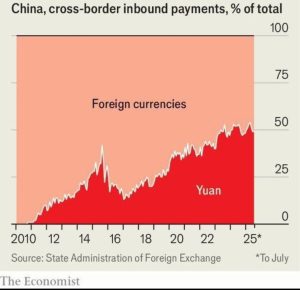

Over roughly fifteen years, China has transformed how it settles with the world. At the start of the 2010s, only a small fraction of the country’s external receipts and payments were in yuan (renminbi, RMB). Today, official statistics show the RMB accounts for more than half of China’s cross-border receipts and payments, with multiple market trackers reporting monthly peaks above that level. The shift is a milestone for China’s financial autonomy and a watershed for corporate treasury practices across Asia, energy trade, and supply chains tied to the Chinese economy.

Within this scope, the RMB has become the default settlement currency for a majority of inflows and outflows for China. Monthly snapshots fluctuate, and goods trade alone typically shows a lower RMB ratio than the combined receipts-and-payments measure, but the structural direction is unmistakable: for China-related business, RMB is now the baseline option rather than a niche.

How We Got Here: A Short History

The journey began with limited pilots for RMB trade settlement around 2009–2010. At first, usage rose slowly as Chinese and foreign firms experimented with CNH (offshore RMB) accounts, discovered the convenience of fewer FX conversions, and learned the documentation requirements.

Over the next decade, authorities laid rails: appointing overseas RMB clearing banks, expanding bilateral swap lines, improving macro-prudential frameworks for cross-border RMB financing, and launching the Cross-Border Interbank Payment System (CIPS). Each step shaved friction from treasury workflows—faster crediting of funds, clearer compliance steps, more predictable cut-offs.

The 2015–2016 outflow episode and tighter capital controls slowed the internationalization narrative, but policy adjustments preserved the core priority: make it simple, safe, and advantageous to use RMB for China-related activities.

From 2021 onward, adoption quickened. Shifts in energy trade, the re-routing of commerce with sanctioned partners, and maturing RMB liquidity arrangements nudged counterparties toward RMB settlement. By mid-2024 and into 2025, official updates and market reporting consistently placed the RMB share above 50% for China’s receipts and payments.

Why RMB Usage Crossed 50% in China’s Cross-Border Flows

a) Persistent Policy Support

The policy goal has been steady: reduce conversion steps, reduce documentation burdens, and ensure adequate RMB liquidity on- and offshore. Connectivity to CIPS, a growing roster of clearing banks, and macro-prudential rules for cross-border RMB financing gave banks and corporates the toolkit to operate comfortably in RMB.

b) Trade Re-composition and Risk Management

As China’s trade footprint evolved, so did currency preferences. Energy and bulk commodity flows into China increasingly accepted RMB settlement when paired with pricing sweeteners, credit lines, or longer-term cooperation agreements. Meanwhile, counterparties facing sanctions constraints pivoted to RMB channels that routed around dollar-based friction points.

c) Corporate Treasury Economics

For a Chinese exporter billing in RMB and sourcing a large share of inputs domestically, RMB invoicing reduces FX exposure and hedging costs. For a foreign supplier paid in RMB with access to CNH liquidity and hedging tools, settlement can be faster and carry fewer compliance uncertainties. Once key anchor firms standardized on RMB terms, suppliers and customers followed.

d) Parallel Rails: CIPS vs. SWIFT

Globally, RMB’s share of payment messages remains small compared with the dollar and euro. The point is not contradiction but segmentation: RMB settlement has grown most where China-related rails and counterparties predominate. CIPS reduces reliance on correspondent banking chains and can make RMB payments cheaper or more predictable in those corridors, even if global messaging shares barely budge.

Why the Global Picture Is Still Dollar-Dominated

Capital account and legal infrastructure: Many global treasurers prize free convertibility, deep hedging markets, and predictable legal recourse. The dollar still wins on these fronts. China’s managed capital account and differing legal frameworks are improving but continue to cap RMB usage outside China-related contexts.

Depth and network effects: Dollar markets offer unrivaled liquidity and instruments from commercial paper to cross-currency swaps. Trade documentation templates, insurance policies, and commodity benchmarks are dollar-centric. Network effects make collective switching slow unless an economic or regulatory shock forces it.

Resulting two-tier reality: Inside China’s ecosystem and its closest trade corridors, RMB usage is now mainstream. In the broader global system, RMB is growing but remains a secondary currency.

Sectoral Dynamics: Where RMB Adoption Is Strongest

-

Energy and commodities. Oil, LNG, coal, metals, and agricultural imports to China have seen expanded RMB settlement, aided by long-term supply contracts, price discounts, or financing support.

-

Manufacturing supply chains. Large Chinese OEMs and their tier-1 suppliers can dictate invoicing terms. As these anchors normalize RMB, downstream firms adopt it to minimize basis risk and settlement delays.

-

Financial and intra-group flows. Intercompany loans, dividends, and cash-pool transfers are natural candidates for RMB once bank limits and documentation are clarified. The gains here help explain why overall receipts-and-payments shares rose faster than goods-only ratios.

Implications for Corporate Treasurers

Corporate treasurers must adopt dual-currency playbooks, treating the RMB as a core operating currency for China-facing business while maintaining the ability to offer or accept RMB terms and preserving dollar options for global pooling and hedging. It is critical to plan for liquidity and hedging access by ensuring credit lines with banks that possess strong CNH capabilities, CIPS connectivity, and a robust suite of RMB hedging instruments; this includes testing settlement cut-offs and holiday calendars across major financial hubs like Hong Kong, Shanghai, Singapore, and London. To optimize working capital, treasurers should seek to net RMB receivables against payables where possible and utilize supply-chain finance programs that can discount RMB invoices without incurring unnecessary currency conversions. Furthermore, tightening documentation is essential, requiring explicit clauses on governing law, dispute venues, and the structure of onshore versus offshore accounts, while also mapping the tax implications of RMB cash pools and intercompany flows. Finally, proactive scenario planning is necessary to consider how external factors like sanctions, tariff changes, or shifts in exchange-rate policy could affect RMB spreads, offshore liquidity, and the willingness of counterparties to accept RMB risk.

Implications for Banks and Market Infrastructure

Banks serving China-related trade can build competitive advantage by expanding RMB clearing, deepening CIPS participation, and offering trade-finance products optimized for RMB invoicing—confirmed letters of credit, forfaiting, receivables finance, and RMB guarantees. On the risk side, they need scalable CNH funding backstops and derivatives expertise to manage client flows through stress periods. Clear client education—documentation, cut-offs, FX options—will remain a differentiator.

Policy and Geopolitical Ramifications

The RMB’s majority status in China’s own cross-border activity gives Beijing more financial autonomy—lower reliance on dollar-centric infrastructures that can become chokepoints during geopolitical frictions. It also reduces currency mismatch on Chinese corporate balance sheets. Nonetheless, it does not dethrone the dollar in global markets, at least under current convertibility and legal conditions. The likely near-term policy trajectory emphasizes resilience and optionality: broadening RMB rails for China-related commerce while keeping macro-prudential guardrails on capital movements.

What This Means for Maritime Transport and Global Shipping

Maritime shipping is where currency preferences meet steel and schedules. As China’s RMB share rises in cross-border settlement, the effects ripple through chartering decisions, freight pricing, bunker procurement, port services, and the financing of vessels and cargoes. Key channels:

a) Chartering, Freight Contracts, and Demurrage

Bulk and container contracts involving Chinese counterparties increasingly include RMB settlement options for freight, demurrage, despatch, and ancillary charges. Owners and operators that can invoice and receive in RMB shorten cash-conversion cycles for China-bound voyages, especially when both freight and port-side services are RMB-denominated. This can reduce basis risk between freight income and China-sourced operating expenses (crew changes, provisions, minor repairs in Chinese yards).

b) Bunkering and Port Services

China’s bunkering hubs and port operators are more frequently quoting and accepting RMB for bunker fuel, pilotage, towage, and terminal handling charges when the counterpart is China-based or settles via RMB corridors. Where owners previously converted USD to pay local fees, RMB settlement can lower transaction costs and speed release of vessels and cargoes, particularly at high-throughput gateways.

c) Shipbuilding, Repair, and Lifecycle Contracts

China is a dominant shipbuilding and repair center. Yard payments, milestone invoices, spares procurement, and warranty claims settled in RMB can reduce FX swings for owners financing a newbuild or major refit in China. Lenders and lessors that can extend RMB credit or structure RMB tranches alongside USD tranches may win mandates from owners who want to align currency of liabilities with currency of yard payments.

d) Trade Finance for Cargoes

Letters of credit, standby guarantees, and receivables finance linked to China-related cargoes—iron ore, coal, grains, containers—are increasingly available in RMB. For shippers and forwarders, RMB L/Cs can accelerate document checking and reduce rejection risks when banks are well integrated with CIPS and local practices. For carriers, RMB-denominated receivables are easier to discount or pledge with RMB-savvy banks.

e) Risk Management and Hedging

As RMB flows grow, shipping companies need playbooks for CNH hedging—forward points, cross-currency swaps (USD/CNH), and optionality around freight revenue and port expenses. Treasury policies that map expected RMB inflows (freight, surcharges) and outflows (port fees, bunkers, repairs) can reduce P&L volatility and improve covenant headroom.

f) Insurance and P&I Considerations

While most hull and machinery and P&I covers remain USD-centric, more placements now contemplate RMB settlement for deductibles, minor claims, or local services. Clubs and brokers with RMB capabilities—banking arrangements, claims handling in Chinese courts—gain efficiency and member satisfaction for China-heavy fleets.

g) Data and Documentation Flows

CIPS adoption and e-document platforms synced to RMB settlement can shorten the time from “NOR tendered” to “freight paid.” When terminal, customs, and bank data flows are synchronized in RMB, discrepancies that often trigger delays—mismatched invoice currencies, unexpected FX fees—decline. For liner carriers, that means faster box release; for bulk, earlier laytime clock stops.

h) Competitive Positioning of Ports and Corridors

Ports that can seamlessly handle RMB settlement—through local banks connected to CIPS, RMB-enabled port community systems, and RMB-priced ancillary services—become more attractive to China-related trades. Over time, this can reallocate volumes among competing hubs, especially in regions where multiple ports vie for the same China-bound cargoes.

Bottom line for shipping: RMB settlement reduces friction where the counterparty, cargo, finance, or services are China-linked. Operators that standardize RMB workflows—banking, compliance, hedging, and documentation—will see faster cash cycles and better pricing in China-centric trades.

Digital RMB (e-CNY), CIPS, and the Next Layer of Efficiency

With CIPS increasingly embedded and pilots for cross-border e-CNY advancing, transaction costs may fall further for China-related maritime commerce. Potential benefits include instant or near-instant settlement for port dues and terminal fees upon departure clearance; smart-contract-like triggers for demurrage/despatch tied to port community timestamps; and lower reconciliation errors between carriers, shippers, and terminals using standardized RMB rails. The hurdles are non-trivial—interoperability with existing standards, cross-border compliance, and risk governance—but in corridors where all participants already bank in RMB, the gains could be material.

In short, potential benefits include:

- Instant or near-instant settlement for port dues and terminal fees upon departure clearance;

- Smart-contract-like triggers for demurrage/despatch tied to port community timestamps;

- Lower reconciliation errors between carriers, shippers, and terminals using standardized RMB rails.

Practical Playbook: Shipping Companies and Port Operators

Carriers and Owners

-

Open and test RMB accounts with banks that have CIPS connectivity in your primary trade lanes.

-

Map RMB inflows (freight, surcharges) and outflows (port services, bunkers, repairs) by port and voyage profile; net where possible.

-

Build a CNH hedging policy targeting forecast RMB exposures over the next 6–18 months.

-

Adapt contracts of affreightment and charter parties to include RMB settlement schedules, bank details, and cut-off provisions.

-

Train ops and documentation teams on RMB L/Cs, RMB invoices, and discrepancy prevention.

Port Authorities and Terminal Operators

-

Partner with banks to offer RMB settlement for port services; publish RMB tariffs transparently.

-

Integrate RMB payment options into port community systems to enable pre-clearance and automated receipting.

-

Coordinate with customs and pilotage authorities to ensure end-to-end RMB workflows.

-

Market RMB capabilities to carriers and forwarders serving China-linked cargoes.

Interpreting the “>50%” Milestone Carefully

The RMB’s majority share of China’s cross-border receipts and payments is a durable new baseline. It signals that for China-related business, RMB is no longer experimental. But it does not imply a sudden global currency rotation. The dollar remains central in trade finance, global payments, reserves, and derivatives. The likely equilibrium for several years is a multipolar settlement landscape: a strong RMB zone for China-centric commerce, alongside the entrenched global dollar system.

Scenarios Through 2030

– Base Case (Most Likely)

- RMB remains in the 45–60% band of China’s cross-border receipts and payments.

- The RMB share of China’s goods trade climbs gradually toward 35–45%, as procurement, freight, and port services deepen RMB support.

- CIPS participation expands; e-CNY sees targeted cross-border uses in trade finance and port payments.

- Globally, the RMB’s share of payment messaging inches up but remains far below the dollar and euro.

- For maritime shipping, RMB settlement becomes routine for China-related voyages; more ports in Asia, the Middle East, and Africa advertise RMB capabilities to win throughput.

– Upside Case

- Commodity trades (oil, LNG, metals) see broader RMB pricing; more energy exporters recycle RMB proceeds into attractive RMB assets.

- Legal and financial reforms in China improve foreign investor confidence and offshore liquidity depth.

- A cluster of major ports standardizes RMB settlement for dues, bunkers, and terminal services, cutting days from voyage cash cycles.

- Shipping finance evolves to include larger RMB tranches, especially for vessels built or financed through Chinese yards and lessors.

– Downside Case

- Episodes of FX volatility or macro slowdown increase risk premia on RMB assets; CNH liquidity tightens.

- Regulatory tightening or geopolitical shocks complicate RMB corridors.

- Shipping companies revert to USD settlement for predictability in multilateral trades, limiting RMB gains to a narrower set of corridors.

Conclusion and Key Takeaways

The RMB has crossed a symbolic and practical threshold inside China’s external ecosystem. For China-related commerce, RMB settlement is now the norm. The global system remains dollar-centric; think segmentation, not displacement. Maritime transport is a prime channel where currency choice becomes operational advantage: faster settlements, fewer discrepancies, and better alignment of income and expenses. Companies that institutionalize RMB capabilities—banking, documentation, hedging—will capture cost and speed benefits in China-linked trades. Through 2030, expect steady RMB consolidation in China-related flows, selective breakthroughs in commodities and ports, and gradual, not dramatic, global share gains.

References (selected)

-

State Administration of Foreign Exchange (SAFE): Monthly and semiannual updates on cross-border receipts and payments; currency composition summaries.

-

The Economist: Coverage of RMB’s share in China’s cross-border receipts/payments and the domestic versus global gap.

-

Bloomberg: Reporting on monthly peaks of RMB usage in China’s cross-border activities.

-

Financial Times: Analyses on RMB settlement surpassing half of China’s cross-border transactions and related policy context.

-

Bank of Finland Institute for Emerging Economies (BOFIT): Briefings on RMB usage in Chinese goods trade and the broader internationalization picture.

-

FXCintel / industry trackers: Trends in China-originated payment currency shares, CIPS growth versus SWIFT.

-

People’s Bank of China and official statements: Guidance on promoting CIPS, cross-border RMB financing, and international e-CNY pilots.