How the Persian Gulf’s rentier states evolved—from oil rents to mega-ports and sovereign wealth funds—and what this political economy means for maritime trade.

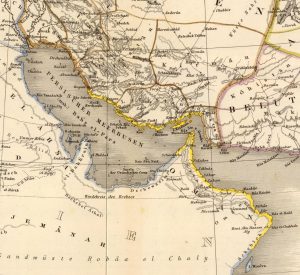

Stand on the bridge of a tanker approaching the Persian Gulf, and the rentier state is not an abstract theory. It appears as coastline infrastructure: long breakwaters, deep-water berths, rows of storage tanks, LNG jetties, pilot boats, coast guard patrols, and—increasingly—container terminals and logistics parks. It appears as policy, too: subsidised energy for domestic industry, state-driven port expansion, and national shipping champions. It even appears in the rhythm of the sea lanes: intense traffic through the Strait of Hormuz, where a significant share of global petroleum liquids flows every day.

The “rentier state” is a political economy model designed to explain what happens when a state’s revenues come primarily from external rents—especially oil and gas—rather than from domestic taxation and diversified production. In the Persian Gulf, this model became one of the most influential lenses for understanding state–society relations, fiscal governance, and the region’s development pathway. It also helps explain why Gulf states often build world-class maritime infrastructure quickly, why they can cushion shocks with sovereign wealth funds, and why shipping and port strategy are so closely linked to national policy.

This article traces the evolution of rentier states in the Persian Gulf—how the model emerged, how it adapted across oil booms and busts, and how it is being re-engineered today through diversification, mega-projects, and port-led logistics strategies. Throughout, the focus stays practical: what the rentier state means for maritime operations, trade patterns, compliance, and future shipping demand.

Why This Topic Matters for Maritime Operations

In global shipping, the Persian Gulf is not “one trade lane among many.” It is a structural pillar of energy logistics, tanker employment, and maritime security planning. When oil revenue expands, it often translates into large-scale port investments, shipyard upgrades, new terminals, and logistics corridors. When oil revenue contracts, it can affect cargo volumes, state spending, and the pace of infrastructure rollouts—sometimes with direct consequences for port fees, service levels, and construction schedules.

The Strait of Hormuz is the most visible expression of this reality. The United States Energy Information Administration (EIA) has described the Strait as critical to global energy trade; in 2024, oil flows through Hormuz averaged about 20 million barrels per day, roughly 20% of global petroleum liquids consumption. For shipping companies, those numbers are not academic: they shape war-risk pricing, insurance decisions, fleet deployment, crew welfare protocols, and contingency routing.

Rentier political economy also influences maritime governance. States with high resource rents typically have strong incentives to secure export routes, protect offshore infrastructure, and maintain investor confidence. That can mean robust coast guard and naval capabilities, rapid regulatory responses after incidents, and close cooperation with international maritime standards—particularly when exports depend on global trust in safety and reliability.

Finally, rentier-state evolution is increasingly tied to diversification strategies that directly affect maritime markets. Gulf states have invested not only in crude and LNG export capacity, but also in container transshipment, free zones, industrial clusters, and port-centric logistics systems. These choices shape demand for container services, feeder networks, coastal shipping, ship repair, bunkering, and—looking forward—alternative fuels and “green corridor” infrastructure.

Understanding the Rentier State: The Core Idea, Explained Simply

The rentier state concept is most associated with the seminal work edited by Hazem Beblawi and Giacomo Luciani, which framed rentierism as a system where the state’s revenue is largely derived from external rents and where the distribution of that revenue becomes central to politics and governance.

A simple analogy helps. Imagine two families living in the same town. One family runs a set of businesses: a shop, a workshop, a small transport company. Their income depends on local customers, productivity, and continuous work. The second family receives a large monthly payment from outside the town—say, from a long-term lease of valuable land. They can build a big house quickly and pay for services without relying on local sales. Over time, the second family’s relationship with the town changes: they can “buy” stability and services through spending, and they do not need to bargain with local customers the same way.

In rentier states, the “outside payment” is typically oil and gas export revenue. This changes the nature of government. When a state does not rely heavily on domestic taxation, classic political bargaining—“no taxation without representation”—becomes weaker. Instead, governance often turns on distribution: public sector jobs, subsidies, infrastructure, and welfare benefits. The state becomes, in many accounts, more of an allocator than a tax-collecting manager of a complex domestic economy.

The concept evolved over time. Scholars later introduced refinements such as “late rentierism,” arguing that Gulf states changed significantly under globalisation, demographic pressure, and economic ambition, while still retaining core rentier features. Matthew Gray’s “late rentierism” is a prominent formulation: it accepts the broad validity of rentier state theory but emphasises how internal and external forces reshaped Gulf political economies without removing the central role of rents and elites.

The Evolution of Gulf Rentierism: Four Overlapping Phases

Early Formation: Oil Rents as State-Building Fuel

In the early decades of oil development, rents were transformative primarily because they arrived quickly and at scale. They funded state-building: administrative institutions, national security forces, basic infrastructure, and ports capable of exporting crude reliably. Maritime capacity was not optional. If oil is the revenue engine, shipping is the exhaust system: without terminals, pilots, dredged channels, and tanker compatibility, rents cannot be realised.

This is why many Gulf ports modernised rapidly in parallel with upstream oil development. Export reliability became a national interest. Over time, this created a distinctive Gulf feature: infrastructure that looks “ahead of its domestic economy,” built for global flows rather than local demand. In rentier logic, that is rational. The export interface—ports and terminals—protects the rent stream.

Consolidation: Allocation States and the Social Contract of Distribution

As rents expanded, the political economy consolidated around distribution. The state could fund generous public sector employment, subsidised fuel and electricity, and wide-ranging infrastructure spending. The “social contract” often became: political acquiescence in exchange for material benefits and stability.

For maritime stakeholders, this phase matters because it produced strong state participation in shipping and logistics. National carriers, port authorities, and maritime academies were built or expanded under public funding. State-led procurement created predictable demand for dredging, ship services, towing, pilotage, and port expansion projects.

At the macro level, oil rents as a share of GDP—while varying by country and year—offer a practical indicator of rentier intensity. The World Bank’s World Development Indicators track “oil rents (% of GDP)” across regions and countries, illustrating how hydrocarbons can dominate value creation in certain economies.

Stress Tests: Oil Price Volatility, Demographics, and “Late Rentierism”

Over time, rentier systems faced stress tests. Oil price collapses reduced fiscal space; populations grew; expectations rose; global competition increased. The Gulf’s response was not uniform, but a pattern emerged: reform and modernisation without abandoning rentier foundations.

This is where “late rentierism” becomes useful. Gulf states began building more complex economic strategies—industrial policy, global finance integration, and large-scale urban development—while still financing much of this through rents and state-led investment. Gray’s analysis captures the idea that rentierism did not simply fade; it adapted and, in some ways, entrenched elite control through more sophisticated tools.

In maritime terms, this period included the rise of Gulf transshipment and logistics ambitions: deep-water container terminals, free zones, global port operators, and integrated trade facilitation. The logic was clear: if oil rents are unstable over decades, the state needs new “rent-like” revenue streams—logistics fees, port services, industrial zones, and strategic investments abroad.

Strategic Re-Engineering: Sovereign Wealth Funds and Port-Led Diversification

The most visible institutional innovation in modern Gulf rentierism is the sovereign wealth fund (SWF). SWFs convert volatile resource revenues into diversified financial assets, often with strategic objectives: domestic development, international influence, and long-term fiscal stability.

An IMF working paper published in 2025 highlights the role of GCC SWFs such as ADIA, Mubadala, and Saudi Arabia’s PIF, noting their significance for both outward investment and domestic investment, and their central role in diversification and integration into global markets.

This matters for shipping because SWFs and state-linked investment vehicles frequently target infrastructure, logistics, industrial zones, and trade facilitation. In practice, they can act as “capital accelerators,” enabling ports and supply chain projects that private markets might finance more slowly or at higher cost. The result is a distinctive Gulf dynamic: diversification executed with the financial muscle of the rentier state.

Key Developments, Technologies, and Principles Applied to Maritime Systems

Ports as “Rent Interfaces” and “Diversification Platforms”

In rentier political economy, export infrastructure is a strategic lifeline. Ports and terminals are not merely commercial assets; they are sovereignty tools. A crude export terminal’s reliability influences national revenue stability. That is why Gulf states have historically prioritised redundancy, resilience, and security for key maritime assets.

In the diversification era, ports also serve as platforms for non-oil growth: logistics clusters, manufacturing zones, cold chains, and re-export hubs. This “port-led development” turns maritime infrastructure into a multiplier. Instead of earning revenue only from exporting oil, the state can generate value from container handling, warehousing, customs facilitation, and industrial processing.

UNCTAD’s Review of Maritime Transport repeatedly emphasises the centrality of chokepoints and the vulnerability of maritime trade to geopolitical disruption, reinforcing why states that depend on maritime corridors invest heavily in port performance and resilience.

The Strait of Hormuz as a Political Economy Asset

The Strait of Hormuz is often discussed in security terms, but it is also a rentier-state asset: the passage through which rent is physically realised. The EIA’s 2025 analysis underscores that flows through the Strait remain critical and substantial. A 2025 Congressional Research Service report also quantifies the Strait’s role in maritime oil trade and global consumption.

For maritime operators, this creates an operating environment where commercial and strategic logics overlap. Routing, AIS practices, security protocols, and insurance decisions become intertwined with geopolitics. The rentier state’s priority is therefore not only economic efficiency but route security and reputational reliability.

Regulation, Standards, and the “Trust Stack” of Oil Shipping

Oil exports rely on an international “trust stack”: classification, insurance, port state control, and international standards. Although rentier states may have strong domestic autonomy, they still depend on global acceptance of their export system.

This is where maritime institutions and technical governance enter the rentier story. Classification societies help ensure vessels and offshore assets meet safety and environmental standards. The IMO’s regulatory framework (notably MARPOL and SOLAS) defines baseline expectations for pollution prevention, ship safety, and operational integrity—conditions that sustain global confidence in energy shipping.

Even when politics are tense, commercial energy shipping needs predictable rules. That is why many Gulf states engage actively with global maritime norms: their rents depend on it.

Digitalisation and the Logistics State

A modern rentier state increasingly uses digitalisation to improve customs efficiency, port performance, and trade transparency. This is not only about technology; it is political economy. Faster logistics increases non-oil revenue, supports private sector growth, and reduces dependence on direct distribution spending.

A World Bank press release in late 2025 describes diversification and digital transformation efforts across GCC economies, framing digitalisation as a key engine for diversification. For ports, this connects directly to single-window systems, digital port community platforms, predictive berth planning, and cargo visibility—capabilities that attract global shipping lines.

Challenges and Practical Solutions for Rentier States and Maritime Stakeholders

The rentier state is powerful, but it carries structural vulnerabilities that maritime stakeholders should understand clearly.

One vulnerability is fiscal sensitivity to oil prices. When oil rents fund a large share of public spending, price downturns can slow infrastructure projects, reduce subsidies that support domestic industries, and constrain maritime sector expansion. This can affect port tariffs, dredging schedules, and the pace of new terminal commissioning. Over time, it can also push governments toward new revenue tools—fees, VAT-like mechanisms, or targeted taxation. In 2025, for example, Oman’s move toward taxing high earners was widely interpreted as a signal of fiscal pressure and a potential regional precedent.

A second vulnerability is over-centralisation. State-led investment can deliver rapid results, but it can also crowd out private initiative if regulatory frameworks and competition policy do not mature. For ports and shipping services, this may show up as limited operator diversity, procurement rigidity, or slower innovation outside flagship projects.

A third challenge is employment structure. Rentier systems often create strong incentives for public sector employment, while private logistics and maritime services may rely heavily on expatriate labour. This can create skills gaps, workforce turnover risks, and “nationalisation” policy shifts that affect crewing, training requirements, and labour costs in port services.

Practical solutions have emerged across the region and can be framed in maritime terms. First, build resilient revenue models around ports by developing diversified service mixes—container, Ro-Ro, offshore support, ship repair, bunkering, and maritime professional services—so that a port’s economics do not rise and fall only with crude volumes. Second, invest in human capital through maritime academies and technical training aligned with international benchmarks, ensuring that diversification is not only infrastructure-led but capability-led. Third, strengthen governance and transparency: predictable regulation, clear concession frameworks, and internationally credible safety and environmental enforcement reduce risk premiums for investors and ship operators.

In the rentier context, these solutions are most successful when they are treated as “statecraft,” not merely “business.” Ports are strategic assets; improving their performance is a national competitiveness project.

Case Studies and Real-World Applications

Case Study 1: Sovereign Wealth Funds as “Stabilisation + Transformation” Tools

SWFs illustrate how rentier states evolved from direct distribution to strategic asset management. In earlier rentier phases, rents funded domestic spending. In contemporary Gulf economies, a growing share of rent management is routed through investment institutions that aim to generate returns and build strategic sectors.

The IMF’s 2025 paper on SWFs and investment patterns highlights the outsized role of GCC SWFs in outward and domestic investment, reinforcing the idea that the rentier state has become more financially sophisticated rather than simply smaller.

For maritime markets, this can mean sustained funding for port expansions even during downturns, and long-horizon investments in logistics corridors, industrial zones, and trade facilitation. It also means Gulf capital increasingly shapes global port ownership and infrastructure finance, affecting maritime competition beyond the region.

Case Study 2: The Strait of Hormuz—A “Rentier Corridor” Under Geopolitical Stress

Energy chokepoints are where rentier logic meets geopolitics. The Strait of Hormuz is critical not just because of geography, but because it concentrates rent flows into a narrow maritime space. The EIA’s 2025 assessment quantifies the magnitude of those flows in 2024 and notes ongoing criticality.

Operationally, this produces a distinctive risk landscape: heightened naval presence, dynamic security advisories, and sensitivity to incident narratives. Even when ships move safely, the perception of risk can raise costs through insurance and market uncertainty. For ship managers and charterers, this is why geopolitical monitoring is part of modern voyage planning—especially for tankers and LNG carriers.

Case Study 3: Port-Led Diversification and the Logistics Economy

Gulf diversification strategies often treat logistics as a “next rent.” Ports generate revenue through throughput, transshipment, and value-added services, while also enabling industrial development. This creates a reinforcing loop: efficient ports attract trade; trade supports industry; industry increases cargo volumes.

Global maritime trade is sensitive to chokepoints and conflict-driven rerouting. UNCTAD’s maritime transport analysis highlights how geopolitical disruptions can extend routes and raise costs, reminding policymakers why resilient port ecosystems matter for national competitiveness.

Future Outlook and Maritime Trends

The rentier state in the Persian Gulf is not disappearing; it is evolving into a more complex hybrid. Oil and gas rents remain central, but states are actively building parallel engines: logistics, digital services, manufacturing clusters, tourism, and strategic investment returns.

Several trends stand out for maritime readers.

First, expect continued investment in ports and corridors as long as states view logistics as a diversification pillar. World Bank commentary on GCC diversification and digital transformation suggests momentum in structural reforms, even if progress is uneven. This supports long-term demand for port construction, dredging, and terminal automation.

Second, the region’s maritime risk environment will remain linked to geopolitical dynamics around Hormuz. Energy flows are large enough that disruptions carry global consequences, which is why external powers and regional states treat maritime security as a permanent priority.

Third, fiscal strategy will increasingly shape maritime policy. As diversification requires large upfront spending, governments will look for stable revenue sources and cost discipline. This can produce new fee regimes, adjustments in subsidy structures, or selective taxation, as seen in Oman’s policy direction. For ports and shipping services, that means regulatory engagement and cost forecasting become even more important.

Fourth, a “green shipping” dimension is emerging. Even rentier states must respond to international decarbonisation pressures. Over time, Gulf ports are likely to expand alternative fuel capabilities (LNG now; hydrogen and ammonia pilots later), shore power, and emissions monitoring—partly to stay competitive and partly to protect their export-based economic model as global regulation tightens.

In short, the future rentier state may look less like a simple distributor of oil wealth and more like a strategic investor, infrastructure orchestrator, and logistics platform—still rent-funded, but operationally diversified.

FAQ

What is a rentier state in simple terms?

A rentier state earns a large share of its income from external rents—especially oil and gas exports—rather than domestic taxes and diversified production.

Why is the Persian Gulf often used to explain rentier state theory?

Because several Gulf economies historically relied heavily on hydrocarbon rents, shaping state spending, social contracts, and development strategies.

How does rentierism affect ports and shipping?

It drives heavy investment in export terminals and port infrastructure to protect revenue flows, and increasingly supports port-led diversification into logistics and trade services.

Does diversification mean Gulf states are no longer rentier?

Not necessarily. Many scholars argue rentierism is adapting (“late rentierism”), with new tools like SWFs and strategic investment, rather than disappearing.

Why is the Strait of Hormuz so central to this discussion?

Because it is the main maritime corridor for Gulf energy exports; in 2024, flows averaged about 20 million b/d, around 20% of global petroleum liquids consumption.

What is the role of sovereign wealth funds in rentier evolution?

They transform volatile rents into diversified assets, funding domestic projects and international investments that support long-term stability and diversification.

How might future maritime regulation affect Gulf rentier states?

Decarbonisation and tighter environmental standards can change demand for hydrocarbons and push Gulf ports to adopt cleaner fuels and greener port operations, reinforcing diversification.

Conclusion

The Persian Gulf rentier state began as an oil-funded project of rapid state-building and distribution. Over time, it became more resilient and more complex—tested by price cycles, demographic change, and global competition. Today, it is being re-engineered through sovereign wealth funds, port-led diversification, and digital logistics strategies that seek to create durable value beyond hydrocarbons.

For maritime professionals, the lesson is practical. The Gulf’s ports, sea lanes, and shipping markets are not only shaped by geography; they are shaped by political economy. Understanding rentier evolution helps you interpret why infrastructure grows quickly, why security policy is intense around chokepoints, and why diversification is pursued through ports, corridors, and global investment.

If you work in shipping, port management, maritime policy, or maritime education, treat the rentier state not as a distant theory but as a living operating context—one that will continue to influence global maritime trade for decades.

References

Beblawi, H., & Luciani, G. (Eds.). (1987/2015). The Rentier State. Routledge. Taylor & Francis

EIA. (2025, June 16). Amid regional conflict, the Strait of Hormuz remains critical to global oil trade. U.S. Energy Information Administration. U.S. Energy Information Administration

Congressional Research Service. (2025, August 4). Iran Conflict and the Strait of Hormuz: Oil and Gas Market Considerations. Congress.gov

Luciani, G. (2017). Rentier state (concept overview). Graduate Institute repository. repository.graduateinstitute.ch

Gray, M. (2011). A Theory of “Late Rentierism” in the Arab States of the Gulf. ETH Zurich / Georgetown repository copy.

International Monetary Fund. (2025). The Role of Foreign Investments and Sovereign Wealth Funds in the GCC (Working Paper). IMF

World Bank. (n.d.). Oil rents (% of GDP) (World Development Indicators). World Bank Open Data

UNCTAD. (2024). Review of Maritime Transport 2024. UN Trade and Development. UN Trade and Development (UNCTAD)

UNCTAD. (2025). Review of Maritime Transport 2025: Staying the course in turbulent waters. UN Trade and Development. UN Trade and Development (UNCTAD)

World Bank. (2025, December 4). GCC economies demonstrate resilience, advance diversification and accelerate digital transformation. World Bank