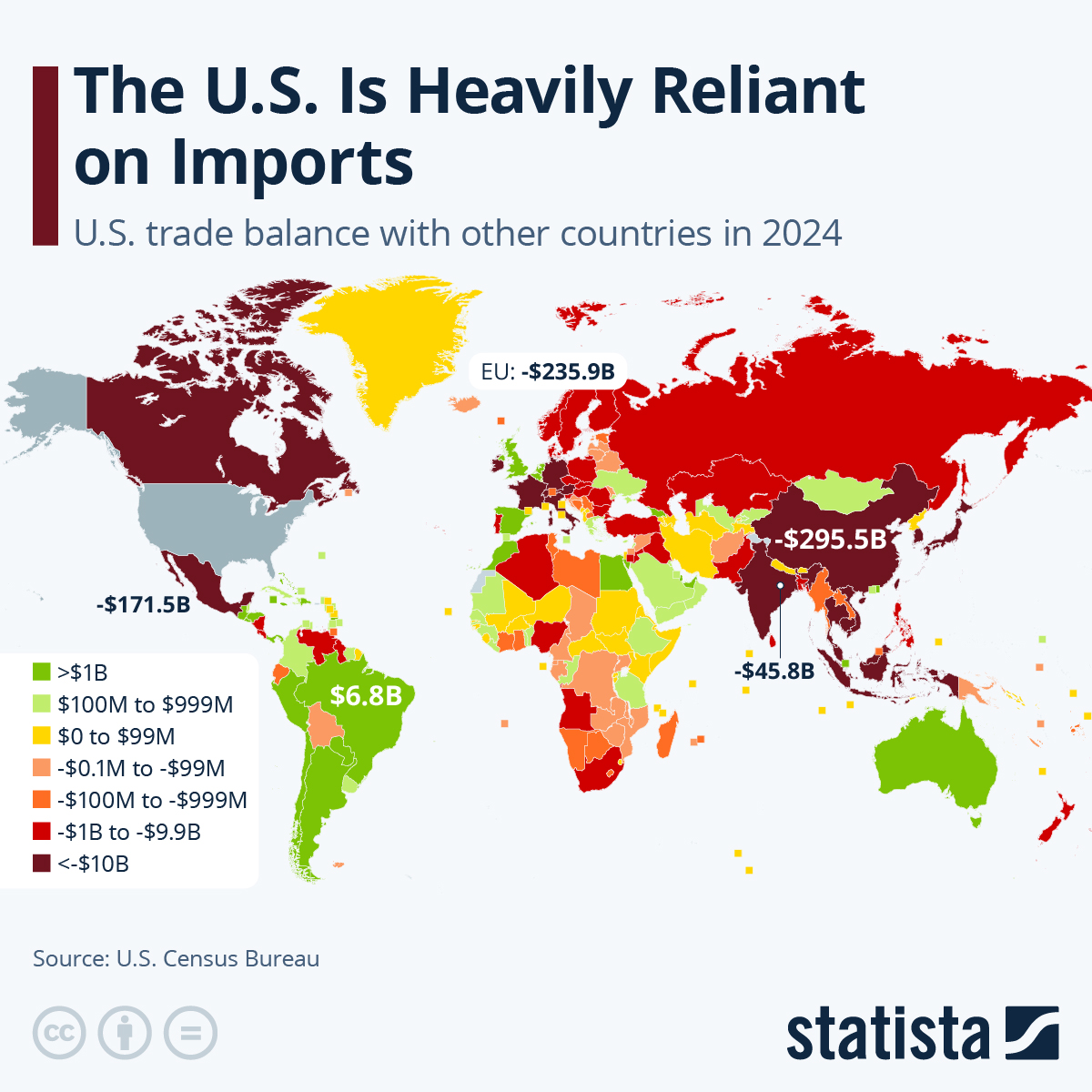

Credit: Statista

The United States has long been a powerhouse in global trade, yet its role is increasingly shaped by one persistent reality: it imports more than it exports. According to U.S. Census Bureau data, the American trade deficit reached $1.44 trillion in 2024, with China, Mexico, and the European Union emerging as the biggest contributors. This imbalance highlights the country’s deep reliance on foreign goods, from electronics and machinery to oil, pharmaceuticals, and consumer products.

Adding to this dynamic, U.S. President Donald Trump’s reinstated tariffs—announced earlier in 2025—have now come into force, raising new questions about how trade politics will reshape global supply chains.

A Deepening Deficit: The Numbers Behind U.S. Trade

The U.S. global trade deficit has been widening steadily, and the numbers from 2024 underscore this reliance:

-

China accounted for the largest share of the gap, with a U.S. trade deficit of $295.5 billion.

-

Mexico, despite its geographic proximity and NAFTA/USMCA ties, came in second with a $171.5 billion deficit.

-

The European Union, as a bloc, added another $235.9 billion to the shortfall.

-

Other significant contributors included Vietnam (-$123.5 billion), Ireland (-$86.5 billion), and Germany (-$84.7 billion).

In contrast, the U.S. recorded trade surpluses with a handful of partners, reflecting strong demand for American goods in select markets. These included the Netherlands ($54.2 billion), Hong Kong ($21.9 billion), the UAE ($19.6 billion), Australia ($17.9 billion), and the UK ($11.4 billion). Brazil also featured on this list, with a surplus of around $7 billion in 2024.

The map (see image above) vividly illustrates this global imbalance, with much of Asia and Europe shaded deep red, signaling heavy U.S. deficits, while parts of Latin America, the Middle East, and Oceania appear in green, indicating American surpluses.

Trump’s Tariff Shockwave

Against this backdrop, President Trump’s decision to raise tariffs has stirred debate. Until recently, most countries faced a minimum 10 percent tariff on exports to the U.S. As of August 2025, more than 60 countries plus the European Union are subject to higher rates, with some facing steep penalties:

-

Brazil now faces the world’s highest U.S.-imposed tariff at 50 percent, a move widely interpreted as retaliation for the prosecution of Trump’s political ally, Jair Bolsonaro.

-

Syria (41 percent), Laos (40 percent), and Myanmar (40 percent) follow closely behind.

-

Even historically strong U.S. economic partners such as Switzerland (39 percent) and Iraq (35 percent) have been targeted.

India has also been singled out, with tariffs set to jump from 25 to 50 percent later in August unless it halts Russian oil purchases.

These measures mark a stark departure from traditional trade liberalization, with Washington using tariffs not only as an economic tool but also as a lever of geopolitical pressure.

Winners and Losers

The impact of tariffs is complex. On one hand, U.S. exporters may benefit when tariffs prompt trading partners to lower barriers in return. On the other, higher costs of imported goods can hurt American businesses and consumers. Brazil, for example, while facing a punitive 50 percent tariff, may not feel the full brunt given its diverse trade ties with China and other emerging markets, alongside exemptions that soften the blow.

At the same time, the U.S. remains locked into reliance on imports for critical sectors. Electronics, automotive parts, textiles, and medical supplies are deeply tied to global supply chains. Even with tariffs, reducing dependence is a long-term challenge that cannot be achieved overnight.

The Bigger Picture: Strategic Dependence

The data and policy shifts highlight three broader realities for the U.S.:

-

Structural reliance on imports — The U.S. consumer market is vast, and domestic production often cannot keep pace with demand, especially for low-cost goods.

-

Geopolitical leverage through trade — Tariffs are increasingly being used as political instruments, whether to pressure allies, penalize adversaries, or extract concessions.

-

Shifting global alliances — Countries hit by tariffs are exploring new trade partnerships, with China often stepping in as an alternative market or supplier.

Conclusion

The United States’ reliance on imports is both its strength and vulnerability. A globalized economy has allowed Americans access to affordable goods, but it has also tied the nation’s economic fortunes to decisions made in Beijing, Brussels, and beyond. President Trump’s new tariffs mark an attempt to recalibrate this relationship—partly by protecting U.S. industries, partly by flexing geopolitical muscle.

Yet, whether tariffs can truly narrow the trade deficit remains uncertain. History suggests that while they may shift trade flows temporarily, the deeper forces of global supply and demand continue to define the U.S. economy. As 2025 unfolds, the tension between protectionism and globalization will remain a central theme in U.S. trade policy—and the world will be watching closely.