10/22/2025

A groundbreaking study from University College London reveals that major Korean, Chinese, and European financiers have billions of dollars exposed to fossil fuel shipping assets that risk becoming stranded as the global economy transitions to low-carbon energy. The research provides the first comprehensive mapping of climate risk exposure across shipping finance portfolios worldwide.

Key Findings: A System Overexposed to Fossil Fuels

The UCL study analyzed over 3,000 financial transactions across loans, bonds, leases, and equity investments, covering USD 378 billion in maritime assets representing approximately 30% of the global vessel fleet value. The research identified significant concentration of fossil fuel exposure in specific financial institutions and geographic regions.

According to Dr. Marie Fricaudet, Senior Research Fellow at UCL Shipping and Oceans Research Group and lead author of the study, “To our knowledge, this is the first attempt to map climate risk to shipping financiers’ portfolios. The results show many financiers have a substantial part of their portfolio linked to fossil fuel transportation and highlight that more transparency is needed to properly anticipate and price-in the climate risk carried by shipping financiers.”

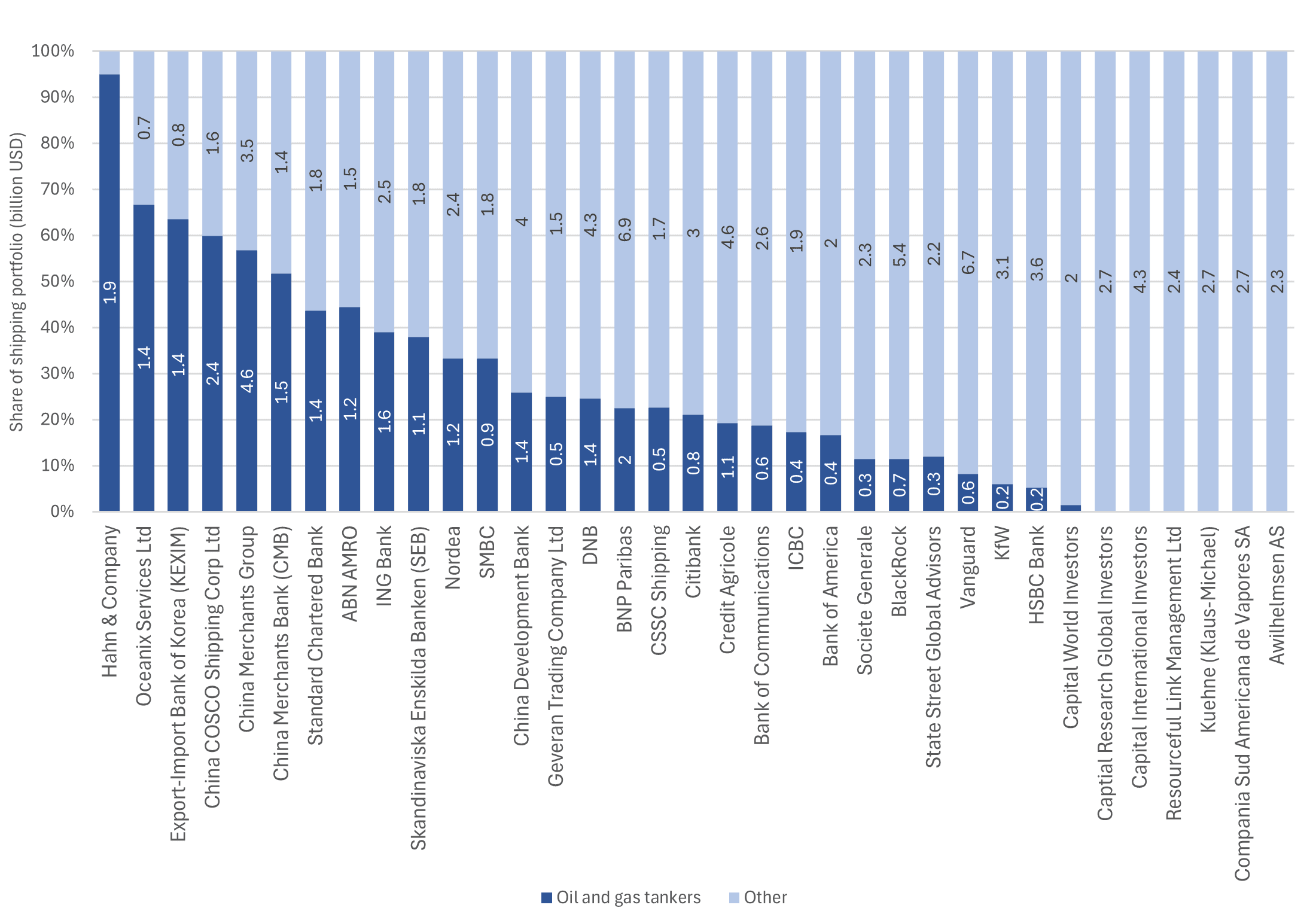

The Most Exposed Institutions

The analysis shows that five financiers have over half of their shipping portfolio tied to fossil fuel carriers, including China Merchants Group and Korea Eximbank. European banks follow closely, with Standard Chartered, ABN AMRO, ING Bank, SEB, and Nordea each having over one-third of their portfolios tied to fossil fuel shipping.

Table: Financial Institutions with Highest Fossil Fuel Shipping Exposure

| Institution | Primary Region | Exposure Level | Key Fossil Fuel Segments |

|---|---|---|---|

| Korea Eximbank (KEXIM) | South Korea | Over 50% of portfolio | LNG carriers, oil tankers |

| China Merchants Group | China | Over 50% of portfolio | Oil tankers, LNG carriers |

| Standard Chartered | Europe | Over 33% of portfolio | Fossil fuel carriers |

| ABN AMRO | Europe | Over 33% of portfolio | Fossil fuel carriers |

| ING Bank | Europe | Over 33% of portfolio | Fossil fuel carriers |

| BNP Paribas | Europe | Almost 25% (USD 2B of USD 9B portfolio) | Various fossil fuel carriers |

South Korea appears particularly exposed, with nearly half of its shipping investments directed toward LNG carriers. Based on the headquarters of financiers, the United States, South Korea, France, China, and the United Kingdom dominate the financing of LNG carriers, while China, the United States, and Hong Kong lead in oil tanker financing.

Why LNG Carriers Face Particular Risk

The study highlights that liquefied natural gas (LNG) carriers face exceptional stranded asset risk due to their high newbuild value and purpose-specific design. Unlike bulk carriers that can be repurposed to transport other commodities like grains with minimal conversion costs, LNG carriers require substantial additional investment to switch to carrying other commodities, reducing their competitiveness and ability to generate profit in a low-carbon future.

The identified financial arrangements for liquefied gas carriers total approximately USD 36 billion, with loans accounting for over half of this amount (USD 21 billion), followed by direct ownership and leases (USD 11 billion) and equity (USD 7 billion).

This risk is particularly acute given that the global shipping industry faces broader decarbonization pressures, with the number of alternative-fuelled vessels in operation set to almost double by 2028.

Financial Instruments and Global Distribution

The study reveals distinct patterns in how different fossil fuel vessel types are financed:

-

LNG carriers are predominantly financed through bank loans (approximately USD 21 billion), which represent over half of the identified financial arrangements for these vessels.

-

Oil tankers show a different pattern, with equity financing playing a more prominent role accounting for about 40% of the total USD 35 billion in identified transactions. Bank loans represent approximately USD 14 billion of oil tanker financing.

-

Geographic concentrations show France and South Korea heavily invested in LNG carriers through bank loans, while Hong Kong dominates oil tanker financing through bonds, consistent with its position as Asia’s leading bond issuance hub.

Broader Context: Shipping’s Decarbonization Challenge

The UCL research emerges as the shipping industry faces increasing pressure to decarbonize. The International Maritime Organization’s revised greenhouse gas strategy aims for net zero emissions “by or around” 2050, but the sector faces significant challenges in meeting climate goals.

The transition away from fossil fuels creates both supply-side risks (carbon-intensive vessels becoming obsolete) and demand-side risks (decreased fossil fuel demand). A separate UCL report found that over 40% of ships globally transport fossil fuels, and nearly all ships are fossil-fuelled, creating significant stranded asset risks across the industry.

“The risks exist regardless of the IMO’s adoption of the Net Zero Framework,” said Dr. Tristan Smith, Professor of Energy and Transport at UCL Shipping and Oceans Research Group. “However, reflecting on the NZF being delayed, this subject has now increased in salience – regulation has not gone away but is now more uncertain. Understanding and managing that risk will now be of greater importance than ever.”

Data Limitations and Transparency Concerns

The researchers noted significant challenges in compiling comprehensive data due to limited transparency in shipping finance. The study covers approximately half of the shipping loan portfolio (just under USD 300 billion) and 25-40% of the global fleet value, equivalent to around USD 1 to 1.5 trillion.

Dr. Nishatabbas Rehmatulla, Principal Research Fellow at UCL Shipping and Oceans Research Group, emphasized that “The gaps in data highlight an urgent need for much greater transparency in shipping finance. Building this dataset from various sources, whilst complex and novel, underscores the current failure of disclosure in the sector.”

The researchers have developed an interactive online tool, ‘Investment Risk Monitor for Fossil Fuel Carrying Ships’, available at shipping-transition.org, which provides users with fleet-wide estimates of future supply and demand balance for different fossil fuel carrying ship types under various climate and energy scenarios.

Conclusion: Navigating Uncertain Waters

The UCL study serves as a critical warning for shipping financiers worldwide, highlighting concentrated exposure to assets particularly vulnerable to energy transition risks. As global climate policy evolves and demand for fossil fuels declines, financial institutions with significant exposure to LNG carriers and oil tankers may face substantial write-downs and losses.

The findings underscore the urgent need for enhanced transparency in shipping finance and more sophisticated risk assessment frameworks that account for transition risks in a decarbonizing global economy.

References

-

UCL Shipping & Oceans Research Group. (2025). Climate Risk Exposure in Global Shipping Finance: A Portfolio Analysis.

-

Fricaudet, M., Smith, T., & Rehmatulla, N. (2025). Stranded Asset Risks in Maritime Transport: Mapping Financier Exposure to Fossil Fuel Carriers. University College London.

-

Clarksons Research. (2025). World Fleet Register and Shipping Intelligence Network.

-

Marine Money International. (2025). Global Shipping Finance Database.

-

London Stock Exchange Group (LSEG). (2025). Dealscan Database.

-

DNV. (2024). Maritime Forecast to 2050: Energy Transition Outlook.

-

International Maritime Organization (IMO). (2023). 2023 IMO Strategy on Reduction of GHG Emissions from Ships.

-

Climate Action Tracker. (2025). Shipping Sector Decarbonization Assessment.

-

UCL & Kuehne Climate Centre. (2025). Investment Risk Monitor for Fossil Fuel Carrying Ships [Interactive tool]. Retrieved from https://shipping-transition.org