Discover how BRICS nations are reshaping global maritime trade through increasing collaboration, port investments, and inter-regional shipping routes. Learn how BRICS shipping trends are impacting global trade patterns, infrastructure, and maritime policy.

Why BRICS Maritime Trade Matters in Global Shipping

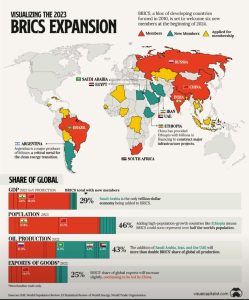

The global maritime industry is undergoing a significant transformation. While Western economies traditionally dominated oceanic trade and shipping logistics, the rise of BRICS nations (Brazil, Russia, India, China, and South Africa) is now shifting global maritime trade routes and influencing port development, fleet ownership, and regional trade dynamics. In 2023, BRICS accounted for more than 30% of global GDP and over 40% of the world’s population (UNCTAD, 2023), making their influence on maritime trade deeply consequential.

BRICS countries, rich in raw materials, energy reserves, and growing consumer markets, rely heavily on ocean transport. Their cooperation through economic corridors, port investments, and shipping alliances is reshaping not only South-South trade but also global maritime strategy.

The BRICS Maritime Trade Landscape: Key Trends and Developments

Growing Trade Volumes Across Oceans

In recent years, intra-BRICS trade has surged. According to the World Bank (2024), trade between BRICS nations reached $600 billion in 2023, up from $420 billion in 2018. Much of this commerce is shipped by sea, with increasing volumes of crude oil, iron ore, LNG, and containerized goods.

- China-India shipping lanes across the Indian Ocean have become increasingly busy, with container and tanker traffic growing steadily.

- Russia-China maritime routes via the Pacific and Arctic Oceans (Northern Sea Route) have been promoted to reduce distance and geopolitical exposure.

- Brazil-China iron ore trade via Capesize bulk carriers forms a vital part of the dry bulk market.

Port Infrastructure and Intermodal Expansion

BRICS countries are investing heavily in port infrastructure to accommodate growing cargo volumes:

- India launched its Sagarmala Programme to develop 14 coastal economic zones and modernize 200+ ports (Ministry of Ports, Shipping and Waterways, 2023).

- China continues its Belt and Road Initiative (BRI), with port investments in Russia’s Far East and Africa.

- Brazil is modernizing Santos and Itaguaí Ports to handle more soybeans, ore, and oil exports.

- Russia is investing in the Arctic’s Murmansk and Vladivostok ports for strategic energy exports.

These projects integrate ports with rail, inland waterways, and special economic zones, improving logistics and boosting trade resilience.

BRICS-Controlled Fleets and Shipbuilding

While BRICS countries lag behind traditional maritime powers in ship ownership, that gap is closing:

- China now controls the world’s largest merchant fleet by deadweight tonnage (UNCTAD, 2023).

- India’s Shipping Corporation of India (SCI) is undergoing strategic investment to expand its fleet capacity.

- Russia is investing in LNG carriers, icebreakers, and Arctic-class ships through Zvezda and Admiralty Shipyards.

- Brazil is reviving its shipbuilding industry under Petrobras logistics contracts.

These trends reflect BRICS ambitions not just as cargo exporters, but as fleet-owning and shipbuilding nations.

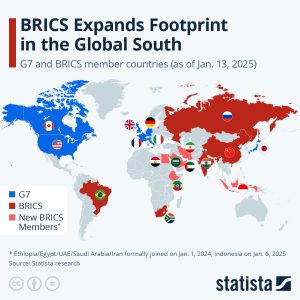

BRICS Vs G7

Case Studies: BRICS Maritime Trade in Action

Brazil-China Iron Ore Trade

Vale, Brazil’s largest mining company, operates a dedicated fleet of Valemax ships—among the world’s largest dry bulk vessels—to transport iron ore to China. These 400,000 DWT ships reduce emissions per ton-mile and make regular transits across the South Atlantic and Indian Oceans. This maritime corridor is central to Brazil’s trade balance and China’s steel production.

India-Russia Arctic Shipping Cooperation

In a strategic shift, India has begun receiving LNG shipments from Russia’s Yamal project via the Northern Sea Route (NSR). In 2023, GAIL India Ltd. received over 1 million tons of LNG through this route, saving time and avoiding the Suez Canal. This NSR cooperation is enabled by Russian ice-class LNG carriers and highlights a new geopolitical and trade partnership in the High North.

China-South Africa Container Trade

China remains South Africa’s top trading partner, with containerized goods flowing regularly between Durban and ports like Shanghai and Ningbo. COSCO and Evergreen operate frequent services, reflecting China’s appetite for South African minerals and agricultural products. Durban Port has undergone dredging and expansion to accommodate larger vessels in line with BRICS trade needs.

–

Maritime Challenges Faced by BRICS Nations

Geopolitical Tensions and Sanctions

- Russia faces maritime sanctions, making port access and insurance difficult.

- India-China border tensions have occasionally impacted shipping cooperation.

These political challenges can disrupt smooth maritime logistics and delay shared initiatives.

Limited Maritime Cooperation Mechanisms

Unlike the EU, BRICS lacks a unified maritime regulatory body. There’s no shared classification society, safety codes, or digital shipping standards yet. Each country follows its own flag state rules, creating inconsistencies.

Climate Change and Port Vulnerability

Coastal infrastructure in BRICS nations is increasingly exposed to sea-level rise and extreme weather:

- Mumbai and Santos Ports face tidal flooding risks.

- Durban and Shanghai ports experience typhoons and heavy storms.

According to the IMO (2023), ports must adopt resilient design and green retrofits to meet both MARPOL and adaptation goals.

–

Opportunities and Innovations

BRICS Maritime Digitalization and Smart Ports

South Africa and China have launched smart port initiatives, including:

- Blockchain-based cargo tracking.

- Automated container terminals (e.g., Shanghai Yangshan).

- AIS and VTS integration across BRICS ports.

The rise of digital twins in logistics and port management offers future efficiency.

Green Shipping Collaboration

BRICS nations are exploring shared efforts in:

- LNG-fueled vessels.

- Shore power facilities.

- IMO’s GHG strategy alignment.

China is leading in green ship design, while Brazil and India are piloting biofuel blends. Joint research could lead to unified green corridors.

Regional Maritime Education and Training

There is growing interest in maritime knowledge-sharing:

- India’s IMU and South Africa’s Cape Peninsula University host BRICS seminars.

- Joint simulation training and STCW updates are being discussed.

Such collaborations help harmonize safety and crew standards.

–

Future Outlook for BRICS Maritime Trade

Looking ahead, BRICS maritime trade will likely see:

- Deeper Arctic involvement: Russia and China could lead NSR development.

- More South-South corridors: Expanding routes between Africa, Latin America, and Asia.

- Joint maritime infrastructure funds: To co-invest in strategic ports and fleets.

- Expanded BRICS+ Membership: New members like Iran, Egypt, and UAE will diversify shipping dynamics.

UNCTAD’s 2024 review emphasizes that “South-South maritime links are vital for reducing dependence on traditional hubs and promoting inclusive trade growth.”

–

Frequently Asked Questions (FAQs)

1. What types of cargo dominate BRICS maritime trade?

Dry bulk (iron ore, coal, grains), crude oil, LNG, and containerized manufactured goods.

2. Are there BRICS shipping alliances like Ocean Alliance or THE Alliance?

Not formally. However, state-owned shipping lines like COSCO, SCI, and Sovcomflot engage in bilateral partnerships.

3. Do BRICS nations follow IMO standards?

Yes, all BRICS countries are IMO members and follow MARPOL, SOLAS, STCW, and other major conventions.

4. Which ports are most important in BRICS maritime trade?

Shanghai, Santos, Mumbai, Durban, and Vladivostok are key nodes.

5. How is climate change affecting BRICS ports?

Ports face rising sea levels, storm surges, and infrastructure strain, requiring resilience investments.

6. Is Arctic shipping viable for BRICS countries?

For Russia and China, yes. India has shown growing interest, while Brazil and South Africa remain distant.

7. Are BRICS countries investing in maritime decarbonization?

Yes. China leads in green shipping tech, India and Brazil explore biofuels, and Russia focuses on LNG.

–

Conclusion: BRICS at the Helm of a New Maritime Order

BRICS countries are no longer passive actors in maritime trade. They are becoming maritime leaders through port investments, fleet expansion, and strategic partnerships. Although challenges remain—from geopolitics to regulatory gaps—the future of BRICS shipping is dynamic, ambitious, and increasingly integrated.

As global trade shifts toward multipolarity, BRICS maritime cooperation may redefine the next era of shipping—connecting emerging economies, enhancing trade resilience, and promoting a more balanced and inclusive ocean economy.

–

References

- UNCTAD (2023). Review of Maritime Transport. https://unctad.org/publication/review-maritime-transport-2023

- World Bank (2024). BRICS Trade Growth Dashboard. https://www.worldbank.org/

- IMO (2023). Greenhouse Gas Strategy Update. https://www.imo.org/

- Ministry of Ports, Shipping and Waterways, India (2023). https://shipmin.gov.in/

- Lloyd’s List Intelligence. https://lloydslist.maritimeintelligence.informa.com/

- MarineTraffic. https://www.marinetraffic.com/

- Journal of Marine Science and Engineering. https://www.mdpi.com/journal/jmse

- RINA. https://www.rina.org/

- BIMCO. https://www.bimco.org/

- WMU Journal of Maritime Affairs. https://link.springer.com/journal/13437

That is good information, thank you.

Wow

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.