The Renminbi has officially overtaken the US Dollar in China’s trade settlements. Explore the data and implications of this historic shift in global finance and the start of de-dollarisation.

A Historic Shift: The Renminbi Overtakes the US Dollar in China’s Trade

A seismic shift is underway in the architecture of global finance. For decades, the US dollar (USD) has reigned supreme as the world’s primary currency for trade and reserves. However, new data confirms a pivotal turning point: the Chinese renminbi (RMB) has surpassed the dollar as the dominant currency for settling China’s own cross-border trade.

This isn’t just a minor statistical blip; it’s the most concrete signal yet of a structural move towards de-dollarisation, a process that could redefine economic power dynamics for years to come.

The Data: A Story of Two Currencies

The trends, visualized in the chart above, tell a compelling story of a gradual but decisive transition over the past 15 years.

-

The Meteoric Rise of the Renminbi: In 2010, the RMB accounted for a negligible 0.3% of China’s cross-border payments and receipts. Fast forward to 2023, and its share has skyrocketed to a commanding 52.9%. This represents an increase of over 170 times in just over a decade.

-

The Decline of the Dollar’s Dominance: Conversely, the share of trade settled in USD has seen a substantial decline. Once the undisputed medium of exchange, the dollar’s portion of China’s trade settlements has fallen to 42.8%, now placing it second to the RMB.

The Tipping Point: March 2023

March 2023 marked a historic milestone. For the first time on record, the renminbi overtook the USD in China’s trade settlements. This moment is symbolic of China’s strategic, long-term effort to internationalise its currency and reduce its dependency on the US dollar system.

–

What is Driving China’s De-dollarisation?

This strategic shift away from the dollar is not accidental. It is driven by a combination of factors:

-

Geopolitical Strategy: Reducing reliance on the dollar insulates China from potential US financial sanctions and policy decisions. Recent global tensions have accelerated this desire for monetary sovereignty.

-

Internationalisation of the RMB: China has actively promoted the use of the renminbi through currency swap agreements with other central banks and the development of its own cross-border payment system, CIPS.

-

Trade Partnerships: China is increasingly encouraging its trading partners, particularly in commodities and emerging markets, to settle transactions in RMB, bypassing the dollar entirely.

-

Domestic Efficiency: For Chinese companies, settling trade in their home currency eliminates foreign exchange risk and reduces transaction costs.

–

What Does This Mean for the Global Economy?

While the US dollar is not about to lose its status as the world’s leading reserve currency overnight, the rise of the RMB signals a fundamental change.

-

A Multipolar Currency System: The world is slowly moving towards a system where multiple currencies, including the RMB and the Euro, play more significant roles alongside the dollar.

-

Reduced US Financial Leverage: As more trade is conducted outside the dollar, the US’s ability to use its currency as a tool of foreign policy may diminish.

-

New Opportunities and Risks: For international businesses and investors, this shift creates new opportunities in Chinese financial markets but also introduces new complexities regarding currency risk and regulatory landscapes.

China’s gold stock levels have surged, hitting record highs in 2025. Discover the strategic drivers behind this accumulation and what it means for the Yuan and global finance.

The Silent Accumulation: Decoding China’s Strategic Gold Rush

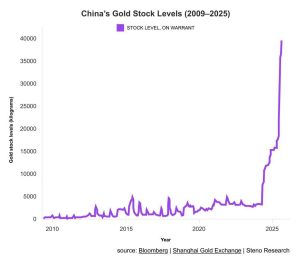

While headlines often focus on currency markets and trade deficits, a quieter, more profound strategic shift has been unfolding in the background. Data from the Shanghai Gold Exchange reveals a consistent and accelerating accumulation of gold, with stock levels on warrant projected to reach new record highs by 2025.

This isn’t a speculative gamble; it’s a calculated, long-term strategy with significant implications for the global financial order and the Chinese yuan’s international role.

The Data: A Steady Climb Turns into a Surge

The chart, sourced from Bloomberg and Steno Research, illustrates a clear and powerful trend in China’s gold stockpiling:

-

The Foundation Phase (2010-2020): Starting from a relatively low base, China’s gold stock levels began a steady, consistent climb. This period laid the groundwork for a more assertive strategy.

-

The Acceleration Phase (2020-2025): The trendline steepens dramatically post-2020. The accumulation pace intensified, moving from gradual growth to a sharp upward trajectory, pointing towards a strategic decision to rapidly bolster gold reserves.

This visual narrative underscores a deliberate policy: China is not just buying gold; it is accelerating its purchases at a pivotal moment in geopolitics.

Why is China Stockpiling Gold at an Accelerating Pace?

The motives behind this “gold rush” are multifaceted and deeply strategic, aligning perfectly with its broader economic goals.

1. Diversifying Away from the US Dollar

Gold is the ultimate non-dollar asset. By converting a portion of its massive foreign exchange reserves (heavily weighted in US Treasuries) into gold, China systematically reduces its exposure to US fiscal policy and potential sanctions. This is a tangible, physical form of de-dollarisation.

2. Bolstering the International Yuan (RMB)

For a currency to be considered a true global reserve currency, it must be seen as stable and trustworthy. A massive gold stockpile provides a bedrock of confidence. It backs the yuan with a tangible, historically proven store of value, enhancing its appeal for international trade and central bank reserves—a process known as currency internationalisation.

3. Geopolitical Insurance and Sovereignty

In an era of rising geopolitical tensions, gold offers a form of financial sovereignty. It is an asset held directly, outside the control of any other nation’s government or financial system. This provides a critical hedge against systemic financial risks.

4. A Hedge Against Global Uncertainty

With global inflation, debt levels, and economic uncertainty on the rise, gold’s traditional role as a safe-haven asset is more relevant than ever. China’s accumulation is a prudent hedge against global macroeconomic instability.

–

The Bigger Picture: Connecting Gold to De-dollarisation

This strategy cannot be viewed in isolation. When combined with the recent milestone of the renminbi surpassing the US dollar in China’s cross-border trade, a clear master plan emerges.

- Promote the Yuan in Trade: Increase the use of RMB for settling international transactions.

- Back the Yuan with Gold: Build a formidable gold reserve to instill confidence and validate the yuan’s value, making it a more attractive asset for other nations to hold.

This two-pronged approach creates a positive feedback loop, steadily eroding the dollar’s dominance and building the foundation for a multipolar currency system.

–

Implications for the Global Financial System & Future Outlook

China’s accelerating gold acquisition sends a powerful message to the world:

- A Shift in Financial Power: It signals a move towards a global financial system less centralized around the US dollar.

- Rising Demand for Gold: Sustained buying from one of the world’s largest economies provides a strong, structural floor for gold prices.

- A New Benchmark for Reserves: Other emerging economies may be encouraged to follow suit, increasing their own gold reserves as a pillar of financial security.

China’s rising gold stock levels are more than just a line on a chart; they are a barometer of strategic intent. This accelerated accumulation is a critical piece of the puzzle in understanding China’s long-term goal: to reshape the global financial architecture and secure its economic future on its own terms. For investors, central banks, and market observers, ignoring this steady, silent accumulation is to miss one of the most significant financial stories of the decade.

The data is clear: de-dollarisation is no longer a theoretical concept but a measurable reality, at least within China’s vast trade network. The renminbi’s ascent to become the leading currency for China’s cross-border settlements is a landmark event with profound and long-lasting implications for global trade, finance, and geopolitics.

Read more here:

China Strikes Back: Charging Port Fees on U.S. Ships, Exempts China-Built Ones

Thanks for sharing your knowledge. This added a lot of value to my day.

Tahnks alot.

Thank you for sharing this! I really enjoyed reading your perspective.

You are welcome. The global center of economic gravity is steadily shifting, and a multipolar system with Asia at the forefront seems inevitable.

Thank you. Indeed, the power of USA with the dominance of US dollar in global trade and transport is declining, and the world will experience a new era of multi poles with leadership of ASIA.

Yes. A significant shift is underway. Asia’s rising economic influence is indeed reshaping global dynamics towards a multipolar world.

Thank you for providing such accurate information to others.

Thank you for providing such accurate information to others.