01/28/2026

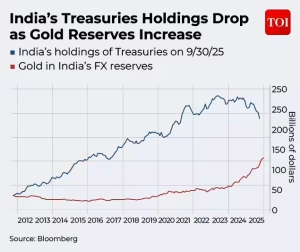

In a decisive move reflecting both economic necessity and long-term strategy, India has significantly reduced its holdings of US Treasury securities to their lowest level in five years. This shift is part of a broader global trend where major economies are reassessing their reliance on US dollar-denominated assets.

The Sharp Decline in Numbers

Recent US government data reveals a stark change: India’s holdings of long-term US debt have fallen to approximately $174 billion. This represents a drastic 26% drop from the peak recorded in 2023. Consequently, US Treasuries now constitute only about one-third of India’s foreign exchange reserves, down from roughly 40% just a year ago.

💡 The Driving Forces Behind the Shift

The Reserve Bank of India’s (RBI) strategy is multi-faceted, driven by several critical factors:

Geopolitical Risk Management: A primary catalyst is the desire to reduce sanction-related vulnerabilities. The US decision to freeze Russia’s forex reserves in 2022 served as a stark lesson for global policymakers. Furthermore, strained US-India trade relations, including the Trump administration imposing 50% tariffs on Indian exports and 25% penal tariffs related to Russian oil imports, have accelerated the move to reduce financial exposure.

Defending the Rupee: The Indian rupee has faced significant pressure, becoming one of Asia’s worst-performing currencies last year. By selling US Treasuries, the RBI frees up dollars that can be deployed to buy rupees and support the domestic currency.

A “Very Considered” Diversification: As stated by Finance Minister Nirmala Sitharaman, the RBI is making a deliberate choice to change the composition of its forex reserves. The goal is to reduce dependence on any single asset class and build a more resilient portfolio.

🌍 A Global Movement, Not an Isolated Move

India’s actions are part of a significant worldwide trend:

-

Following Larger Holders: India’s strategy echoes steps taken by China, which has also been reducing its Treasury holdings while stepping up gold purchases.

-

Broad Central Bank Consensus: A November survey by think tank OMFIF found that while most central banks still hold dollars, nearly 60% intend to explore substitutes over the next one to two years.

-

The Global Rush to Gold: The shift toward the precious metal is accelerating. China and Brazil lowered their Treasury holdings to multi-year lows in October. Simultaneously, Poland, the world’s largest reported gold buyer, plans to add another 150 tonnes to its reserves. India itself now holds the world’s 7th largest gold reserves.

🔮 Outlook and Implications

Analysts believe this strategic reallocation is likely to persist. Michael Brown, a senior strategist at Pepperstone, noted that the “trend is very much embedded,” suggesting that even a potential US-India trade deal would lead to stabilization rather than a reversal of the strategy.

This move by India, one of the world’s top five economies, adds fresh momentum to the global debate on de-dollarization and the future role of US sovereign debt as the world’s premier reserve asset.

*This analysis is based on the article “Decoupling from dollar: India sells US Treasuries & buys gold, holdings drop to 5-year low” published by The Times of India on January 23, 2026.*