How Persian Gulf ports and the Strait of Hormuz shape global shipping routes, energy supply chains, and maritime trade security in modern international logistics.

Every day, thousands of vessels move across the oceans carrying the materials that power economies, feed populations, and support modern life. Yet, despite the global scale of maritime trade, certain geographic regions exert a disproportionately strong influence on international shipping patterns. Among them, the Persian Gulf stands out as one of the most strategically significant maritime zones in the world.

Persian Gulf ports do not simply handle cargo; they shape how ships travel across continents. Their location, infrastructure, and cargo specialization influence global route planning, vessel design, freight rates, and even shipbuilding demand. The combination of high-capacity energy export terminals and mega container ports makes the region central to both bulk and liner shipping sectors.

Understanding how Persian Gulf ports shape international shipping routes is essential for maritime professionals, logistics planners, policy makers, and maritime students. The region acts like a “heart valve” for global shipping — when flows move smoothly, the world economy runs efficiently. When disruptions occur, the ripple effects reach every continent.

–

Why This Topic Matters for Maritime Operations

The Persian Gulf represents one of the most concentrated hubs of energy export and strategic port infrastructure in modern maritime history. The Strait of Hormuz alone carries a substantial portion of global maritime trade, including a very large share of seaborne crude oil and liquefied petroleum gas exports. This level of concentration means the region plays a direct role in shaping global energy logistics and supply chain resilience.

For maritime operations, this concentration directly influences route planning, risk assessment, insurance structures, and fleet deployment strategies. Even minor disruptions in the region can increase voyage distances, raise freight rates, and trigger supply chain congestion across multiple continents. As a result, shipping companies and cargo owners closely monitor operational and geopolitical developments in the region.

–

Key Developments, Technologies, and Operational Principles

Geographic Position: The Strait of Hormuz as a Maritime Gateway

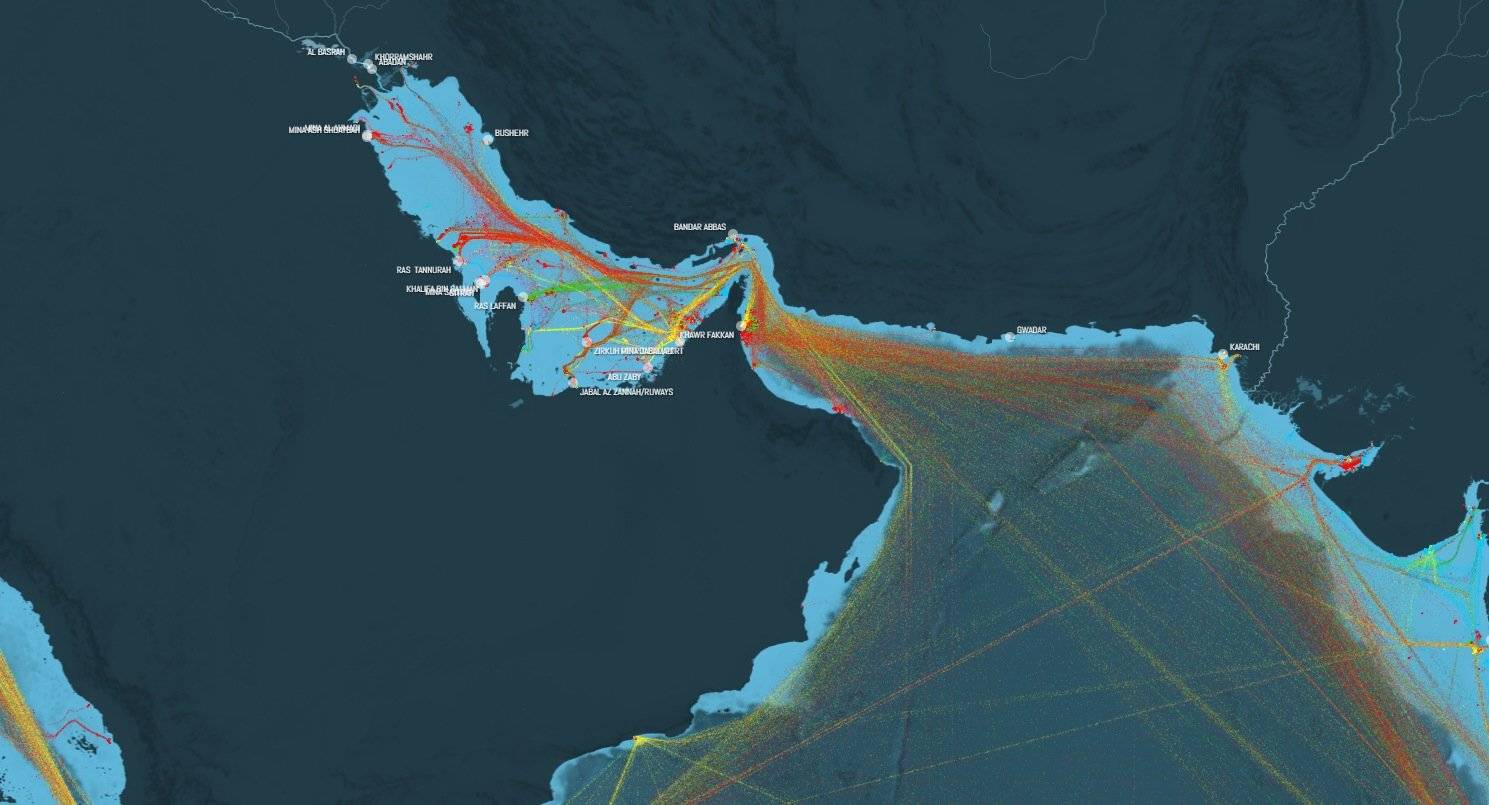

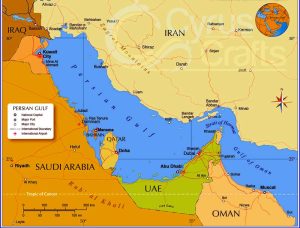

The Persian Gulf connects to the open ocean through the Strait of Hormuz, widely considered one of the most critical maritime chokepoints in the world. The strait serves as the main maritime gateway linking Gulf energy producers to global markets through the Arabian Sea and the wider Indian Ocean trading system.

A significant portion of global oil and liquefied natural gas flows through this narrow maritime corridor. The channel depth and navigational width allow the safe passage of the world’s largest crude carriers, including Very Large Crude Carriers (VLCCs) and Ultra Large Crude Carriers (ULCCs). Because these vessels operate on long-haul intercontinental routes, the efficiency and safety of this corridor directly impact global energy supply chains.

From a maritime network design perspective, the strait acts as a funnel. Cargo from multiple producing nations converges into a single maritime exit route. This concentration creates operational efficiency but also introduces systemic risk. When conditions are stable, tanker traffic operates on predictable schedules. When tensions rise or disruptions occur, ships may delay voyages, adjust routing speeds, or seek alternative loading patterns, creating ripple effects across global shipping networks.

Mega-Hub Port Infrastructure: The Rise of High-Capacity Container Ports

Persian Gulf container ports have transformed significantly over the last three decades. Today, many function as major transshipment and distribution hubs linking Asia, Europe, and Africa. These ports serve as critical nodes in global liner shipping alliances and integrated logistics chains.

Major Gulf ports handle millions of TEUs annually and operate large-scale logistics zones that integrate warehousing, customs clearance, and inland distribution. Their strategic positioning allows shipping lines to consolidate cargo flows from multiple origin markets before redistribution to final destinations.

From a network optimization perspective, these ports influence hub-and-spoke routing strategies, feeder service deployment, and vessel scheduling efficiency. Modern Gulf ports increasingly rely on automation technologies, digital cargo tracking systems, and integrated customs platforms. These improvements help reduce turnaround time, improve port productivity, and strengthen global competitiveness against established mega ports in East Asia and Northern Europe.

Energy Export Infrastructure and Specialized Terminal Design

Energy export terminals dominate the Persian Gulf maritime landscape. Specialized crude oil loading terminals, LNG export facilities, and petrochemical terminals require highly structured vessel traffic management and scheduling systems. Unlike container shipping, which often prioritizes schedule flexibility, energy export logistics depend on precise loading windows and strict terminal coordination.

Regional refinery expansion has also increased intra-Gulf shipping demand. Instead of exporting only crude oil, some countries now export refined petroleum products and petrochemical feedstocks. This shift changes traditional tanker trade patterns and increases demand for product tankers and chemical carriers.

These energy flows influence global tanker fleet demand, LNG carrier fleet expansion, and global shipbuilding order cycles. They also shape bunker fuel demand patterns in regional maritime hubs and influence global energy freight rate benchmarks.

Multimodal Connectivity and Trade Corridor Integration

Modern Persian Gulf ports increasingly integrate with rail, road, and inland logistics corridors. This transformation expands their strategic importance beyond maritime cargo handling and positions them as global trade gateways.

Some regional ports now connect directly to inland rail corridors linking Central Asia, Eastern Europe, and parts of China. This integration allows cargo to move efficiently between maritime and land-based transport networks, reducing overall transit time and logistics costs.

From a supply chain perspective, Gulf ports are evolving into logistics accelerators. Instead of simply transferring cargo from ship to shore, they increasingly function as integrated distribution and value-added logistics centers supporting global trade networks.

Challenges and Practical Solutions

The Persian Gulf shipping environment faces several structural challenges. However, the maritime industry has developed adaptive strategies to maintain trade continuity and operational resilience.

One major challenge is geopolitical risk. Regional tensions can increase insurance premiums, alter shipping schedules, and create freight market volatility. These disruptions can increase voyage distances and transportation costs, influencing global commodity pricing and supply chain stability.

Another structural challenge is route concentration. Limited alternative maritime routes for large-scale energy exports mean that disruptions can quickly affect global tanker supply capacity. This concentration increases the importance of strategic route planning and cargo diversification.

The maritime industry has implemented several practical solutions to address these risks. Pipeline diversification projects reduce dependence on maritime chokepoints by enabling exports through alternative coastal regions. Advanced voyage risk assessment tools, satellite monitoring systems, and AIS analytics help shipping companies optimize routing decisions and improve safety planning.

–

Case Studies and Real-World Applications

Case Study 1: Hormuz Traffic and Global Energy Pricing

The Strait of Hormuz experiences extremely high daily vessel traffic. Because global energy markets depend heavily on this corridor, any slowdown or disruption can influence oil pricing and shipping freight rates. Even short-term uncertainty can trigger price fluctuations and increase insurance costs for vessels operating in the region.

Case Study 2: Container Shipping and Transshipment Strategy

Container trade routes connecting Asia to Africa and Europe often rely on Gulf transshipment hubs. These routing strategies allow carriers to reduce transit time and improve schedule reliability. By consolidating cargo in strategic hub ports, shipping lines can operate larger vessels on mainline routes while using feeder vessels for regional distribution.

This model mirrors airline hub systems, where major airports consolidate passengers before connecting them to regional flights. In maritime logistics, this approach improves operational efficiency and reduces shipping costs.

Case Study 3: Strategic Port Development and National Trade Strategy

Several Gulf ports demonstrate how national economic strategies rely heavily on maritime gateway development. These ports support domestic trade, regional logistics corridors, and international supply chain connectivity. Their expansion often aligns with broader economic diversification strategies designed to reduce reliance on energy exports alone.

–

Future Outlook and Maritime Trends

Looking forward, Persian Gulf ports are expected to increase their influence on global shipping routes due to several long-term trends.

Growing energy demand from Asian economies will likely reinforce tanker and LNG shipping routes between the Gulf and Asia. At the same time, geopolitical risk awareness will continue to drive investment in alternative export corridors, strategic energy reserves, and diversified supply chain planning.

Digital transformation is another major trend. Smart port technologies, automation systems, predictive maintenance tools, and AI-based logistics optimization platforms are becoming increasingly common in Gulf port operations. These technologies improve cargo efficiency and strengthen competitiveness against leading global port hubs.

Global seaborne trade volumes are projected to continue growing over the next decade, reinforcing the importance of stable maritime chokepoints and efficient port infrastructure in sustaining global economic growth.

–

FAQ Section

1. Why are Persian Gulf ports so important for global shipping?

They handle large volumes of global energy exports and act as logistics hubs connecting Asia, Europe, and Africa.

2. What is the role of the Strait of Hormuz in shipping routes?

It serves as the main maritime exit for Persian Gulf exports and carries a significant share of global oil and LNG trade.

3. Do Persian Gulf ports handle container cargo or only energy cargo?

They handle both. Many Gulf ports are major global container transshipment hubs.

4. What happens if shipping is disrupted in the Strait of Hormuz?

Global energy prices can rise, shipping routes may become longer, and freight costs typically increase.

5. How do shipping companies reduce risks in the region?

They use advanced route monitoring, war-risk insurance structures, and diversified logistics planning.

6. Are Gulf ports becoming global logistics hubs?

Yes. Many are integrating smart port technology, automation, and multimodal logistics networks.

–

Conclusion

Persian Gulf ports shape international shipping routes through geography, infrastructure development, and cargo specialization. Their influence extends far beyond regional trade and directly affects global tanker routes, container shipping networks, and energy supply chains.

For maritime professionals and students, understanding Persian Gulf shipping dynamics is essential to understanding modern global trade systems. As maritime technology advances and trade patterns evolve, these ports will remain critical nodes in global shipping networks.

The future of global shipping will continue to pass through the Persian Gulf — both physically and strategically.

–

References

UNCTAD. Review of Maritime Transport.

https://unctad.org

U.S. Energy Information Administration (EIA). World Oil Transit Chokepoints.

https://www.eia.gov

International Maritime Organization (IMO).

https://www.imo.org

International Chamber of Shipping (ICS).

https://www.ics-shipping.org

International Association of Classification Societies (IACS).

https://iacs.org.uk

DNV Maritime Research.

https://www.dnv.com

Lloyd’s Register Maritime Insights.

https://www.lr.org

World Bank Global Trade and Logistics Reports.

https://www.worldbank.org

The Maritime Executive – Industry Analysis.

https://www.maritime-executive.com

Marine Policy Journal (Elsevier).

https://www.journals.elsevier.com/marine-policy