Explore how surging oil prices and a potential Strait of Hormuz blockade could reshape China’s maritime strategy, economy, and global trade routes. A comprehensive, insightful guide for maritime professionals, students, and global readers.

Why the Topic Matters for Maritime Professionals

Imagine this: the engine room of the world’s biggest trading nation running short of oil, with tankers stalled, ports delayed, and shipping lines forced into emergency rerouting. That is not a far-fetched scenario if oil prices surge dramatically or the vital Strait of Hormuz faces a blockade. For China, the world’s largest crude importer — responsible for over 10.8 million barrels per day (UNCTAD, 2024) — any shock in oil price or maritime choke point disruption could send ripples across not only its economy but the global maritime industry.

This topic is critical because nearly 40% of China’s seaborne oil passes through the Strait of Hormuz, one of the world’s most strategically sensitive waterways. A blockade there, or dramatic price spikes in oil, would force China’s shipping, energy, and port industries to adapt rapidly, triggering policy shifts with wide implications for global maritime operations.

In this article, we will explore in depth how China — and the wider maritime industry — might be impacted by an oil shock or a Hormuz disruption, with a human-centered narrative that speaks to maritime professionals, students, and enthusiasts alike.

China’s Energy Dependence: Why It Is So Vulnerable

China’s phenomenal industrial growth has made it the world’s second-largest economy. But this economic engine is thirsty: the International Energy Agency (IEA, 2023) notes that China relies on imports for more than 70% of its oil needs.

Vast volumes of these imports arrive by sea, in tankers steaming from the Persian Gulf, often passing through the Strait of Hormuz — a narrow bottleneck just 33 km across at its narrowest point (Encyclopaedia Britannica, 2024). This geographical pinch-point handles about 20% of global oil flows daily, according to Lloyd’s List Intelligence.

In other words, the Strait of Hormuz is the maritime equivalent of a main artery for China’s energy security. Block that artery — or force its cargoes to detour thousands of nautical miles — and China could see:

- shipping insurance costs skyrocket

- fuel for transport and power generation rationed

- maritime supply chains snarled

- inflationary pressures driving up consumer prices

Chinese refiners, shipowners, and even ports would all feel the impact within weeks, if not days.

The Surging Oil Price Threat: More Than Just Higher Bunkers

When oil prices rise, the average maritime observer might think first of bunker fuel for ships. Yes, that cost is vital — a typical ultra-large crude carrier (ULCC) burns 50–100 metric tonnes of fuel per day (Marine Insight, 2024). A $20/barrel jump in crude prices could translate into a $500,000–$1,000,000 higher fuel bill per voyage on long-haul routes.

But the bigger picture goes further:

✅ Chinese manufacturing depends on oil-linked inputs (plastics, fertilizers, transport).

✅ Domestic inflation is tied to oil prices through food and goods distribution.

✅ The Chinese shipping sector itself, one of the largest globally, must pass on these higher costs to cargo owners, risking price-sensitive customers leaving.

According to BIMCO’s shipping market review (2024), a 30% spike in oil prices typically pushes container shipping operating costs up by at least 15% due to both bunker costs and higher supply chain energy demands.

China’s ports, from Shanghai to Shenzhen, would see the knock-on effects as cargo patterns shift, demand softens, or — ironically — surges with panic buying of commodities.

Strait of Hormuz: Why This Chokepoint Terrifies China

Picture a maritime funnel with the Persian Gulf on one end and the Arabian Sea on the other. That’s the Strait of Hormuz. At its tightest, only two miles of navigable water separate inbound and outbound lanes.

The strategic stakes are enormous:

🛢 20% of world oil passes through Hormuz (IMO data, 2024)

🛢 China alone takes in around 45% of Persian Gulf oil exports

🛢 Over 80% of Chinese oil tankers pass through this route

In the worst-case scenario of a blockade, Chinese importers would have to scramble for alternative supplies, possibly West African or Russian cargoes, but at a huge premium. Diversion routes around the Cape of Good Hope add nearly 6,000 nautical miles to voyages — meaning longer transits, higher insurance premiums, and massive bunker fuel costs.

Beyond tankers, bulkers carrying petrochemicals, fertilizers, and even LNG vessels could also be stranded or forced into risky re-routing. The cascading effect on China’s industrial production, which feeds the world’s manufacturing orders, could trigger a global maritime trade slowdown.

Recent Tensions in the Strait of Hormuz

This is not just a theoretical problem. In the past five years, there have been at least six major incidents of tanker harassment or seizure in or near Hormuz (Maritime Executive, 2023). Military exercises, drone attacks, and political standoffs have all shown how vulnerable this route is.

UNCTAD’s Review of Maritime Transport (2023) warned that the Strait of Hormuz remains the most likely maritime chokepoint to face disruption due to its geopolitical volatility.

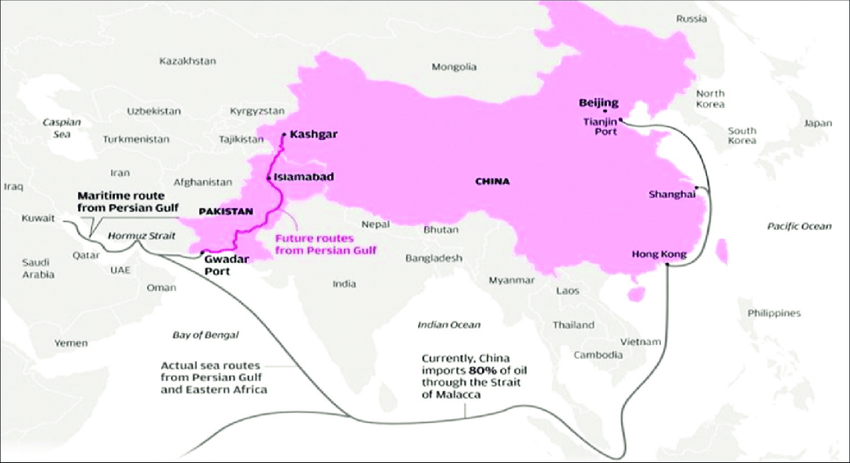

China has tried to hedge against these risks by:

-

investing in pipelines through Pakistan (China-Pakistan Economic Corridor)

-

boosting ties with Russia for overland oil imports

-

expanding its strategic petroleum reserves

…but none of these measures fully replace the sheer volume that arrives through Hormuz.

How a Hormuz Disruption Would Reshape China’s Shipping

A blockade or attack in Hormuz would spark a maritime domino effect. China’s shipowners, charterers, ports, and even shipyards would all have to pivot overnight. Let’s break it down:

Shipowners & Charterers

- forced to bid for ships on less risky routes

- pay higher war-risk insurance premiums

- negotiate emergency contracts with alternative suppliers

Ports & Terminals

- unpredictable berthing schedules due to rerouted vessels

- congestion at Chinese ports as tankers scramble for delivery slots

- lower throughput if domestic refineries slow down

Shipyards & Bunker Suppliers

- potential rise in demand for LNG retrofits or dual-fuel ships

- opportunistic bunkering players shifting supply to alternative hubs

According to DNV’s Maritime Forecast 2024, about 35% of China’s coastal bunkering capacity relies directly on Persian Gulf oil. That means any squeeze in Hormuz could see bunker shortages rippling through Chinese ports within days.

China’s Strategic Support for Iran: Ensuring Stability and Countering Rivals

To prevent a disruptive Hormuz Strait blockade, China must actively promote regional stability by strengthening Iran both economically and militarily. This approach serves multiple strategic objectives:

1. Iran’s Strategic Position & Retaliation Risks

- Iran considers a Hormuz blockade a last-resort retaliation against potential U.S. or Israeli military actions.

- A stronger Iran (economically and militarily) reduces Tehran’s reliance on extreme measures, ensuring uninterrupted oil flows critical for China.

2. How China Can Mitigate the Risk

- Economic Support: Expanding trade, investment, and energy deals to reduce Iran’s isolation and economic vulnerabilities.

- Military Cooperation: Modernizing Iran’s defenses to deter foreign aggression, lowering the risk of conflict escalation.

- Diplomatic Mediation: Using China’s influence to de-escalate tensions between Iran and its adversaries, preventing a regional crisis.

3. Aligning with China’s Belt and Road Initiative (BRI) & Countering IMEC

Supporting Iran directly benefits China’s Belt and Road Initiative (BRI), as Iran is a crucial transit hub connecting Asia to Europe. Strengthening Tehran ensures:

- Secure BRI routes, protecting China’s infrastructure investments and trade corridors.

- Countering the India-Middle East-Europe Corridor (IMEC), a U.S.-backed initiative designed to bypass China’s economic influence.

- Expanding China’s geopolitical leverage in the region, reducing Western dominance.

By bolstering Iran’s stability, China not only prevents a Hormuz crisis but also reinforces its own economic and strategic interests in Eurasia.

Real-World Example: The 2019 Tanker Crisis

A vivid case study comes from 2019, when a series of tanker seizures and drone attacks near Hormuz rattled markets. Chinese VLCC charter rates jumped by nearly 40% in just two weeks (Clarksons Research, 2020). Oil prices surged, and China’s importers scrambled to secure cargoes with longer lead times and higher premiums. At the same time, major Chinese ports such as Ningbo-Zhoushan reported a 9% dip in crude arrivals over the following month (Marine Traffic, 2019 data). These figures show how quickly the maritime sector can go from business-as-usual to crisis mode.

Challenges China Will Still Face

No matter the technology or policy shift, a Hormuz disruption will always carry pain points:

- higher shipping and bunkering costs

- extended voyage times

- possible political backlash if China is seen to ally too closely with controversial regional powers

- limits on its storage and rerouting capacity

As the International Chamber of Shipping (ICS, 2024) emphasizes, global maritime trade is interconnected. A shock to one artery eventually constricts the entire global system.

Future Outlook: Will China Become Less Dependent?

Many maritime analysts wonder if China can ever free itself from the Persian Gulf. The answer is complex. Alternative energy, renewables, and green shipping can certainly help, but the International Energy Agency still forecasts 40% of China’s energy mix will rely on oil by 2040 (IEA, 2024).

This means Hormuz will remain crucial for decades. However, China’s maritime planners are investing billions in “resilience,” from pipeline diplomacy to port modernization. Over the next decade, expect:

✅ more dual-fuel ships

✅ more diversified crude sourcing

✅ tighter port security cooperation

✅ digital scheduling tools to manage crisis flows

It is a future shaped by lessons painfully learned, but one where maritime professionals will play a frontline role in keeping global trade afloat.

Frequently Asked Questions

Why does the Strait of Hormuz matter so much to China?

Because nearly 40% of China’s imported oil comes through it, and there are few cost-effective alternatives that can match those volumes.

How would higher oil prices hit China’s maritime sector?

Higher oil prices raise bunker costs, shipping rates, and port fees, which means higher prices for Chinese manufacturers and eventually global consumers.

Can pipelines replace Hormuz?

Not fully. Pipelines from Russia, Central Asia, or Myanmar help diversify supplies but cannot match the sheer volume of tankers moving through Hormuz.

What would happen to Chinese ports in a Hormuz crisis?

Ports could see unpredictable schedules, congestion, or even a drop in throughput if refineries run out of feedstock.

Is there a risk to container shipping too?

Yes. While containers do not carry crude, they rely on bunker fuel, so higher oil prices and regional conflicts could disrupt global container schedules.

How fast would the crisis impact China?

Possibly within days for bunkering, and within weeks for refinery feedstock — the maritime chain is tightly interlocked.

Are there international efforts to secure Hormuz?

Yes, multinational naval coalitions regularly patrol the area, but the risk cannot be fully eliminated.

Conclusion

China’s dependence on Persian Gulf oil, combined with the vulnerability of the Strait of Hormuz, creates a uniquely fragile maritime trade lifeline. If prices surge or the strait is blocked, the knock-on effects could test every link in China’s vast supply chain — from shipowners to ports, from manufacturers to end consumers.

Yet China is not entirely helpless. Through strategic reserves, pipeline diversification, green ship technologies, and digital tools, the country is trying to build a more resilient maritime system.

For maritime professionals and students around the world, this is a living case study of how geopolitical risks and maritime trade are woven together. The lessons will be critical for the next generation of shipping officers, naval architects, port operators, and supply chain managers.

Maritime professionals, stay sharp: the next surge in oil prices or a sudden chokepoint crisis could be around the corner, and those prepared with knowledge will keep world trade moving. 🌏