-

Rotterdam: Remained Europe’s largest container port, handling over 13 million TEUs, with a modest growth of 2.4%.

-

Antwerp-Bruges: Surpassed Rotterdam in growth rate, recording a 4.1% year-on-year increase.

-

Hamburg: Experienced a slight decline of 0.3%, offset by a significant 12.8% increase in Bremerhaven

Southern European ports benefited from rerouted shipping lanes due to disruptions in the Suez Canal. Valencia and Barcelona reported substantial growth, with Barcelona’s throughput increasing by 23.6% . Gioia Tauro also saw an 11.9% rise in container volumes. In contrast, Piraeus faced a 7.8% decline, attributed to reduced traffic through the Suez Canal

Data source: Upply

4/ US Top 10

U.S. ports experienced a remarkable recovery in the first half of 2024, with the top 10 ports collectively handling 51.3 million TEUs, a 13.1% increase compared to the same period in 2023 .

-

Los Angeles/Long Beach: This port complex led the growth, with a combined throughput nearing 20 million TEUs, up 19.8% year-on-year.

-

Seattle/Tacoma (NWSA): Reported a 12.3% increase in overall container volumes, driven by a 19.6% rise in import TEUs .

East Coast ports also demonstrated positive trends, despite labor negotiations and potential strikes. The anticipation of additional customs tariffs prompted importers to expedite orders, contributing to the sustained growth in container traffic

Data source: Upply

📊 Conclusion: A Promising Outlook for Global Container Ports

The first half of 2024 has been marked by a significant rebound in global container port activity, driven by increased consumer demand, strategic rerouting of shipping lanes, and substantial investments in port infrastructure. While challenges such as labor disputes and geopolitical tensions persist, the overall trajectory indicates a resilient and adaptive global maritime trade network poised for continued growth in the latter half of the year.