Explore world sea routes for oil, gas, and energy shipping, including major maritime chokepoints, tanker corridors, and how global energy trade shapes modern shipping lanes.

Why This Topic Matters for Maritime Operations

If global trade were a circulatory system, energy shipping routes would be the arteries that keep the world alive. Every day, vast tanker fleets move crude oil, liquefied natural gas (LNG), refined fuels, and petrochemical feedstocks across oceans. These cargoes power industries, transport systems, electricity grids, and food supply chains across continents. Yet global energy shipping does not move randomly across oceans. Instead, it follows predictable maritime corridors shaped by geography, infrastructure, political stability, and economic demand. These world sea routes form a complex network connecting energy production regions with consumption centers.

Understanding world sea routes for oil, gas, and energy shipping is essential for maritime professionals, logistics planners, energy analysts, and maritime students. These routes influence freight rates, shipbuilding demand, insurance markets, naval security planning, and even global economic stability.

Energy shipping represents one of the most strategically sensitive sectors of global maritime trade. Oil, LNG, and refined products move through a small number of high-traffic sea corridors known as maritime chokepoints. Because so much cargo passes through narrow waterways, disruptions in these areas can affect global supply chains within days. For maritime operations, this means voyage planning, risk management, fleet allocation, and commercial strategy are directly linked to global energy shipping lane stability. Shipping companies continuously monitor geopolitical risk, weather patterns, and port congestion along these routes because small disruptions can quickly translate into major cost increases.

–

Key Developments, Technologies, and Operational Principles

Global Maritime Energy Network: How Sea Routes Are Formed

World sea routes for energy shipping form naturally around three core elements: resource location, demand centers, and navigational geography.

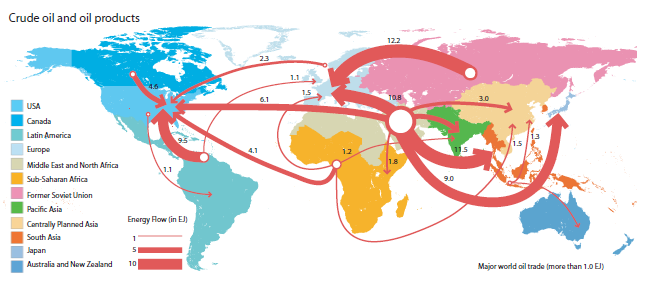

Most crude oil and LNG exports originate from regions such as the Middle East, West Africa, North America, Russia, and Australia. Meanwhile, the largest import markets are Asia, Europe, and increasingly parts of South America. Ships naturally follow the shortest safe routes between these zones, but geography forces vessels through specific narrow passages.

Over time, these forced routes evolve into major shipping highways, with dense vessel traffic patterns similar to multi-lane motorways at sea. Satellite tracking data consistently shows heavy tanker traffic concentrated along a small number of global corridors.

The Strait of Hormuz: The Gateway of Global Oil Exports

The Strait of Hormuz remains the most strategically critical oil shipping lane in the world. This narrow waterway connects the Persian Gulf to the open ocean and acts as the primary export route for Gulf energy producers.

On average, tens of millions of barrels of oil move through this corridor daily, representing a large portion of global seaborne oil trade and a significant share of global LNG shipments. The strait serves as the main export route for major energy exporters, particularly supplying Asian markets such as China, India, Japan, and South Korea.

Because of its importance, the Strait of Hormuz is heavily monitored by naval forces and maritime security organizations. Even minor disruptions can create immediate market reactions, including increased oil prices and freight rate volatility.

The Strait of Malacca: The Energy Superhighway of Asia

The Strait of Malacca connects the Indian Ocean with the South China Sea and Pacific Ocean. It is widely considered the busiest energy shipping corridor in the world.

This narrow route carries massive volumes of Middle Eastern oil and LNG to Asian import markets. China alone accounts for a large share of crude imports moving through this corridor. The strait’s strategic location makes it indispensable for global energy trade, but also exposes it to risks such as congestion, piracy, and geopolitical tensions.

Because alternative routes are significantly longer, shipping companies strongly prefer Malacca when security and traffic conditions are stable.

Suez Canal and Bab el-Mandeb: The Europe–Asia Energy Bridge

The Suez Canal and the Bab el-Mandeb Strait form a combined corridor linking the Mediterranean Sea with the Indian Ocean. This route represents the fastest maritime connection between Europe and Asia.

A significant share of global trade and energy cargo moves through this corridor. The canal allows tankers and LNG carriers to avoid long detours around Africa, saving fuel, time, and operational costs. The Bab el-Mandeb acts as the southern gateway into this corridor, connecting the Red Sea to global ocean routes.

Disruptions in this region often force vessels to reroute around the Cape of Good Hope, significantly increasing voyage duration and fuel consumption. When this occurs, global shipping capacity effectively shrinks because vessels spend more time at sea.

Cape of Good Hope: The Strategic Alternative Route

The Cape of Good Hope route around southern Africa serves as the primary alternative when Suez or Red Sea routes become unstable.

Although longer, this route offers operational reliability during geopolitical disruptions. During periods of regional instability, large volumes of crude oil and refined products shift toward this route despite higher fuel consumption and longer transit times.

This flexibility highlights a core principle of maritime energy logistics: reliability often becomes more valuable than speed during crisis periods.

Panama Canal: Linking Atlantic and Pacific Energy Markets

While the Panama Canal is more closely associated with container and dry bulk shipping, it also plays an important role in LPG, refined product, and some LNG movements.

The canal enables energy cargo movement between the U.S. Gulf Coast, Latin America, and Asian markets. Expansion projects have increased capacity for larger LNG carriers and product tankers, strengthening its role in global energy logistics.

Turkish Straits: The Black Sea Energy Gateway

The Bosporus and Dardanelles connect the Black Sea with the Mediterranean, enabling oil exports from Russia and Caspian region producers. These narrow waterways play an important role in European energy security.

Traffic restrictions, weather conditions, and congestion often influence tanker scheduling through these straits, requiring careful voyage planning and traffic coordination.

–

Challenges and Practical Solutions

Global energy sea routes face multiple operational challenges. However, the maritime industry has developed advanced solutions to maintain supply chain continuity.

Geopolitical tensions remain the largest risk factor. Conflicts, sanctions, and regional instability can rapidly change shipping patterns. When risks rise, insurers increase premiums, charterers demand rerouting, and freight markets become volatile.

Climate change also introduces new operational uncertainties. Changing weather patterns affect routing efficiency, while extreme weather events increase navigational risk in some sea lanes.

The industry increasingly relies on advanced route analytics, satellite monitoring, real-time weather modeling, and predictive risk analysis. These tools allow shipping companies to optimize routes while maintaining safety and cost efficiency.

Pipeline diversification also reduces reliance on maritime chokepoints. Several energy-exporting countries now use combined pipeline-maritime export strategies to improve supply security.

–

Case Studies and Real-World Applications

Case Study: Red Sea Route Disruptions and Global Rerouting

Recent security incidents in the Red Sea demonstrated how quickly global shipping routes can change. When security risks increased, many shipping companies rerouted vessels around southern Africa. This rerouting increased global tanker voyage times and tightened available shipping capacity. The result was higher freight rates and temporary fuel price increases in some regions.

Case Study: Asian Energy Demand and Malacca Dependency

Rapid industrial growth in Asia has reinforced dependence on the Strait of Malacca. Because alternative routes add significant time and cost, most tankers continue using this corridor despite security risks. This dependency drives continued investment in maritime security and naval cooperation in the region.

Case Study: U.S. Energy Exports and Atlantic–Pacific Integration

Growth in U.S. energy exports has increased tanker movements between the Gulf of Mexico, Europe, and Asia. Canal infrastructure expansion has supported this shift, enabling more flexible global routing.

–

Future Outlook and Maritime Trends

Several long-term trends will reshape global energy shipping routes.

Energy demand growth in Asia will continue strengthening tanker traffic across the Indian Ocean and Pacific. LNG shipping routes will likely expand as more countries transition toward gas-based energy systems.

Digitalization will transform voyage planning, enabling real-time optimization based on weather, congestion, and geopolitical risk. Autonomous navigation support systems may eventually improve safety in high-traffic chokepoints.

Decarbonization policies will also influence route planning. Slow steaming, alternative fuels, and optimized routing will become increasingly common as the maritime industry reduces emissions.

New Arctic shipping routes may also play a future role in energy trade, although environmental risks and seasonal limitations remain major constraints.

–

FAQ Section

1. What are the most important world sea routes for energy shipping?

The Strait of Hormuz, Strait of Malacca, Suez Canal corridor, Cape of Good Hope route, Panama Canal, and Turkish Straits.

2. Why are maritime chokepoints important?

They concentrate large volumes of global trade into narrow waterways, making them strategically critical and vulnerable to disruption.

3. Which region depends most on energy sea routes?

Asia depends heavily on maritime oil and LNG imports from the Middle East and other producing regions.

4. Can shipping avoid major chokepoints?

Sometimes, but alternative routes usually increase costs and transit time.

5. How do shipping companies manage route risk?

Through insurance planning, naval coordination, predictive analytics, and diversified routing strategies.

6. Will new sea routes emerge in the future?

Possibly, especially Arctic routes, but most global energy shipping will continue using established corridors.

–

Conclusion

World sea routes for oil, gas, and energy shipping form the backbone of modern global trade. These maritime corridors connect energy producers with global consumers through a small number of strategically critical sea lanes.

Understanding these routes helps maritime professionals better manage risk, optimize logistics planning, and respond to global market changes. As technology evolves and global energy demand shifts, these shipping lanes will continue shaping the future of maritime trade.

For maritime students and professionals, studying global energy shipping routes is not just about geography — it is about understanding how the modern world moves, powers itself, and grows.

–

References

International Maritime Organization (IMO) — https://www.imo.org

International Chamber of Shipping (ICS) — https://www.ics-shipping.org

International Association of Classification Societies (IACS) — https://iacs.org.uk

UNCTAD Review of Maritime Transport — https://unctad.org

World Bank Global Trade and Logistics — https://www.worldbank.org

DNV Maritime Research — https://www.dnv.com

Lloyd’s Register Maritime Insights — https://www.lr.org

American Bureau of Shipping (ABS) — https://www.eagle.org

Bureau Veritas (BV) — https://marine-offshore.bureauveritas.com

Marine Policy Journal (Elsevier) — https://www.journals.elsevier.com/marine-policy

The Maritime Executive — https://www.maritime-executive.com

World Ports Organization Energy Chokepoint Reports — https://www.worldports.org