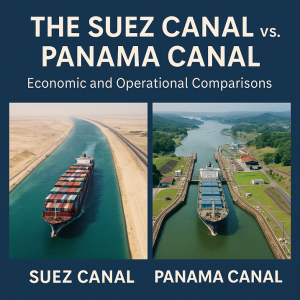

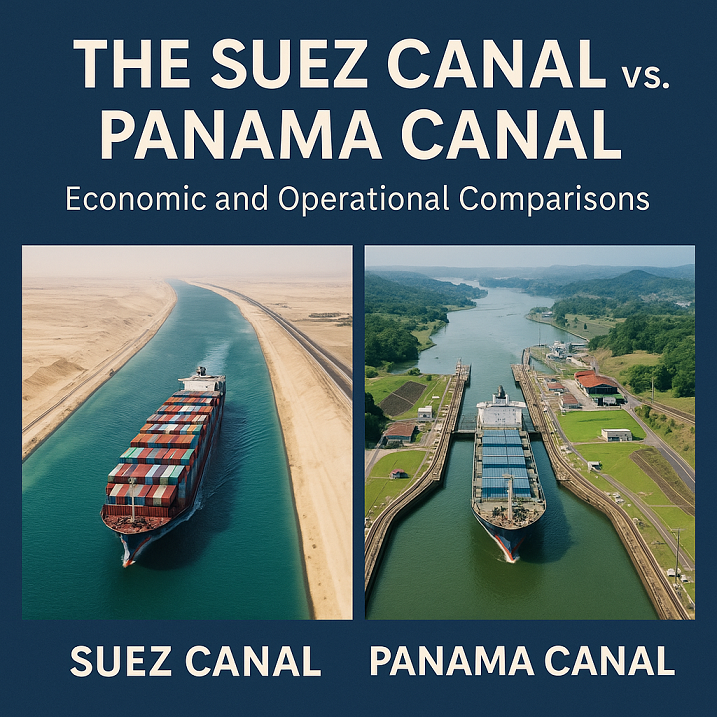

Compare the Suez Canal and Panama Canal in terms of operations, economics, and global impact. Discover which route is more efficient for different shipping sectors in this in-depth maritime analysis.

Two Canals That Move the World

The Suez Canal and the Panama Canal are two of the most vital arteries in global maritime trade. Together, they save ships thousands of nautical miles and weeks of transit time by connecting major oceans and regional markets. While the Suez Canal links the Mediterranean Sea with the Red Sea, the Panama Canal connects the Atlantic Ocean with the Pacific—serving as critical shortcuts for East–West and North–South trade routes.

Though they serve different geographies and engineering principles, these canals are often compared for their economic impact, operational efficiency, and strategic value. In an era of rising freight costs, geopolitical tensions, and decarbonization mandates, choosing between the two routes can dramatically affect a shipping company’s bottom line.

This article explores the key differences and similarities between the Suez and Panama Canals, highlighting recent developments, technological innovations, and real-world examples that influence maritime decision-making today.

Why the Canal Choice Matters in Modern Maritime Operations

For shipping companies and charterers, selecting the most efficient and cost-effective route has major operational implications. According to IHS Markit (2024), approximately 13% of global trade transits through the Suez Canal, while the Panama Canal handles around 5%. Though smaller in share, the Panama Canal is critical for inter-American and trans-Pacific trade.

Canal selection affects:

-

Fuel consumption and emissions

-

Vessel size limitations

-

Toll costs and surcharges

-

Piracy risks and insurance premiums

-

Port connectivity and transshipment strategies

Both canals play indispensable roles—but in different contexts depending on vessel type, trade route, and geopolitical climate.

–

Historical and Engineering Overview

The Suez Canal

-

Location: Egypt

-

Opened: 1869

-

Length: ~193 km

-

No locks; sea-level canal

-

Main Operator: Suez Canal Authority (SCA)

The Suez Canal allows continuous passage, which is ideal for large vessels. It has undergone major expansions, including the New Suez Canal Project (2015) to increase capacity and reduce waiting times.

The Panama Canal

-

Location: Panama

-

Opened: 1914 (expanded in 2016)

-

Length: ~82 km

-

Uses locks to raise/lower ships

-

Main Operator: Panama Canal Authority (ACP)

The Panama Canal Expansion Project (2016) introduced Neo-Panamax locks, allowing ships up to 366 meters in length and 49 meters in beam. However, its reliance on freshwater reservoirs presents operational challenges, especially during droughts.

Operational Comparisons: Throughput, Traffic, and Efficiency

Vessel Size and Capacity

| Criteria | Suez Canal | Panama Canal |

|---|---|---|

| Max Vessel Size | ~400m LOA (Suezmax / ULCV) | ~366m LOA (Neo-Panamax) |

| Daily Transits | ~70 ships/day | ~35–40 ships/day |

| Canal Draft Limit | ~20.1m | ~15.2m (dependent on lake levels) |

| Waiting Time (avg) | 8–12 hours (less with booking) | Can extend to 24–48 hours in peak |

The Suez Canal accommodates larger ships like ULCVs and VLCCs, making it preferable for the Asia-Europe container trade and Middle Eastern oil exports. The Panama Canal’s limitations restrict certain ships to alternate routes, such as via the Cape Horn or Suez itself.

Toll Costs and Economic Implications

Both canals charge tolls based on tonnage, vessel type, cargo, and service priority. These fees are adjusted annually and can significantly impact voyage economics.

-

Suez Canal Toll Example (2024):

A 200,000 DWT crude oil tanker may pay USD 500,000–700,000 per transit, depending on rebate schemes and convoy participation. -

Panama Canal Toll Example (2024):

A 14,000 TEU Neo-Panamax containership may incur USD 400,000–600,000, including slot reservation and freshwater surcharges.

The Suez Canal Authority offers rebates of up to 75% for specific routes (e.g., U.S. Gulf to Asia), while the ACP adjusts pricing based on supply and rainfall conditions.

–

Environmental and Logistical Considerations

Emissions and Fuel Use

Using the canals significantly reduces voyage distance:

-

Asia–Europe via Suez: 12,000 nm

-

Asia–East U.S. via Panama: 10,000 nm

-

Alternative routes via the Cape: up to 20,000 nm

This results in:

-

Fuel savings of 20–60%

-

Lower CO₂ and NOx emissions

-

Improved compliance with IMO’s CII/EEXI regulations

However, the Panama Canal’s reliance on fresh water and frequent droughts raises sustainability concerns. In 2023, low water levels forced the ACP to limit transits, causing a backlog of over 100 vessels—a situation covered widely by Lloyd’s List Intelligence.

Digitalization and Smart Canal Initiatives

-

Panama Canal: Uses Canal Waters Time (CWT) optimization software, AIS tracking, and electronic booking to manage queues.

-

Suez Canal: Introduced E-SCZone platform, real-time GPS navigation, and dynamic convoy scheduling post-2021 blockage.

Both authorities are investing in digital twins and predictive maintenance, supported by partners like DNV, Wärtsilä Voyage, and Inmarsat.

–

Case Studies: Lessons from High-Profile Incidents

MV Ever Given – Suez Canal (March 2021)

The 400-meter-long containership ran aground, blocking the canal for six days. Over $10 billion in trade was delayed daily. The event revealed:

-

The vulnerability of single-lane channels

-

The need for better pilot training and tug deployment

-

Increased demand for risk-based route modeling

2023 Drought – Panama Canal

Extreme drought reduced the Gatun Lake’s water levels, forcing the ACP to cut daily transits and draft limits. This led to:

-

Significant scheduling delays

-

A spike in spot market shipping rates

-

More ships rerouting via the Cape of Good Hope or Suez Canal

These incidents stress the importance of redundancy planning and climate-adaptive infrastructure.

–

Frequently Asked Questions

Which canal is more cost-effective?

It depends on the vessel type and route. Suez is better for large container and crude tankers; Panama is suited for medium container and LNG carriers trading between the Americas and Asia.

Are both canals open 24/7?

Yes, both operate continuously but require advance booking and scheduling, particularly for priority slots.

Can VLCCs use the Panama Canal?

No. VLCCs are too large. They either split cargo at transshipment hubs or reroute via the Cape.

Is piracy a concern in the Suez route?

Yes, especially in the Bab el-Mandeb and Gulf of Aden. Ships often implement BMP5 anti-piracy measures in this corridor.

What’s the impact of climate change on these canals?

Panama is affected by freshwater shortages; Suez by potential sea-level changes and desert storms. Both are upgrading infrastructure to adapt.

–

Conclusion: Canal Choices in a Complex World

The Suez and Panama Canals are more than waterways—they are strategic assets that shape the flow of global commerce. While the Suez Canal dominates in size and throughput, the Panama Canal offers vital flexibility for trans-Pacific trade. Yet both face mounting challenges: from climate variability and infrastructure constraints to shifting geopolitical risks.

For ship operators, route planners, and maritime economists, understanding the economic and operational trade-offs between these two corridors is essential for efficient and resilient supply chains. As digital tools, alternative fuels, and climate-resilient strategies gain traction, the canal of choice will depend not just on cost or distance, but on how well each adapts to the future of global shipping.

References

thank you !