Credit: Statista

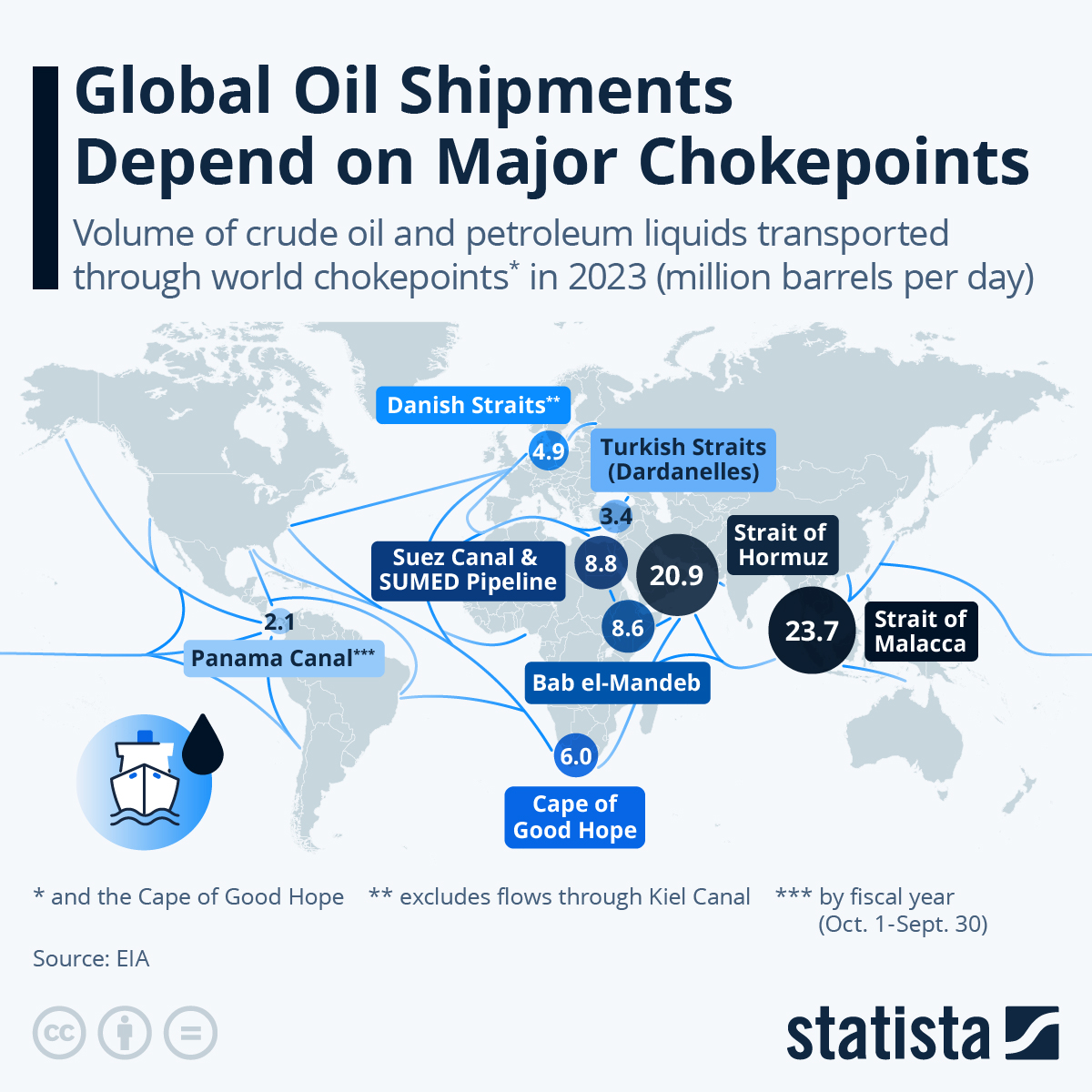

The flow of crude oil and petroleum products across oceans depends on a handful of narrow maritime passages. Known as chokepoints, these straits and canals are critical for sustaining global energy supply. When they function smoothly, energy trade remains efficient and affordable. But when they are threatened by war, piracy, blockades, or even natural constraints like drought, the ripple effects are immediate: oil prices surge, insurance costs spike, and nations scramble to secure alternative routes.

By 2024–2025, global dependence on these chokepoints has deepened, even as geopolitical risks have grown. From the Strait of Hormuz, the world’s most politically sensitive oil passage, to the Strait of Malacca, the busiest corridor in Asia, the security of these maritime arteries remains under constant scrutiny.

Strait of Hormuz: The Geopolitical Flashpoint

Located between Oman and Iran, the Strait of Hormuz remains the most watched chokepoint in global energy trade. In 2023, around 20.9 million barrels per day of crude oil and petroleum liquids transited through this corridor. This represented more than a quarter of global seaborne oil trade and nearly one-fifth of global liquefied natural gas (LNG) shipments.

The majority of these flows—an estimated 83%—headed to Asian markets, with China, India, Japan, and South Korea as the top recipients. The United States, despite its growing domestic production, still imported 0.5 million barrels per day through the strait, representing about 8% of U.S. crude imports and 2% of total petroleum liquids consumption.

Yet the strategic importance of Hormuz comes with fragility. Tehran has repeatedly threatened closure during periods of heightened conflict, most recently amid the escalating Iran–Israel tensions in 2025. While experts consider a complete shutdown unlikely, even a partial disruption could shock markets, pushing oil prices well above $120 per barrel within days. At present, only Saudi Arabia and the United Arab Emirates have pipeline networks capable of bypassing Hormuz, though their capacity is limited compared to the vast volumes that move through the strait daily.

Strait of Malacca: Asia’s Vital Lifeline

While Hormuz is the most geopolitically fragile, the Strait of Malacca is the busiest in terms of oil transit. Stretching between Malaysia, Singapore, and Indonesia, Malacca carried 23.7 million barrels per day in 2023, making it the world’s top oil chokepoint.

The strait is critical for energy-hungry economies in East Asia, serving as the main route for Middle Eastern oil bound for China, Japan, and South Korea. It also handles massive containerized trade, making it one of the world’s busiest waterways overall.

The challenges in Malacca are primarily operational rather than military: congestion, piracy, and environmental vulnerability. Its narrowest point—less than three kilometers wide—makes it highly exposed to accidents. In the event of disruption, some oil tankers can reroute through the Lombok–Makassar Strait, but the detour adds significant time and cost.

Bab el-Mandeb: The Red Sea’s Southern Gateway

At the junction of the Red Sea and the Gulf of Aden, the Bab el-Mandeb Strait is another vital artery for Persian Gulf oil heading toward Europe and North America. In 2023, an average of 8.6 million barrels per day passed through the strait.

Its strategic position has made it a hotspot of risk. In 2024–2025, Houthi rebel attacks on merchant vessels disrupted safe passage, forcing many shipping lines to divert around the Cape of Good Hope. For oil and gas shipments, these detours extended travel times by 10–14 days and raised freight costs sharply. For energy-importing nations in Europe, Bab el-Mandeb remains one of the most fragile links in the supply chain.

Suez Canal & SUMED Pipeline: Egypt’s Dual Arteries

The Suez Canal and the parallel SUMED pipeline together carried around 8.8 million barrels per day in 2023. They connect the Red Sea with the Mediterranean, making them central for Persian Gulf oil shipments to Europe and the Atlantic.

The importance of this corridor was underscored in 2021 during the Ever Given blockage, which halted nearly 12% of global trade for six days. More recently, security threats in the Red Sea have reduced traffic, with some shipping companies opting for the Cape of Good Hope despite longer distances. The SUMED pipeline provides a partial backup, but it cannot fully compensate for a complete closure of Suez.

Turkish Straits: The Dardanelles and Bosporus

The Turkish Straits, comprising the Dardanelles and Bosporus, carried about 3.4 million barrels per day in 2023. They are the only maritime passage from the Black Sea to the Mediterranean, making them critical for Russian, Azerbaijani, and Kazakh oil exports.

Since the outbreak of the Russia–Ukraine war, the geopolitical weight of these straits has grown. While Turkey maintains control and neutrality, any escalation of regional conflict could turn them into another flashpoint of energy insecurity.

Danish Straits: Northern Europe’s Access Point

The Danish Straits in the Baltic Sea region handled 4.9 million barrels per day in 2023. This route is crucial for Russian oil shipments as well as Northern European energy trade. Since sanctions on Russian crude exports began in 2022, flows through this corridor have shifted toward Asian buyers, with tankers rerouting via complex shadow fleets. The straits’ location between NATO and Russian naval spheres makes them a sensitive chokepoint in 2025.

Panama Canal: Climate Constraints on Energy Flows

The Panama Canal carried 2.1 million barrels per day of petroleum liquids in 2023. While smaller in scale compared to Hormuz or Malacca, the canal is essential for U.S. energy flows between the Atlantic and Pacific.

In 2024, severe drought forced restrictions on vessel drafts, reducing daily transits and delaying LNG cargoes bound for Asia. By mid-2025, rainfall improved, but the event highlighted how climate change threatens canal reliability. For energy markets, it underscored the vulnerability of chokepoints not just to conflict but also to environmental stress.

Cape of Good Hope: The Costly Detour

Although not a chokepoint in the traditional sense, the Cape of Good Hope has re-emerged as a critical alternative. In 2023, about 6 million barrels per day passed around the southern tip of Africa, much of it rerouted due to Red Sea instability. While it offers a safety valve, the Cape route adds weeks to transit times and significantly raises fuel and insurance costs.

–

Conclusion: Fragile Arteries of the Global Energy System

The image of oil tankers threading through narrow straits and canals is more than symbolic—it represents the structural fragility of global energy flows. The Strait of Hormuz remains the world’s ultimate oil chokepoint, but the Strait of Malacca, the Suez Canal, and Bab el-Mandeb are equally indispensable.

By 2024–2025, geopolitical flashpoints, piracy, and climate pressures have exposed just how vulnerable these maritime arteries are. While new pipelines, LNG terminals, and overland routes are being developed, they cannot replace the sheer scale of these sea lanes. For now, the global economy will continue to depend on these chokepoints—its most fragile but indispensable energy lifelines.