The Global Importance of Gulf LNG Exports

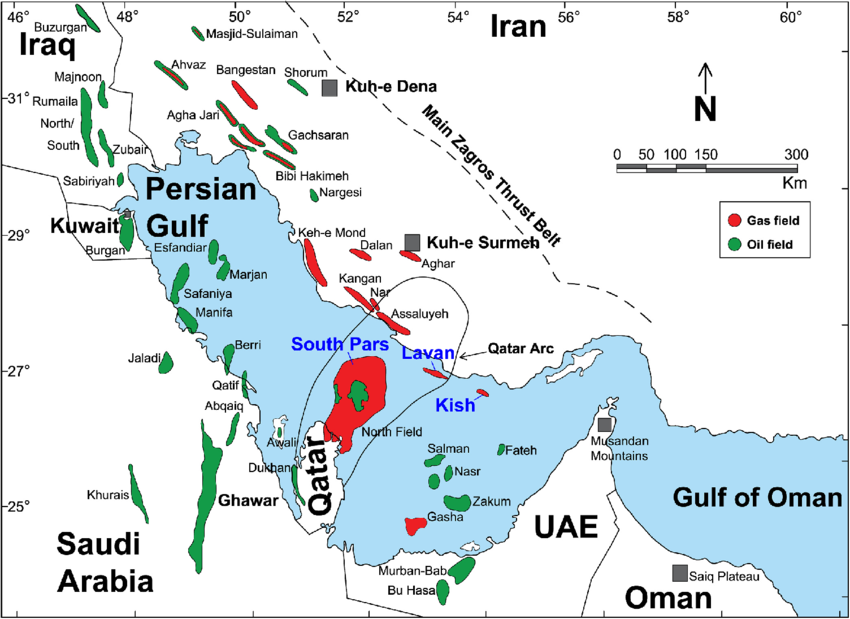

The Strait of Hormuz is a narrow maritime corridor linking the Persian Gulf with the Arabian Sea. Just 21 nautical miles wide at its narrowest point, it is the only sea route for the export of hydrocarbons from Qatar, Iran, the UAE, and parts of Saudi Arabia. According to the U.S. Energy Information Administration (EIA), about 25% of globally traded LNG and a significant share of regional gas exports pass through the Strait daily (EIA, 2023).

If gas and LNG tankers are entirely blocked from passing through the Strait, the consequences for global energy security, economic stability, and climate policy would be immediate and far-reaching.

The South Pars/North Dome field is a natural-gas condensate field located in the Persian Gulf. It is by far the world’s largest natural gas field, with ownership of the field shared between Iran and Qatar.

1. Qatar’s LNG Exports: The Core Risk

Qatar: The World’s Second-Largest LNG Exporter

-

Qatar exported 79.9 million metric tonnes (MT) of LNG in 2023, second only to the U.S. (IGU, 2024).

-

Nearly all of Qatar’s LNG is shipped through the Strait of Hormuz from its Ras Laffan terminal, the largest single gas export facility in the world.

-

Main customers include Japan, South Korea, China, India, Pakistan, and Europe (especially post-Ukraine crisis).

What Happens If Qatar’s LNG is Cut Off?

-

Asia-Pacific countries, which rely on Qatari LNG to power homes and industry, would face severe energy shortages.

-

Pakistan, already on the edge of energy collapse, could suffer widespread blackouts.

-

India’s gas-fired power and fertilizer sectors would face fuel insecurity, affecting agriculture and food prices.

Europe, too, would be hit. In 2023, Qatar provided 13–15% of Europe’s LNG imports, crucial after the loss of Russian pipeline gas (European Commission, 2023).

2. Supply Shortages and Price Volatility

Global LNG Market Disruption

The LNG market operates on long-term contracts but also depends heavily on spot trades. In 2022, after Russia’s invasion of Ukraine, spot LNG prices on the JKM (Japan-Korea Marker) spiked to over $70 per million BTU, causing global panic (S&P Global, 2022).

A total Gulf blockade would:

-

Remove nearly 20% of global LNG supply from the market.

-

Push spot prices to unprecedented levels, possibly over $100 per MMBtu, triggering recession risks in Asia.

-

Lead to emergency LNG bidding wars, with wealthier nations outcompeting poorer importers.

Regional Gas Shortages and Rationing

-

Bangladesh, India, Pakistan, and Sri Lanka could be forced into gas rationing, industrial closures, and reliance on expensive oil for power.

-

Thailand and Vietnam, planning to expand LNG use, would need to defer infrastructure investments.

-

Europe, even with increased U.S. and African LNG imports, could not fully replace Gulf volumes without major demand reduction or coal fallback.

3. Power Generation, Industry, and Agriculture at Risk

Electricity and Heating Blackouts

-

In many Asian countries, LNG fuels peak-load power plants, essential for urban areas.

-

Without gas, power companies would either switch to coal and diesel or cut electricity entirely.

-

Europe’s winter heating would face a crisis, especially in countries like Germany, Italy, and the Netherlands, still dependent on imported gas for district heating systems.

Petrochemical and Fertilizer Production Halted

-

Gulf LNG and pipeline gas feed regional urea, ammonia, and methanol plants.

-

A supply freeze would stall global fertilizer production, affecting grain and rice output in India, Indonesia, and Africa.

-

Chemical industries in Germany, China, and the Gulf itself would be forced to suspend operations or pass on major cost increases to consumers.

4. Strategic and Military Tensions

Iran and the Strait of Hormuz Threat

Iran has repeatedly threatened to close the Strait in response to sanctions or military pressure, most recently during the 2019 tanker seizures and 2020 Qassem Soleimani assassination aftermath (Reuters, 2020).

A blockade could be initiated via:

-

Naval mines, fast-attack boats, or anti-ship missiles along the Iranian coast.

-

Targeted attacks on LNG infrastructure (e.g., Ras Laffan, UAE’s Jebel Ali port).

-

Use of Houthi or proxy forces to harass tankers or choke Red Sea lanes.

U.S. and Allied Military Intervention

The U.S. Navy’s Fifth Fleet, based in Bahrain, would likely initiate Operation-level responses to secure gas and LNG traffic. But:

-

Conflict would raise shipping insurance premiums by 300–500% (Lloyd’s, 2023).

-

LNG carriers, more fragile and dangerous than crude oil tankers, would face severe transit delays or rerouting around the Cape of Good Hope.

-

Any miscalculation could trigger full-scale regional war involving Iran, Israel, Saudi Arabia, and U.S. forces.

5. Climate and Energy Transition Backlash

Coal Comeback?

In the absence of LNG, many countries would fall back on coal—the most carbon-intensive fossil fuel—to meet baseload electricity demand. This would:

-

Set back global climate goals under the Paris Agreement.

-

Increase air pollution and health costs, especially in urban India and Southeast Asia.

-

Undermine COP commitments and reduce public trust in clean energy transitions.

Renewables Not Yet Ready

While wind, solar, and battery storage are growing, they cannot instantly scale to replace LNG baseload capacity. Storage limitations, intermittency, and infrastructure bottlenecks mean that LNG remains a “bridge fuel”—a bridge that would collapse under blockade conditions.

6. Global Strategic Realignments

LNG Diversification and Infrastructure Acceleration

-

Europe would fast-track regasification terminals (FSRUs) and pivot harder toward U.S., Nigerian, and Algerian LNG.

-

Asia would explore new suppliers like Mozambique, Australia, Papua New Guinea, but capacity limits and long lead times apply.

-

China and India might re-prioritize domestic coal, nuclear, and pipeline gas from Russia and Central Asia.

Long-Term Impact on Global LNG Markets

-

Prices would become more volatile and geopolitically driven, rather than demand-supply balanced.

-

Insurance and tanker chartering costs for Middle East cargoes would remain elevated even after a temporary resolution.

-

LNG may lose its appeal as a “stable energy transition fuel,” pushing countries to redefine national energy strategies.

Conclusion: A Ticking Time Bomb for Global Energy Security

A complete blockade of LNG and natural gas exports from the Persian Gulf through the Strait of Hormuz would be catastrophic. It would lead to blackouts in Asia, fertilizer and food crises, LNG bidding wars, and a potential return to coal dependence. The geopolitical risk would not only affect the energy sector but could trigger a chain reaction involving global inflation, recession, and even military conflict.

The world remains dangerously reliant on a narrow chokepoint for energy stability. While diplomatic efforts and diversification continue, the Strait of Hormuz remains a single point of failure in the global gas system—a vulnerability that no country can afford to ignore.

References

-

U.S. Energy Information Administration (2023). Strait of Hormuz: The World’s Most Important Oil and Gas Chokepoint

-

International Gas Union (2024). World LNG Report

-

European Commission (2023). LNG Supply Diversification After Ukraine

-

S&P Global (2022). LNG Spot Market Trends Post-Russia Sanctions

-

Lloyd’s of London (2023). War Risk Premiums and LNG Shipping

-

Reuters (2020). Iran Threatens Strait of Hormuz Closure