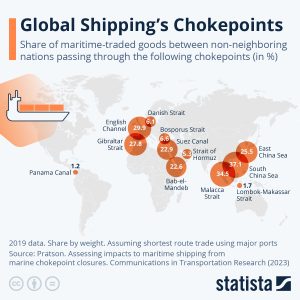

Global shipping checkpoints (2023). Credit: Statista

Maritime trade is the backbone of the global economy, with more than 80% of goods by volume and around 70% by value transported by sea. The world’s shipping network, however, depends heavily on a small number of narrow passages known as chokepoints. These geographic bottlenecks funnel enormous volumes of cargo, energy, and raw materials. When disruptions occur—whether due to conflict, climate events, or congestion—they send shockwaves across global supply chains.

By 2024–2025, the vulnerabilities of these chokepoints have become more visible than ever. Security crises in the Red Sea, water shortages in the Panama Canal, rising geopolitical tensions in the Strait of Hormuz, and climate pressures in Asia have highlighted just how fragile these maritime arteries truly are.

The Red Sea & Suez Canal (22.9% of global trade)

The Suez Canal, connected via the Bab-el-Mandeb Strait to the Red Sea, has long been one of the most strategic arteries of maritime trade. Before the current disruptions, almost 30% of container traffic between Europe and Asia passed through this corridor.

In late 2023, attacks by Houthi rebels on merchant vessels escalated dramatically. By 2024, traffic through the Gulf of Aden, Bab-el-Mandeb, and the Suez Canal fell by more than 70%. Shipping companies rerouted vessels around the Cape of Good Hope, adding up to two weeks to journeys, pushing up fuel consumption, and raising freight rates. Insurance premiums also tripled in some cases.

Even as of mid-2025, Suez Canal trade remains well below pre-crisis levels. While naval coalitions like Operation Prosperity Guardian provided some protection, the fear of sudden strikes persists. Food and fertilizer shipments, once flowing reliably through Bab-el-Mandeb, remain disrupted, worsening food security in importing nations.

Strait of Hormuz (5.3% of global trade, 20% of global oil)

Few chokepoints rival the Strait of Hormuz in energy importance. Around 20% of global oil exports and a significant share of liquefied natural gas (LNG) move through this narrow passage between Oman and Iran.

In June 2025, Iran threatened to close the strait following escalating confrontations with the United States. Even before any closure, tanker operators became reluctant to enter the area, driving oil prices to volatile highs. A closure—even temporary—would have catastrophic effects, potentially sending oil prices to $120–150 per barrel and creating a chain reaction of inflation worldwide.

The strait’s narrowness—only 21 nautical miles wide at its narrowest point—means even minor naval confrontations could block shipping. This chokepoint continues to embody the risks of geopolitics directly intersecting with global energy markets.

Malacca Strait (34.5% of global trade – the busiest chokepoint)

The Malacca Strait, linking the Indian Ocean with the South China Sea, is the busiest maritime chokepoint in the world. More than one-third of global trade by weight passes through this narrow passage between Malaysia, Indonesia, and Singapore. It is also the lifeline for China, Japan, and South Korea, delivering vital oil, LNG, and containerized goods.

However, the strait faces multiple pressures:

-

Congestion: The density of shipping raises risks of collisions and environmental incidents.

-

Piracy: Though significantly reduced since its peak, piracy remains a lingering threat.

-

Geopolitical tension: With the South China Sea nearby, the Malacca Strait could be affected by disputes involving China, the U.S., and Southeast Asian nations.

Any prolonged disruption would have massive consequences, forcing vessels to reroute through longer paths such as the Lombok–Makassar Strait.

South China Sea (37.1% of global trade) & East China Sea (25.5%)

The South China Sea is not only the busiest trade corridor in the world but also one of the most politically contested. Nearly 40% of all global maritime trade passes through its waters. It carries everything from crude oil bound for China to containerized goods heading to Western markets.

Tensions over disputed islands and exclusive economic zones have grown in 2024–2025. Military drills by China and the U.S. have heightened risks of miscalculation. Meanwhile, the East China Sea, handling about a quarter of global shipping, remains vital for trade to and from Japan, South Korea, and Taiwan. Any escalation around Taiwan would instantly endanger this corridor.

Panama Canal (1.2% of global trade)

While the Panama Canal accounts for only a small percentage of world trade by weight, it is critical for trans-American shipping, particularly U.S. East Coast container and energy flows.

In 2024, severe drought caused by El Niño forced the canal authority to impose transit restrictions, reducing daily passages and limiting vessel drafts. This cut traffic by nearly a third, delaying shipments of LNG and manufactured goods. By 2025, some improvement occurred as rainfall returned, but the incident highlighted the canal’s vulnerability to climate change. For large container ships, rerouting around Cape Horn or using alternative rail corridors in Mexico dramatically increases costs and time.

Gibraltar Strait (27.8% of global trade) & English Channel (29.9%)

The Gibraltar Strait and the English Channel are the two key maritime gateways into and out of Europe.

-

The Gibraltar Strait is the entrance from the Atlantic into the Mediterranean, carrying nearly 28% of world trade. It is the access point for vessels heading toward the Suez Canal and beyond. Rising migrant crises and security patrols have added operational complexity.

-

The English Channel, the narrowest stretch between continental Europe and the UK, carries nearly 30% of maritime trade between nations. While generally stable, it has faced increased congestion, stricter environmental regulations, and disruptions linked to labor strikes at major European ports.

Danish Strait (6.1%) & Bosporus Strait (6.6%)

Northern Europe’s Danish Strait and Turkey’s Bosporus Strait are smaller in volume compared to the giants like Malacca or Suez, but they are strategically vital.

-

The Danish Strait funnels trade into the Baltic Sea, crucial for Northern European economies. With rising tensions over Russian access, this chokepoint has gained military and economic importance.

-

The Bosporus Strait, linking the Black Sea to the Mediterranean, has been central in the ongoing fallout of the Russia–Ukraine war. Restrictions on grain shipments and naval confrontations have disrupted global food security. Nearly 7% of global maritime trade depends on this corridor.

Bab-el-Mandeb (22.6% of global trade)

At the southern entrance of the Red Sea, the Bab-el-Mandeb Strait connects the Suez Canal to the Indian Ocean. Almost a quarter of global maritime goods once passed here.

By 2024–2025, however, it has become a hotspot of instability due to rebel attacks. The disruption of fertilizer, rice, and wheat shipments passing through Bab-el-Mandeb has worsened inflation and food insecurity in parts of Africa and the Middle East. Naval escorts remain active, but many shipping companies prefer rerouting around Africa.

Lombok–Makassar Strait (1.7%)

Though much smaller in share, the Lombok–Makassar Strait in Indonesia has grown in importance as an alternative to the congested Malacca Strait. It is deeper and can accommodate larger vessels, including Very Large Crude Carriers (VLCCs).

In 2024–2025, traffic here increased slightly as carriers sought to bypass piracy risks or congestion in Malacca. However, using Lombok–Makassar adds distance and costs, limiting its use to selective routes.

Conclusion: Fragility and Adaptation

The maritime chokepoints illustrated above remain the fragile arteries of globalization. The Red Sea crisis, drought in Panama, tensions in Hormuz, and instability in the South and East China Seas highlight how quickly disruptions can cascade into global crises.

Shipping companies, insurers, and governments are responding with new strategies—longer routes, naval patrols, diversified corridors, and investments in infrastructure. Yet, the reality of 2024–2025 is clear: maritime chokepoints will continue to define both the resilience and vulnerability of global trade in the years to come.

Thx