Where to bunker in the Persian Gulf and near the Strait of Hormuz: key hubs, services, risks, and best practices for ship operators.

Why the Persian Gulf–Hormuz corridor is a global bunkering hotspot

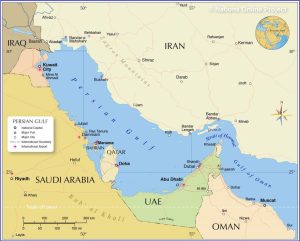

The Persian Gulf and the Strait of Hormuz sit on one of the world’s densest maritime energy corridors. Large volumes of crude oil, refined products, and LNG move through the Strait of Hormuz, generating continuous tanker, LNGC, container, and offshore support traffic—and, consequently, steady demand for marine fuels, lubes, and related port services. In 2024, oil flows through the Strait of Hormuz averaged about 20 million b/d, roughly 20% of global petroleum liquids consumption, underscoring why vessel operators plan conservatively for fuel availability, pricing, and contingency bunkers in this region.

From a commercial perspective, the region offers three distinct bunkering “value propositions”:

- High-volume, internationally benchmarked bunkering hubs (notably Fujairah, increasingly complemented by Abu Dhabi and Dubai anchorages).

- Industrial-port bunkering tied to LNG and refinery ecosystems (Qatar, Bahrain, Saudi east coast, Kuwait).

- Strategic “outside-the-strait” or “near-strait” options that help manage congestion, security posture, or itinerary changes (e.g., Gulf of Oman-side ports such as Fujairah and Sohar).

What “bunkering opportunities” really mean in this region

Bunkering opportunities in the Persian Gulf and around the Strait of Hormuz are not just about “where fuel exists.” They are about operational flexibility, time-to-bunker, fuel assurance, and risk-managed routing. In practical terms, operators are typically optimizing across:

- Delivery mode: berth, anchorage barge, or ship-to-ship (STS)

- Fuel slate: HSFO/VLSFO, MGO/LSMGO, and—emerging—LNG

- Turnaround time: congestion, availability of bunker barges, night operations permissions

- Commercial controls: measurement (increasing focus on mass flow meters), sampling, BDN integrity, and claims handling

- Security and insurance: war risk premiums, routing advisories, and local port notice updates

–

The main bunkering hubs and places to bunker

1) Fujairah (UAE): the region’s anchor bunkering hub (Gulf of Oman side, outside the Strait)

Why it matters:

Fujairah is widely treated by operators as the Persian Gulf–Hormuz area’s primary “fuel insurance policy” because it is outside the Strait of Hormuz on the Gulf of Oman, while still serving Hormuz-bound traffic efficiently. It supports large-scale physical supply, storage, and STS/anchorage operations.

Operational strengths

- Large-scale bunkering ecosystem with regular published sales data and market visibility.

- Port infrastructure explicitly configured for oil terminal operations and associated marine services, including bunker barge berths and support facilities.

Best-fit vessel profiles

- Tankers and LNGCs doing long-haul lifts and seeking predictable supply windows

- Container lines and tramp operators needing fast anchorage bunker calls

- Owners managing risk posture, where bunkering outside the Strait can be operationally attractive during periods of heightened tension

Planning note:

In periods of regional escalation, operators may adjust transit behavior and scheduling, which can affect local demand patterns and timing.

2) Khor Fakkan (UAE, Sharjah): near-strait support option on the Gulf of Oman

Why it matters:

Khor Fakkan sits on the Gulf of Oman coastline (east coast of the UAE), providing a near-strait option for vessels that want an alternative to Fujairah’s anchorage dynamics or are coordinating with Sharjah and UAE east coast port calls.

Where it fits operationally

- Useful for vessels aligning with east-coast UAE port calls or schedule constraints

- Can serve as a tactical option for ships adjusting routing around the Strait of Hormuz

(Availability, grades, and delivery constraints vary by supplier and port permissions; operators should rely on port agent notices and nominated supplier confirmations.)

3) Dubai / Jebel Ali (UAE): expanding anchorage bunkering flexibility

Dubai is a major trade hub, and Jebel Ali’s scale makes it operationally relevant for liner services and multi-service calls. A notable development for operators is the explicit permission for bunker supply at a designated anchorage area (J-Charlie), including the ability for vessels without an operational call at Jebel Ali to bunker at anchorage.

Why this is an “opportunity”

- It converts Dubai into a more viable fuel-only stop (anchorage) in some voyage plans

- It can reduce deviation costs if the vessel already needs Dubai-area anchorage time

- It adds redundancy when Fujairah schedules are tight

4) Abu Dhabi / Khalifa Port (UAE): conventional bunkers plus emerging LNG bunkering

Abu Dhabi is positioning itself more explicitly in the “next fuels” space. The hosting of ship-to-ship LNG bunkering operations at Khalifa Port signals growing readiness for alternative-fuel supply chains.

Implication for operators

For LNG-capable vessels, or fleets transitioning toward lower-carbon fuels, Abu Dhabi’s momentum can become strategically relevant as charterers and regulators increasingly scrutinize emissions trajectories.

5) Saudi Arabia (East Coast): Ras Tanura, Jubail, Dammam (King Abdulaziz Port area)

Saudi Arabia’s Persian Gulf coast is an industrial and energy shoreline with significant tanker and industrial vessel activity. For bunkering, operators often think in terms of port-call integration (bunker while calling) and local supplier ecosystems.

Best-fit use cases

- Vessels already calling Saudi terminals or ports, minimizing deviation

- Operators seeking regional diversification beyond UAE bunkering nodes

6) Qatar: Ras Laffan and broader Qatari port availability

Qatar’s bunkering relevance is closely tied to its LNG and energy shipping ecosystem. Bunkering availability at Ras Laffan is often integrated with energy-sector port operations rather than offered as a stand-alone fuel-only stop.

Best-fit use cases

- LNG carriers and energy-linked trades with scheduled calls

- Operators prioritizing integration with Qatar port operations

7) Oman (near-strait, Gulf of Oman): SOHAR as a practical alternative; Duqm as a wider-ocean contingency

Although not inside the Persian Gulf proper, Oman’s Gulf of Oman ports are highly relevant to Hormuz-adjacent voyage planning.

SOHAR Port

SOHAR provides bunkering services via active suppliers and is operationally attractive for ships combining bunkering with MARPOL waste handling and other compliance services. It is also relevant for operators emphasizing quantity assurance and standardized measurement practices.

Duqm

Duqm lies farther from the Strait of Hormuz but can function as a strategic back-up on certain routes. Its bunkering framework reflects a structured approach to STS operations, governance, and risk management.

8) Iran (Persian Gulf): Bandar Abbas, Qeshm Island, and Asaluyeh anchorages

Iran’s southern coastline along the Persian Gulf and at the eastern approaches to the Strait of Hormuz hosts several operationally relevant anchorages that are frequently considered by ship operators for bunkering, particularly in tramp trades, regional tanker movements, and vessels already calling Iranian ports.

Bandar Abbas anchorage

Bandar Abbas, located close to the Strait of Hormuz, is one of the busiest maritime zones on the Persian Gulf’s northern shore. Its anchorage areas are commonly used by tankers, general cargo vessels, and container ships awaiting port clearance, cargo operations, or onward transit. Bunkering activity at anchorage is typically integrated with local port operations and regional supply chains rather than marketed as a global bunker hub. Operators considering Bandar Abbas generally do so in conjunction with scheduled port calls or regional trading patterns.

Qeshm Island anchorage

Qeshm Island lies strategically within the Strait of Hormuz approaches and hosts extensive anchorage areas. These anchorages are often utilized by vessels for waiting, STS-related operations, or logistical staging. From a bunkering perspective, Qeshm is sometimes evaluated as a flexible anchorage option for ships operating within Iranian waters or transiting nearby routes, with fuel supply arrangements usually handled through local coordination rather than standardized international bunker markets.

Asaluyeh anchorage

Asaluyeh, associated with Iran’s major gas-processing and petrochemical zone on the Persian Gulf coast, supports heavy industrial marine traffic, including gas carriers and supply vessels. Anchorage use is closely linked to terminal and project-related operations. Bunkering in the Asaluyeh area is therefore typically operationally driven, supporting vessels engaged in energy-sector activities rather than serving as a general-purpose bunkering stop.

Operational considerations for Iranian anchorages

When evaluating Bandar Abbas, Qeshm, or Asaluyeh for bunkering, operators generally factor in:

- Alignment with port calls or regional employment

- Local procedures, documentation, and port authority requirements

- Insurance, sanctions compliance, and charterparty constraints

- Limited price transparency compared with international bunkering hubs

These anchorages are most relevant where bunkering can be combined with unavoidable operational stops, minimizing deviation and idle time.

–

Practical bunkering decision framework for ship operators

A) Choose the hub based on voyage geometry and risk posture

-

For “outside-the-strait” flexibility: Fujairah or SOHAR are typically evaluated first.

-

For “inside-the-Gulf” integration with port calls: Jebel Ali, Abu Dhabi, Saudi east coast ports, or Qatar may fit better.

B) Treat delivery method as a schedule and claims variable

-

Anchorage bunkering can be fast but may be sensitive to weather, queue discipline, and barge availability.

-

Berth bunkering can be efficient when aligned with cargo operations but requires careful coordination to avoid demurrage escalation.

-

STS or simultaneous operations can improve turnaround when properly governed but raise operational control requirements related to safety and environmental protection.

C) Quantity and quality assurance: align contracts with regional realities

Key elements typically include:

-

Tight specification references and clear off-spec remedies

-

Robust, witnessed sampling protocols aligned with MARPOL documentation

-

Quantity verification controls, including mass flow measurement where mandated or available

D) Security and insurance: integrate Strait of Hormuz risk into fuel planning

Because the Strait of Hormuz is a critical maritime chokepoint, geopolitical flare-ups can influence:

-

Transit timing and routing behavior

-

Insurance premiums and security advisories

-

Crew workload and bridge and engine readiness posture

These factors are operationally material for voyage planning and bunker strategy in the Persian Gulf region.

–

Compliance and governance notes (important)

-

The Persian Gulf is not an Emission Control Area, but vessels must comply with global IMO sulphur limits and MARPOL requirements.

-

Operators should ensure bunker procurement and trading arrangements align with sanctions compliance and applicable international regulations. Legal counsel and P&I guidance are recommended for route- and counterparty-specific decisions.

–

References

AD Ports Group. (2025, April). AD Ports Group hosts first ship-to-ship LNG bunkering at Khalifa Port. https://www.adportsgroup.com

Energy Information Administration. (2023). World oil transit chokepoints: Strait of Hormuz. U.S. Energy Information Administration. https://www.eia.gov

GAC Group. (2025, June 1). Dubai: Jebel Ali Port – bunker supply at J-Charlie anchorage. https://www.gac.com

Hellenic Shipping News Worldwide. (2024). Middle East bunker activity mixed amid regional uncertainty. https://www.hellenicshippingnews.com

Ken Research. (2024). Middle East LNG bunkering market outlook. https://www.kenresearch.com

MaritimEducation. (2024). Bunker fuel supply and regulations in the Persian Gulf. https://maritimeducation.com

Port of Duqm. (2023). Bunkering and ship-to-ship transfer guidelines. https://portofduqm.om

Port of Sohar. (2024). Marine services and bunkering operations. https://www.portofsohar.com

QatarEnergy. (2023). Marine fuel and bunkering services at Ras Laffan Port. https://www.qatarenergy.qa

Reuters. (2024, January 17). Marine fuel sales at UAE’s Fujairah bunker hub rebound. Reuters. https://www.reuters.com

S&P Global Commodity Insights. (2022). Iraq and Oman stand to gain bunkering demand from Fujairah. https://www.spglobal.com

Shargh Daily. (2023). Iran to turn Qeshm into a Persian Gulf bunkering hub. https://www.sharghdaily.com

TFG Marine & Oman Oil Marketing Company. (2023). Launch of bunker fuel supply operations at SOHAR Port. https://www.tfgmarine.com

Wikipedia. (2024). Port of Fujairah. https://en.wikipedia.org/wiki/Port_of_Fujairah

Wikipedia. (2024). Strait of Hormuz. https://en.wikipedia.org/wiki/Strait_of_Hormuz