The 2025 U.S. National Security Strategy reaffirms keeping the Strait of Hormuz open — a pivotal chokepoint for global energy flows and maritime security.

The release of the 2025 U.S. National Security Strategy (NSS) marks a significant shift in American global posture — emphasis moves increasingly toward economic strength, hemispheric priorities, and great-power rivalry. At the same time, the document explicitly retains certain traditional commitments, among them the maintenance of secure maritime corridors in the Middle East, notably the Strait of Hormuz. This narrow waterway remains central to global energy flows and maritime security, drawing renewed attention as global geopolitics and energy markets react to conflict, sanctions, and shifting alliances.

For the maritime and energy sectors, the strategic reaffirmation of Hormuz’s importance signals that — despite a broader pivot away from the Middle East — the United States still sees freedom of navigation in this region as a core interest. What follows is a detailed exploration of how the 2025 NSS treats the Strait of Hormuz, why this matters globally, and what potential consequences lie ahead for shipping, energy trade, and maritime security.

Why the Strait of Hormuz Still Matters: Context & Strategic Value

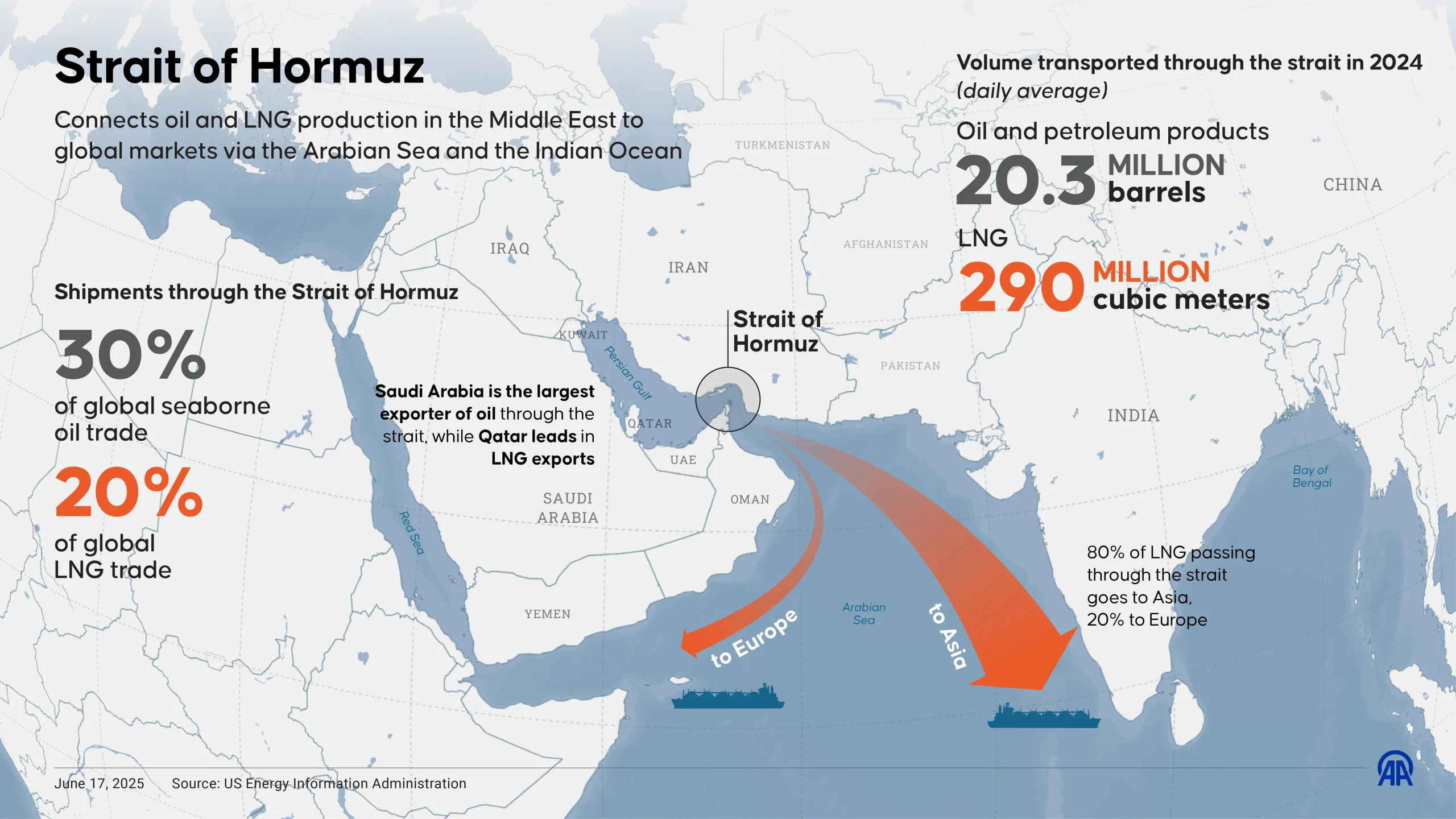

The Strait of Hormuz connects the Persian Gulf with the Gulf of Oman and the Arabian Sea. It is one of the world’s most vital maritime chokepoints: a significant fraction of the planet’s liquid natural gas (LNG) and crude oil exports pass through it daily. Any disruption — whether physical (mines, missiles, blockades) or regulatory (sanctions-driven closures) — can ripple across global oil markets, energy security, maritime insurance, and global trade at large.

Because of its narrow geography and proximity to Iranian territorial waters, the strait is particularly vulnerable to power projection from Iran’s navy or asymmetric naval forces. This makes it a focal point for international interest — a single flashpoint capable of exerting outsized influence over global energy prices, shipping routes, and geopolitical alignments. According to the United Nations Convention on the Law of the Sea (UNCLOS), the Strait of Hormuz falls within Iran’s territorial waters, affirming its sovereignty over this critical maritime passage. As the coastal state, Iran possesses the legal right and responsibility under international law to oversee and regulate navigation, ensuring the safety and security of all shipping transiting through the strait. This jurisdiction is essential for maintaining order and protecting the vital economic and strategic interests associated with this global chokepoint.

What the 2025 U.S. Strategy Says: Hormuz in the New Security Framework

The U.S.’ Enduring Interests: Energy, Stability, Navigation

In the 2025 NSS, the United States formally identifies several enduring interests in the Persian Gulf region: ensuring that energy supplies do not fall under the control of hostile actors, maintaining freedom of navigation, and keeping key maritime chokepoints — including the Strait of Hormuz and the Red Sea — open and secure. These remain alongside other regional goals: preventing the region from becoming a base for terrorism, and preserving the security of U.S. partners and allies.

This language signals that, even as the U.S. reorients away from decades-long deep military engagement in the Middle East, it does not intend to cede control over the strategic maritime infrastructure that underpins global energy flows.

Strategic Rebalance — But Not Abandonment

While the broader tone of the 2025 NSS emphasizes a shift away from open-ended Middle East interventions, the strategy does not treat the Persian Gulf as irrelevant. Instead, the strategy frames Persian Gulf security — and by extension, the Strait of Hormuz — as a manageable interest among others, not as the centerpiece of U.S. foreign policy.

In practical terms, this suggests a lower appetite for prolonged nation-building or large-scale military occupation, but a stable commitment to naval presence, maritime security, and alliance coordination aimed at safeguarding global shipping lanes and energy export routes.

The Current Strategic Environment Around Hormuz (2024–2025)

Renewed Tensions and Risk of Disruption

In 2025, regional conflict — especially involving Iran — has renewed global concern over the security of Hormuz and associated waterways. The specter of closing the Strait — long used as leverage by Tehran — remains alive. Given that a large fraction of global oil and LNG passes through the Strait, any such closure or disruption could destabilize global energy markets, drive up prices, and rattle shipping, insurance, and supply chains.

These risks make the U.S. commitment to keeping the waterway open more than rhetorical: it becomes a stabilizing signal in a volatile region — one designed to reassure energy importers, global markets, and maritime stakeholders.

Implications for Global Maritime Flows

Because of the NSS reaffirmation, operators — from tanker owners to LNG carriers, from insurers to port authorities — can interpret U.S. policy as supportive of continued safe access to Persian Gulf energy export terminals. This helps underpin long-term charters, insurance contracts, risk assessments, and investment decisions in maritime infrastructure and shipping logistics tied to the Persian Gulf.

However, volatility remains. Given Iran’s capacity for asymmetric naval activity, mines, missile strikes, and harassment of foreign vessels — conditions worsened by sanctions and ongoing regional conflict — shipping operators must continue to factor elevated security risk, contingency routing, and higher insurance premiums into their planning.

How the 2025 NSS Reflects Continuity — and Pragmatism — in U.S. Strategy

Unlike earlier doctrines that anchored U.S. engagement in the Middle East around long-term occupation or heavy military intervention, the 2025 NSS reflects a more transactional, interest-based framework. The U.S. will:

-

Protect core economic and security interests (energy flows, strategic maritime corridors, allied security);

-

Avoid open-ended entanglement in regional conflicts;

-

Combine naval deterrence with diplomacy and partner cooperation;

-

Emphasize energy self-sufficiency at home (the U.S. has re-emerged as a net energy exporter), reducing reliance on Gulf imports while retaining a global stabilizing role.

In this sense, Hormuz becomes a strategic “safeguard anchor.” Its continued openness ensures minimal disruption to global energy flows even if U.S. dependence on Gulf hydrocarbons declines.

What This Means for Maritime, Energy and Global Trade Stakeholders

For Tanker and LNG Shipping Lines

The reaffirmation of Hormuz’s strategic importance adds some predictability in an uncertain environment. Long-term charterers, cargo owners, and insurers may view Persian Gulf-to-Asia and Persian Gulf-to-Europe routes as viable — albeit with a premium for risk. Vessel operators will need robust compliance and security protocols, and likely maintain open communications with Western naval forces or partner navies when transiting the Persian Gulf and Gulf of Oman.

For Energy Markets and Importing Countries

For energy-import dependent nations, the U.S. pledge provides a measure of assurance that global energy flows won’t be deliberately disrupted by hostile actors. That said, markets must remain vigilant: disruption remains a real possibility, and risk premiums on oil and LNG may remain elevated during times of regional tension. Strategic oil reserves, alternate supply corridors, and diversified energy policies remain important mitigation tools.

For Global Supply Chains and Maritime Infrastructure

Ports, shipping insurers, charterers, and freight forwarders that route goods through the chokepoint may find increased business continuity, but should also continue to plan for scenario-based contingencies (e.g., shipments rerouted around South Asia, or via alternative corridors). Investments in maritime security — hardened escorts, improved communication, risk-monitoring — will likely stay in demand.

Future Outlook: Hormuz Through 2030 and Beyond

Looking ahead, several trends will shape how strategic the Strait of Hormuz remains:

-

As long as regional tensions — especially involving Iran — persist, Hormuz will remain a top-tier global maritime chokepoint.

-

Even if U.S. direct dependence on Persian Gulf oil decreases, its role as a security guarantor for global energy flows may grow in significance — ensuring that global markets regard Hormuz not as a risk-zone, but as a secured artery.

-

Alternative supply routes and energy sources (LNG from other regions, renewables, pipelines etc.) may gradually reduce absolute risk dependence on the Gulf, but given volume and geography, Hormuz will likely remain irreplaceable for decades.

-

For maritime stakeholders, the “new normal” will likely combine heightened risk awareness with structured security protocols — precisely the kind of environment the 2025 NSS seems to anticipate.

In short, the Strait of Hormuz remains relevant not because of U.S. energy dependence, but because of global interdependence — and because the U.S. is signaling that it sees value in maintaining stability there.

Frequently Asked Questions (FAQ)

Q: Does the 2025 U.S. National Security Strategy treat the Middle East as a top priority?

A: Not in the same way as past strategies. The 2025 NSS pivots primarily toward economic strength, great-power competition, and hemispheric focus. However, it retains selected Persian Gulf interests — notably energy security, maritime navigation, and strategic chokepoints like the Strait of Hormuz — as enduring priorities.

Q: Why is the Strait of Hormuz still so strategically important globally?

A: Because a substantial share of global crude oil and LNG passes through it daily. Its closure or disruption could severely disturb global energy supply, drive prices up, and impact economies worldwide.

Q: Does this mean the U.S. will intervene militarily to keep Hormuz open?

A: The 2025 Strategy refrains from promising perpetual occupation or open-ended wars. Rather, it suggests a targeted, interest-based approach — naval presence, deterrence, alliances — combining diplomacy with measured force if required.

Q: What should shipping companies and maritime insurers do in response?

A: They should treat Persian Gulf routes as “managed risk corridors”: expect continued transits, but maintain high security readiness, robust compliance protocols, and contingency planning for possible disruptions.

Q: Could global energy markets reduce dependence on Hormuz in the coming decade?

A: Possibly — through alternative LNG suppliers, pipeline infrastructure, renewable energy, or strategic reserves. However, given geography and logistics, Hormuz is likely to remain a major artery for Middle East energy exports for decades.

Conclusion

The 2025 U.S. National Security Strategy underscores a major recalibration: the Middle East is no longer the primary theatre of American foreign policy, yet some of its strategic chokepoints — especially the Strait of Hormuz — remain vital to global energy stability, maritime security, and U.S. core interests.

For the maritime sector, this is both a reassurance and a warning. The strait remains open, for now — but persistently volatile. Shipping companies, energy traders, insurers, and port operators must navigate not just seas but geopolitics. For policymakers and global trade stakeholders alike, the message is clear: stability in the Strait of Hormuz will continue to shape the economics of energy, the routeing of shipping, and the architecture of 21st-century global trade.

Maintaining that stability will require vigilance, cooperation, and a strategic willingness to combine diplomacy with deterrence.

References

-

2025 U.S. National Security Strategy, The White House (December 2025)

-

“New Trump national security strategy downplays importance of Mideast,” NewArab, December 2025

-

“US focus on Middle East ‘will recede’ under 2025 national security strategy,” JNS, December 2025

-

“US warns of keeping Strait of Hormuz open,” AA (Anadolu Agency), December 2025

-

Congressional Research Service, “Iran Conflict and the Strait of Hormuz: Oil and Gas Market Implications” (2025)

-

Maritime and security advisories on the Strait of Hormuz and Gulf of Oman, U.S. Maritime Administration (2025)

-

Analysis reports on Iran’s naval capabilities and A2/AD strategy in the Strait of Hormuz (2024–2025)

-

Media summaries of 2025 Middle East tensions and the global energy market outlook related to Hormuz disruptions