A Historic Reversal in Global Reserves

For the first time in nearly three decades, a seismic shift is reshaping the foundation of the global financial system. In 2024, foreign central banks now hold a greater percentage of their reserves in gold than in U.S. Treasury securities—a reversal not seen since 1996. This isn’t merely a statistical blip; it’s a profound vote of no confidence in the traditional pillars of dollar hegemony and a strategic repositioning for a more fragmented, multipolar world.

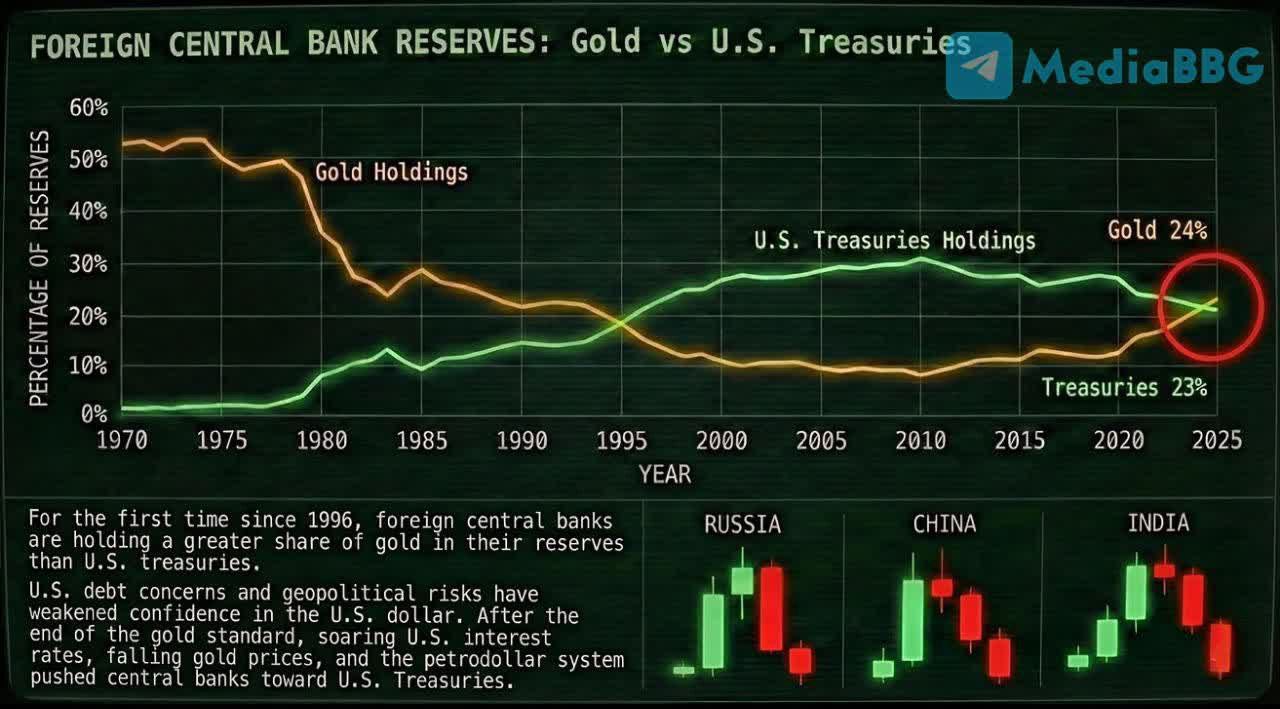

The attached chart tells a story half a century in the making. It traces the dramatic decline of gold’s share in central bank reserves from over 60% in 1970 to a low near 10% in the late 1980s, overtaken and vastly outstripped by the rise of U.S. debt instruments, which peaked at over 55% of reserves in 2015. But the lines have converged and crossed. As of the latest data, gold holdings stand at approximately 24% of aggregate foreign central bank reserves, while U.S. Treasuries have fallen to about 23%.

This article will delve into the decades-long journey to this inflection point, analyze the powerful economic and geopolitical forces driving it, and explore the far-reaching implications for the U.S. dollar, global trade, and the future of international finance.

–

The Rise and Reign of the U.S. Treasury Reserve System (1970-2000)

The Collapse of Bretton Woods and the “Exorbitant Privilege”

The chart’s starting point in 1970 is pivotal. The post-WWII Bretton Woods system had pegged global currencies to the U.S. dollar, which was in turn convertible to gold at $35 an ounce. This system conferred what French Finance Minister Valéry Giscard d’Estaing famously called the “exorbitant privilege” upon the United States—the ability to finance its deficits and project power by issuing the world’s primary reserve currency.

By 1971, President Nixon suspended gold convertibility, effectively ending Bretton Woods. The initial reaction, visible in the chart, was a rush into gold, as central banks clung to the last vestige of tangible value. Gold’s share spiked. However, the U.S., led by Treasury officials like William Simon, engineered a new system. They brokered a deal with Saudi Arabia in 1974, ensuring oil was priced and traded in dollars. This created the “petrodollar” recycling system: global oil importers needed dollars, exporting nations accumulated dollar surpluses, and these surpluses were conveniently parked in deep, liquid U.S. Treasury markets, earning a return.

The Volcker Shock and the Golden Bear Market

The second crucial force driving gold down and Treasuries up was monetary policy. To crush the rampant inflation of the 1970s, Federal Reserve Chairman Paul Volcker jacked up the Fed Funds rate to unprecedented highs, peaking near 20% in 1981. Soaring nominal interest rates made interest-bearing U.S. bonds incredibly attractive compared to non-yielding gold. The opportunity cost of holding gold became punishing. Concurrently, a strong dollar and disinflationary policies triggered a brutal, two-decade-long bear market in gold, cementing its reputation as a “barbarous relic” in the eyes of many Western policymakers.

The Triumph of the Washington Consensus

The 1990s represented the zenith of U.S. financial hegemony. The collapse of the Soviet Union left a “unipolar moment.” The Washington Consensus—promoting deregulation, free capital flows, and dollar-centric globalization—was dominant. U.S. financial markets were seen as deep, safe, and sophisticated. The chart shows U.S. Treasury holdings soaring through this period, while gold languished. Central banks, particularly in emerging markets, built massive war chests of dollar reserves as a buffer against financial crises, further fueling demand for Treasuries. By the late 1990s, the system seemed unassailable.

–

The Cracks Begin to Show (2000-2020)

The Dot-Com Bust and the Seeds of Debt

The early 2000s planted the first seeds of doubt. The dot-com bust prompted the Fed under Alan Greenspan to slash interest rates to historic lows (1%), a policy largely maintained after the 9/11 attacks. While this stabilized markets, it began a long period of suppressed yields, making Treasuries less attractive. It also fueled a debt boom, first in housing and then across the entire economy.

The 2008 Global Financial Crisis: A Paradigm Fracture

The 2008 crisis was a direct indictment of the core of the U.S.-centric financial system. The contagion that originated on Wall Street nearly collapsed the global economy. The immediate response was a flight to the safety of U.S. Treasuries (a spike visible in the chart around 2010), as the dollar remained the ultimate safe-haven asset in a panic.

However, the long-term consequence was a crisis of trust. The Fed’s response—zero interest rates and quantitative easing (QE)—involved creating trillions of new dollars to buy Treasuries and mortgage-backed securities. To the world, this looked like the monetization of U.S. debt. Concerns about long-term dollar debasement and fiscal recklessness began to move from the fringe to the mainstream of central bank discourse. Emerging market central banks, burned by dollar volatility, started to quietly question the wisdom of accumulating more dollar-denominated IOUs.

The Strategic Pivot of Eastern Central Banks

During this period, a divergence emerged. Western central banks (like the ECB and the Fed itself) largely held their gold steady. In contrast, central banks in Russia and China, having accumulated enormous dollar reserves, began a systematic, multi-year program of gold accumulation. Their motivations were clear:

-

Diversification Away from Dollar Risk: Reducing vulnerability to U.S. sanctions and financial power.

-

Sanctions Proofing: Following Western sanctions over Crimea in 2014, Russia explicitly stated it was building a “fortress balance sheet.”

-

Supporting National Currency Ambitions: Gold bolstered the credibility of the ruble and yuan, supporting long-term goals of internationalization.

This buying provided a steady, price-supportive undercurrent to the gold market throughout the 2010s, slowing the decline in gold’s reserve share and setting the stage for its resurgence.

–

The Accelerants: Why the Shift Went Critical (2020-Present)

The convergence and crossover of the lines on the chart after 2020 were driven by an explosive cocktail of fiscal, monetary, and geopolitical factors.

Unprecedented Fiscal and Monetary Expansion

The U.S. response to the COVID-19 pandemic was to unleash fiscal and monetary firepower on a scale dwarfing the 2008 crisis. The Fed’s balance sheet ballooned from ~$4 trillion to nearly $9 trillion. The U.S. government passed multi-trillion-dollar relief packages, skyrocketing the national debt past $30 trillion. While necessary to avert depression, this “whatever it takes” approach screamed “fiscal dominance”—where central bank policy is subordinated to financing government debt. For foreign reserve managers, the prospect of higher inflation and currency depreciation became a tangible risk, not a theoretical one.

The Return of Inflation and Aggressive Fed Pivot

The surge in inflation to 40-year highs in 2022 confirmed central banks’ worst fears. The Fed’s belated but aggressive rate-hiking cycle, while aimed at curbing inflation, created a new problem: massive mark-to-market losses on existing Treasury holdings. In 2022, the Bloomberg US Treasury Total Return Index had its worst year in history. Central banks saw the value of their massive Treasury portfolios plummet. Unlike a default, this is a realized loss if securities are sold, and a painful opportunity cost if held. Gold, in contrast, held its value and even appreciated during this period of high inflation and volatility, proving its role as a hedge.

Weaponization of the Dollar and Geopolitical Rupture

Perhaps the most profound accelerator has been geopolitical. The extensive use of financial sanctions—freezing approximately $300 billion of Russian central bank reserves following the invasion of Ukraine—was a watershed moment. It demonstrated to every nation not squarely in the U.S. geopolitical camp that dollar assets are not neutral, safe assets. They are liabilities that can be frozen with a keystroke.

This “weaponization” of the dollar system triggered a global strategic reassessment. If the rules of the game can be changed overnight for geopolitical reasons, then the foundational trust required for a reserve currency is broken. Countries from China and India to Saudi Arabia and Brazil have since accelerated efforts to settle trade in local currencies, establish alternative financial messaging systems to SWIFT, and yes, buy more physical gold—an asset that, once in your own vault, cannot be frozen or digitally altered.

–

Implications of the Great Diversification

For the U.S. Dollar and Economy

-

Higher Long-Term Interest Rates: As the most reliable, captive source of demand for U.S. debt wanes, the U.S. Treasury will have to offer higher yields to attract other buyers (domestic institutions, individual investors, etc.). This increases the nation’s debt servicing costs, crowding out other fiscal priorities.

-

Erosion of the “Exorbitant Privilege”: The ability to run persistent current account deficits with cheap financing is diminished. The U.S. will face more market discipline.

-

Increased Volatility: With a less stable, non-official buyer base for Treasuries, the dollar and U.S. bond markets could become more prone to sharp swings.

For the Global Financial System

-

Fragmentation and Regionalization: The world is moving toward a more fragmented system with regional currency blocs (dollar, euro, and a growing yuan area). Gold acts as a neutral, swing asset between these blocs.

-

Reduced Global Liquidity: A move away from a single, deep pool of dollar/Treasury liquidity could make it harder to manage global capital flows during crises.

-

Rise of Alternative Reserve Assets: This includes not just gold, but also Special Drawing Rights (SDRs), other sovereign bonds (e.g., EU bonds), and potentially digital assets from major central banks (CBDCs).

For Gold and Commodity Markets

-

Structural Demand Floor: Central bank buying, driven by strategic rather than purely return-seeking motives, provides a powerful, persistent source of demand for gold.

-

Re-monetization on the Margins: While a full return to the gold standard is improbable, gold is being subtly “re-monetized” as a high-level, strategic monetary asset.

-

Commodity Links: Nations may increasingly back their currencies with baskets of commodities (including gold), strengthening the link between tangible resources and financial strength.

–

The Future Outlook – What Comes Next?

The crossing of the lines on the chart is not an end point, but a milestone on a longer journey. Several scenarios are possible:

-

The Managed Decline: The U.S. addresses its fiscal trajectory, stabilizes political divisions, and the dollar retains its primary role, albeit with a reduced share. Gold’s rise plateaus as a diversification play.

-

The Accelerated Fragmentation: Geopolitical blocs harden, dedollarization efforts gain momentum, and central bank gold buying accelerates. The Treasury share continues to fall, and gold potentially reclaims a 30%+ share of global reserves.

-

A Crisis and Dollar Renaissance: A major global recession or geopolitical crisis triggers a panicked flight back to the dollar’s liquidity, temporarily reversing the trend. However, this would likely be a short-term reprieve unless underlying trust issues are resolved.

The most likely path is a continued, gradual diversification. The era of the U.S. Treasury as the undisputed, preferred asset for global savings is over. It will remain critically important, but it now shares the stage. Central banks are preparing for a world with more options, more risks, and less certainty. They are building resilience, not just returns.

–

Conclusion: The Silent Vote for a New Monetary Order

The quiet, steady accumulation of gold bars in vaults from Moscow to Beijing to Istanbul is a silent vote against the old order. It is a tangible expression of sovereign caution in the face of unprecedented debt, of strategic autonomy in a world of renewed great power competition, and of a primal desire for an asset free from counterparty risk.

The chart from 1970 to 2025 is a visual history of global trust. The steep fall of the gold line marked the world’s faith in American promises and the system it built. The meteoric rise and subsequent fall of the Treasury line tells the story of that faith being tested, strained, and ultimately withdrawn in part. The crossing of the lines is the moment the ledger turned.

For investors, policymakers, and citizens, understanding this shift is crucial. It signals higher volatility, a rebalancing of global economic power, and the end of financial conditions taken for granted for a generation. In the long arc of monetary history, the age of fiat dollar dominance may be seen as a brilliant, but finite, chapter. The world’s central banks, through their actions, are now cautiously writing the next one, with gold playing a foundational role once more.