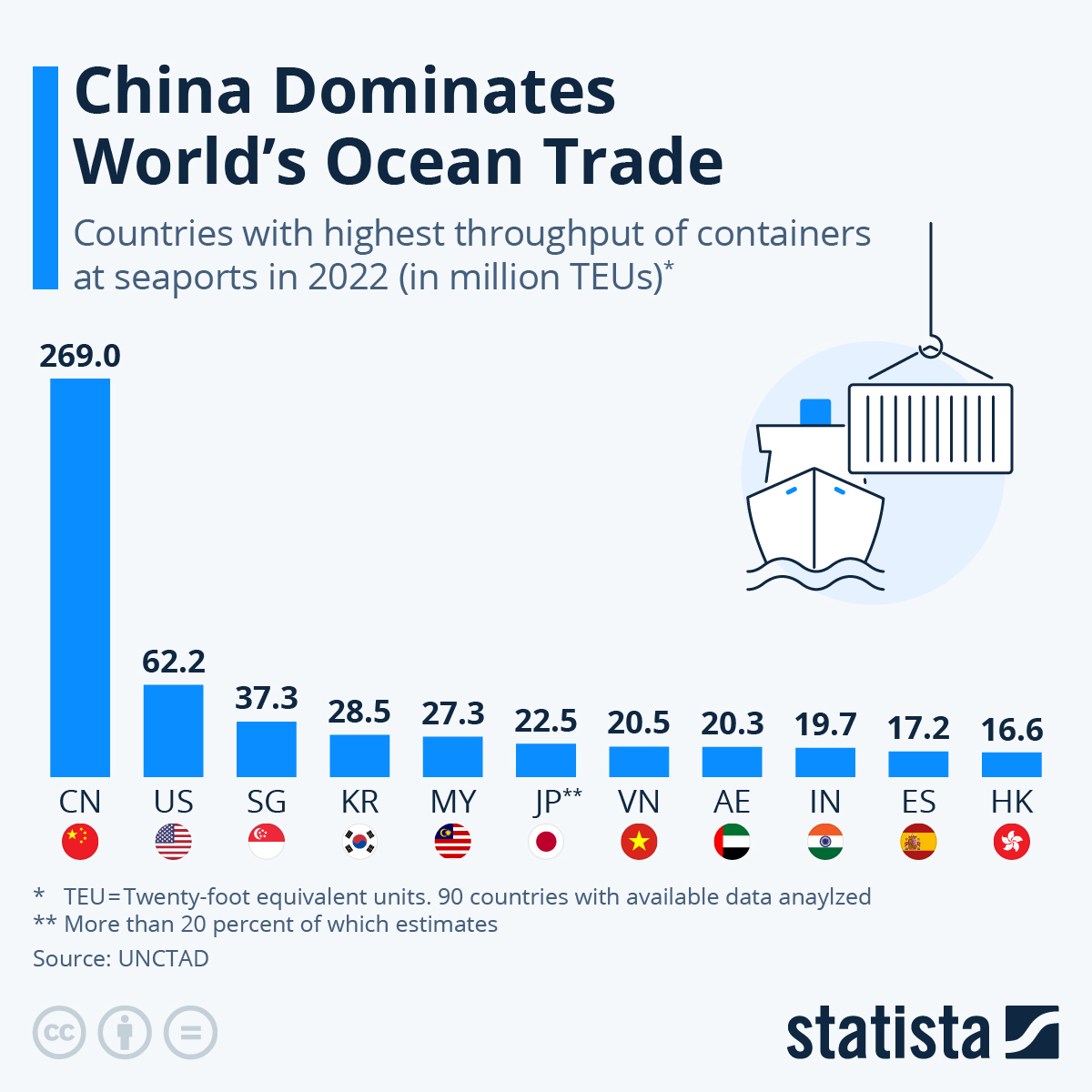

By the end of 2022, China solidified its position as the undisputed leader in global maritime trade, handling a staggering 269 million TEUs (Twenty-foot Equivalent Units)—more than four times the volume of the second-ranked United States (62.2 million TEUs). According to UNCTAD data, Asian economies dominate the top 10 list, with Singapore (37.3M TEUs), South Korea (28.5M TEUs), and Malaysia (27.3M TEUs) following closely. India, a rising player, secured its spot with 19.7M TEUs, reflecting its growing reliance on seaborne trade.

As data from the United Nations Conference on Trade & Development (UNCTAD) shows, India relies heavily on importing and exporting goods via seaports. In 2022, Indian ports handled 19.7 million twenty-foot equivalent container units (TEUs), landing the country in the top 10 in container throughput worldwide. However, China remains at the top of the list with 269 million TEUs, with no other place even coming close to these volumes. The country’s maritime trade dominance is owed largely to its thriving business of exporting electronics, fashion and other consumer goods. For example, the People’s Republic exported ICT goods like computers, electronic components and consumer electronics worth $858 billion in current prices in 2021, more than double the amount of the second-ranked region Hong Kong with $410 billion, according to UNCTAD data.

The rest of the list of countries and regions with the highest container throughput is also dominated by regions and countries in Asia. The only entrants in the top 11 not located on the Asian continent are the United States (62 million TEUs), the United Arab Emirates (20 million TEUs) and Spain (17 million TEUs).

–

Why Is China’s Maritime Trade So Dominant?

China’s unrivaled export industry—particularly in electronics, fashion, and consumer goods—fuels its port activity. In 2021 alone, China exported 858billionworthofICTgoods∗∗,includingcomputersandelectronics,∗∗doublingHongKong’s410 billion. This massive trade volume is supported by world-class port infrastructure, strategic coastal locations, and integration into global supply chains.

Key Takeaways from 2022 UNCTAD Data:

- China (269M TEUs) – #1 by a huge margin

- United States (62.2M TEUs) – Only non-Asian country in the top 5

- India (19.7M TEUs) – Rising trade hub, but still far behind China

- Asia dominates – 8 of the top 11 are Asian economies (including UAE & Hong Kong)

Global Trade Shifts & Emerging Players

While China remains unchallenged, India’s inclusion in the top 10 signals its growing trade ambitions. Meanwhile, Spain (17.2M TEUs) and the UAE (20.3M TEUs) represent key non-Asian players in global container shipping.

(Source: UNCTAD 2022, Statista – Image shows top countries by container throughput)

–

India’s Growing Role in Global Maritime Trade

India’s ports handled 19.7 million TEUs in 2022, earning it a spot among the world’s top 10 in container throughput. While this marks progress, it pales in comparison to China’s 269M TEUs, underscoring the vast gap between the two economies.

What’s Driving India’s Port Growth?

- Rising manufacturing & export demand

- Government investments in port modernization (e.g., Sagarmala Project)

- Strategic location for Asia-Europe & Africa trade routes

Yet, challenges like port congestion and infrastructure bottlenecks remain. For India to compete with giants like China and Singapore, further logistical upgrades are essential.

Key Comparisons:

- China’s TEU volume = 13x India’s

- U.S. (62.2M TEUs) processes 3x more than India

- Vietnam (20.5M TEUs) & UAE (20.3M TEUs) are close competitors

Main Reference: Statista