08/28/2025

Navigating Uncharted Waters

The global shipping industry is undergoing a significant transformation in response to the United States’ aggressive tariff policies and upcoming port fees targeting Chinese-built vessels. As trade dynamics shift, major alliances are restructuring their operations to mitigate financial impacts and maintain competitiveness.

The global shipping industry is undergoing a significant transformation in response to the United States’ aggressive tariff policies and upcoming port fees targeting Chinese-built vessels. As trade dynamics shift, major alliances are restructuring their operations to mitigate financial impacts and maintain competitiveness.

This article explores the latest developments, including strategic changes by the Premier Alliance, broader implications for global trade, and the economic repercussions of the U.S. tariff strategy.

Premier Alliance Splits MS2 Service to Evade U.S. Fees

The Premier Alliance, comprising HMM, Ocean Network Express (ONE), and Yang Ming, has announced the splitting of its Mediterranean Pacific South 2 (MS2) pendulum service into two separate routes. This strategic move aims to remove 10 Chinese-built vessels from U.S. routes ahead of the U.S. Trade Representative (USTR) port fees scheduled to take effect in October 2025.

The new Asia-Mediterranean 2 (MD2) service will focus exclusively on trade between Asia and the Mediterranean, with port rotations including Pusan, Shanghai, Valencia, and Genoa. Simultaneously, the Middle East Gulf-US Gulf Pacific South 2 (GS2) service will connect the Middle East and Asia to the U.S. Gulf, integrating segments of the former MS2 and AG1 services. This restructuring allows ONE to avoid higher fees imposed on Chinese-built ships but may increase operational costs due to the loss of efficiency previously achieved through pendulum services.

Overview of U.S. Tariff Policies and Port Fees

The U.S. has implemented a series of tariffs and fees aimed at reducing dependence on Chinese manufacturing and strengthening domestic industries. Recent measures include reciprocal tariffs on goods from countries like India with additional duties of up to 25%, while Canadian goods face 35% tariffs (excluding USMCA-qualified goods). Section 232 tariffs have imposed duties as high as 50% on steel, aluminum, and copper products.

The upcoming port fees specifically target Chinese-built vessels, reflecting Washington’s broader strategy to counter China’s shipbuilding dominance. Starting October 2025, the USTR will impose these fees on ships connected to China, which has already prompted carriers to reassess vessel deployments and charter arrangements.

Broader Industry Responses and Implications

Carriers are implementing various strategies to adapt to the new tariff environment. OOCL, controlled by Chinese COSCO, has cautioned that the new fees could have a “relatively large” impact on its operations, potentially forcing significant route diversifications. Throughout the industry, Chinese-built vessels are being redirected to non-U.S. routes, particularly to Africa and South America, reducing available capacity for U.S.-focused trade.

These developments are driving increased shipping costs that are likely to be passed on to consumers through higher prices for goods. Additionally, tighter customs checks and regulatory changes are causing delays at U.S. ports, further complicating global logistics and supply chain management.

U.S. Tariff Policies and International Framework Violations

The U.S. tariff strategy has sparked significant controversy regarding its alignment with international trade rules and frameworks. Critics argue these measures violate principles upheld by the World Trade Organization and other multilateral agreements. The legal foundation of these tariffs has been questioned, particularly the use of national emergency powers and the International Emergency Economic Powers Act to justify reciprocal tariffs.

The economic damage extends beyond immediate trade disruptions. Major international organizations have downgraded global growth forecasts for 2025, citing U.S. tariffs as a primary factor. Within the United States, consumer prices have risen significantly, driven partly by tariffs on essential goods like clothing and appliances.

De-dollarization: Accelerating Shift from USD in Global Trade

The unilateral nature of U.S. trade measures is accelerating a strategic shift away from the U.S. dollar in international transactions. Numerous countries are increasingly exploring alternatives to dollar-denominated trade, concerned about their exposure to U.S. policy changes and financial sanctions.

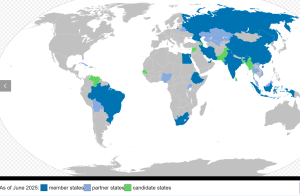

This de-dollarization trend is manifesting through several developments. The BRICS nations (Brazil, Russia, India, China, and South Africa) have been actively promoting the use of national currencies in bilateral trade settlements. China has significantly expanded the international use of the yuan, particularly in energy transactions and commodity trading. The European Union has been advocating for greater use of the euro in international transactions, especially following the implementation of various U.S. trade measures.

Even cryptocurrency platforms are being explored as potential alternatives for settling cross-border transactions, particularly by countries facing restrictions from the dollar-dominated global financial system. In the shipping and transportation sectors, there’s growing interest in alternative payment mechanisms that bypass the traditional dollar-based systems, reducing vulnerability to U.S. policy changes.

BRICS members, Credit: https://en.wikipedia.org/wiki/Member_states_of_BRICS

Future Outlook and Industry Adaptation

The shipping industry must navigate a complex landscape of geopolitical and regulatory challenges. Carriers are increasingly constrained by nationality-based restrictions, such as Turkey’s ban on Israeli-linked vessels and Houthi targeting policies, which complicate optimal vessel deployment.

Looking ahead, operational innovations will continue as alliances restructure services to avoid high-fee routes, though often at the cost of operational efficiency. If tariffs persist long-term, supply chains could permanently shift away from China, benefiting manufacturing hubs in Southeast Asia and India. The industry may also see increased investment in vessel construction outside of China to avoid future restrictions.

Conclusion

The U.S. tariff policies and port fees are reshaping global shipping dynamics, forcing carriers to adapt swiftly. While these measures aim to protect domestic interests, they risk violating international trade frameworks and exacerbating economic instability. The accelerating de-dollarization trend represents a fundamental shift in global trade mechanics that could have long-lasting implications for international commerce. Industry stakeholders must stay informed and agile to thrive in this evolving environment.

For more updates on global trade and shipping trends, subscribe to our newsletter or follow us on social media.

References:

-

UPS Supply Chain Solutions. (2025). 2025 Tariffs and Their Impact on Global Trade.

-

Linerlytica. (2025). Premier Alliance Splits MS2 Pendulum Service.

-

ONE News. (2024). ONE, HMM, and Yang Ming Confirm Alliance Partnership.

-

USTR. (2025). China Section 301 Tariff Actions and Exclusion Process.

-

J.P. Morgan Global Research. (2025). US Tariffs: What’s the Impact?.

-

Lars Jensen’s LinkedIn Post. (2025). Premier Alliance Adjusts Network.

-

USTR. (2025). Exclusions from China Section 301 Tariffs.

-

U.S. Department of Justice. (2025). Shipping Company Fined $2M for Maritime Pollution Offense.

-

BBC News. (2025). What Tariffs Has Trump Announced and Why?.

-

ONE News. (2025). *Premier Alliance Service Update – MD2 and GS2*.

Somebody essentially lend a hand to make significantly posts I might state That is the very first time I frequented your web page and up to now I surprised with the research you made to create this particular put up amazing Excellent job

Interesting article, thx.

Thanks for the sensible critique. Me and my neighbor were just preparing to do a little research on this. We got a grab a book from our local library but I think I learned more clear from this post. I’m very glad to see such excellent information being shared freely out there.

Really clear internet site, regards for this post.