Discover the latest insights from the Fishing Global Market Report 2025. Explore growth trends, regional dynamics, trade war impacts, and sustainability challenges shaping the fishing industry worldwide.

Discover the latest insights from the Fishing Global Market Report 2025. Explore growth trends, regional dynamics, trade war impacts, and sustainability challenges shaping the fishing industry worldwide.

Fishing is one of humanity’s oldest industries, but in today’s interconnected world, it has become a multi-billion-dollar global trade that influences food security, coastal livelihoods, and international relations. Reports like the Fishing Global Market Report 2025 give maritime professionals, policymakers, and students a clear lens into where the industry is heading.

Why is this important? Because fishing is no longer just about casting nets. It’s about balancing supply and demand in a volatile world: rising seafood consumption, climate change affecting stocks, and geopolitical tensions disrupting trade routes. Understanding the market through data and analysis helps stakeholders—from governments to fishing cooperatives—make smarter, more sustainable decisions.

Global Market Growth Trends

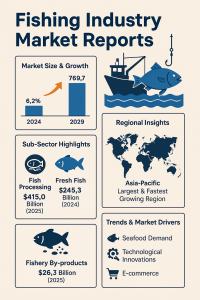

According to UNCTAD and the FAO, the global seafood industry is expected to exceed USD 300 billion by 2025, with annual growth rates between 3–5%. This growth is powered by:

-

Rising demand for protein: Especially in Asia, where seafood remains a staple.

-

Technological advancements: From satellite-based vessel monitoring to remote electronic monitoring (REM).

-

Aquaculture expansion: Now providing over 50% of the world’s fish for human consumption.

Yet growth is not evenly distributed. Regions such as East Asia and Europe are investing heavily in aquaculture and sustainable fisheries, while parts of Africa and Latin America continue to rely on traditional capture fishing.

Trade wars have also shaped growth. For example, tariffs between the U.S. and China in 2019–2020 pushed Chinese exporters to seek new buyers in Africa and the Middle East, reshaping trade flows in ways still visible today.

–

Regional Insights from the 2025 Market

Asia-Pacific: The Powerhouse of Global Fishing

The Asia-Pacific region—dominated by China, Indonesia, Japan, and Vietnam—accounts for over 60% of global fish production (FAO, 2024). China remains the largest fishing nation, both in capture and aquaculture, although concerns about overcapacity and IUU (Illegal, Unreported, and Unregulated) fishing remain.

Technological innovation is strong here: Chinese distant-water fleets now use advanced vessel monitoring systems, while Japan leads in precision aquaculture using AI to optimise feed and reduce waste.

Europe: Sustainability and Regulation

Europe is less about sheer volume and more about value and compliance. The EU Common Fisheries Policy enforces Total Allowable Catches (TACs), and the European Commission has tied fishing to broader Green Deal objectives. North Sea nations such as Norway and Denmark have invested in low-emission fishing vessels, aligning with IMO’s GHG reduction strategy.

North America: Market Stability with Sustainability Pressure

The U.S. and Canada together make up around 10% of global seafood exports. While production is steady, these markets are more consumer-driven, with traceability and eco-labels (like MSC certification) becoming decisive for supermarket sales.

Africa: Growth Potential and Challenges

West African waters remain among the richest in the world, yet local economies struggle to benefit. Large fleets from Asia and Europe dominate offshore catches, while artisanal fishermen face declining stocks. Reports show potential for Africa to expand sustainable aquaculture, but investment and infrastructure are critical.

Latin America: Exports and Climate Impacts

Peru and Chile remain top players in fishmeal and fish oil exports, essential for global aquaculture. However, El Niño climate cycles frequently disrupt catches, leading to volatility in revenues and supply chains.

–

Challenges Facing the Global Fishing Industry

Overfishing and Resource Pressure

The FAO estimates that over 35% of global fish stocks are overfished. This unsustainable pressure threatens long-term market stability. Trade wars and competitive pricing exacerbate the issue, as exporters sometimes chase short-term profits over sustainability.

Trade Wars and Geopolitics

From U.S.–China tariff disputes to Brexit’s impact on North Sea quotas, politics has reshaped fishing trade routes. For example, after Brexit, the U.K. renegotiated fishing rights with the EU, creating uncertainty for fleets operating in the English Channel.

Climate Change

Rising ocean temperatures are shifting fish migration patterns. Species such as mackerel are moving further north, creating disputes between nations over quotas. The World Bank warns that without adaptation, climate change could cut global fisheries’ revenues by up to USD 10 billion annually by 2050.

Technology and Monitoring

While tools like Global Fishing Watch and Inmarsat vessel tracking improve transparency, many developing nations lack the capacity to enforce compliance. This creates unequal regulatory environments where illegal fishing can thrive.

Opportunities and Solutions

Embracing Aquaculture

Aquaculture is projected to grow by 6% annually until 2030 (FAO). Countries investing in sustainable fish farming—like Norway’s salmon industry or Vietnam’s shrimp sector—are not only reducing pressure on wild stocks but also generating high export revenues.

Remote Electronic Monitoring (REM)

REM systems, combining onboard cameras and sensors, are becoming standard in developed markets. They offer cost-effective surveillance compared to traditional observers and provide credible data for regulators and trade partners.

Green Transition in Fishing Fleets

With the IMO aiming for net-zero emissions by 2050, shipbuilders like Wärtsilä and MAN Energy Solutions are testing hybrid engines and alternative fuels for fishing vessels. This creates long-term competitiveness for fleets that adapt early.

Digital Marketplaces and Traceability

Blockchain technology is increasingly used to trace seafood “from net to plate.” For instance, Icelandic fisheries now use blockchain to certify the origin of cod, enhancing trust in export markets like the EU and U.S.

–

Case Studies: Fishing Market Dynamics in Action

Peru’s Anchoveta Fishery

Peru’s anchoveta fishery is the world’s largest single-species fishery, critical for global fishmeal. Yet during the 2023–2024 El Niño, quotas were slashed by 50% due to stock declines. This impacted aquaculture producers worldwide, showing how one regional event can ripple across global markets.

Norway’s Salmon Boom

Norway remains the world leader in salmon aquaculture. In 2024, it exported over 1.3 million tonnes of salmon, valued at USD 10 billion (Norwegian Seafood Council). Advanced feed technology and disease management have allowed steady growth despite environmental concerns.

West African Struggles

Senegalese fishermen increasingly protest against foreign fleets, claiming depletion of local resources. Reports highlight how inadequate monitoring allows illegal fishing, costing West Africa an estimated USD 2.3 billion annually in lost revenues (World Bank).

–

Future Outlook for the Fishing Industry

Looking ahead to 2030, three themes dominate market forecasts:

-

Sustainability will become non-negotiable: Eco-certifications and traceability will be prerequisites for entering major consumer markets.

-

Aquaculture dominance: Farmed fish will surpass wild-caught as the main source of seafood.

-

Digital transformation: AI-driven forecasting, smart nets, and blockchain supply chains will be standard tools.

The fishing industry’s growth is inevitable, but whether it is sustainable depends on cooperation among governments, businesses, and communities.

–

Frequently Asked Questions

What is the current size of the global fishing market?

The global seafood market is valued at over USD 300 billion in 2025, with steady annual growth.

Which region dominates fishing production?

The Asia-Pacific region leads with over 60% of global production, mainly from China, Indonesia, and Vietnam.

How do trade wars affect fishing markets?

Tariffs and disputes shift export routes, increase costs, and create uncertainty. The U.S.–China trade war pushed Chinese exporters toward Africa and the Middle East.

What role does aquaculture play in the market?

Aquaculture already supplies over half of fish for human consumption and is expected to grow rapidly, reducing reliance on capture fisheries.

What are the main sustainability challenges?

Overfishing, climate change, and IUU fishing remain the biggest threats to long-term viability.

How is technology shaping fishing?

Digital monitoring, blockchain traceability, and green vessel technology are transforming fishing into a more transparent and sustainable industry.

–

Conclusion

Fishing industry market reports are more than statistics—they are roadmaps for the future of food, trade, and the oceans themselves. The Fishing Global Market Report 2025 highlights both opportunities (aquaculture, technology, new trade flows) and risks (overfishing, climate change, geopolitics).

For maritime professionals, students, and enthusiasts, the message is clear: the future of fishing will be shaped not just by how much fish we catch, but by how responsibly we manage the oceans. Sustainable growth is not a choice but a necessity.

Thank you.

so much great information on here, : D.