The Strategic Heart of Global Commerce

The Persian Gulf—often described as a Mediterranean sea within Western Asia—is far more than a semi-enclosed body of water. It is the strategic heart of global energy markets and a pivotal junction of international trade. Covering roughly 251,000 km² and bordered by eight states, the Gulf facilitates around 35% of global seaborne crude oil shipments and approximately 20% of liquefied natural gas (LNG) trade. Its ports are not merely gateways; they are sophisticated logistics ecosystems that connect Middle Eastern producers to consumers across Asia, Europe, and Africa.

This refined guide provides a structured, country-by-country examination of the Persian Gulf’s principal ports—tracing their historical evolution, operational specializations, economic roles, and future trajectories. From mega-container hubs to highly specialized energy export terminals, these ports together form one of the most concentrated and consequential maritime networks in the world.

Historical Context & Geographical Overview

Maritime activity in the Persian Gulf spans more than five millennia, reaching back to Mesopotamian and Dilmun trade routes. For centuries, wooden dhows carried pearls, dates, spices, and textiles along coastal lanes linking Arabia, Persia, and the Indian subcontinent. The discovery of hydrocarbons in the early 20th century fundamentally altered this pattern, triggering unprecedented investment in ports, pipelines, and export terminals.

Post-World War II industrialization, the rise of supertankers in the 1970s, and the containerization revolution transformed Gulf ports into capital-intensive, technology-driven infrastructures. What were once modest anchorages have become deep-draft, automated complexes capable of serving ultra-large container vessels (ULCVs) and very large crude carriers (VLCCs).

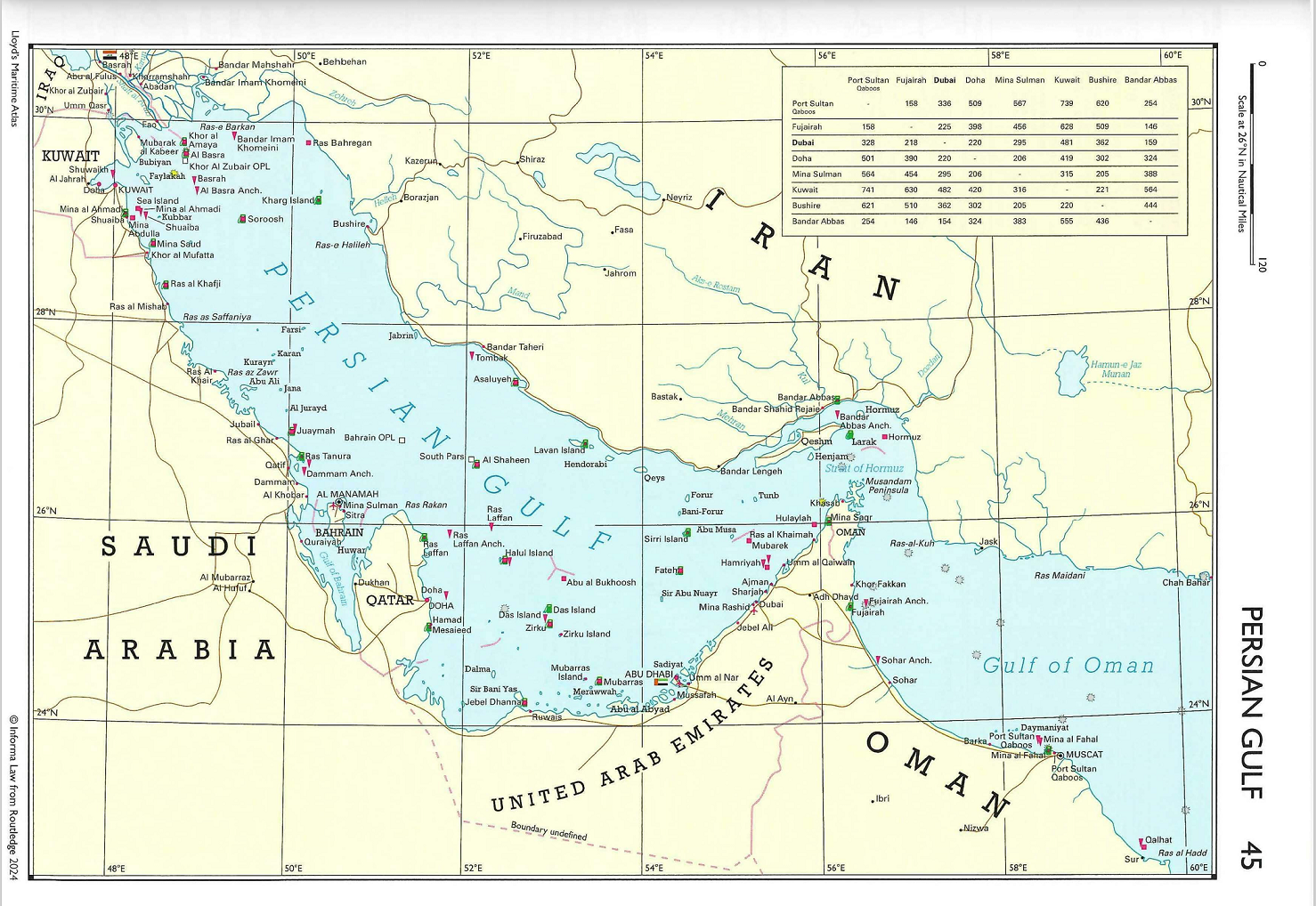

The Persian Gulf stretches approximately 989 km from the Shatt al-Arab delta to the Strait of Hormuz, the narrow maritime chokepoint through which about 21 million barrels of oil per day transit. The surrounding states—Iran, Iraq, Kuwait, Saudi Arabia, Bahrain, Qatar, the United Arab Emirates, and Oman—have invested heavily in port infrastructure to monetize this geography while mitigating navigational, security, and environmental constraints.

–

Country-by-Country Port Analysis

Iran: The Western Shore

Bandar Abbas (Shahid Rajaee Port)

Iran’s principal container gateway, handling around 85% of national container traffic, with capacity exceeding 3.5 million TEUs and 55 million tons of non-containerized cargo. Its position just outside the Strait of Hormuz offers operational resilience, though sanctions have constrained modernization.

Bandar Imam Khomeini

A bulk- and petrochemical-focused complex with 42 berths and annual throughput of ~45 million tons, closely integrated with Iran’s largest petrochemical clusters.

Asaluyeh (Pars Special Economic Energy Zone)

A purpose-built energy port serving the South Pars gas field, the world’s largest. Over 40 specialized berths support LNG, petrochemical exports, and offshore construction.

Bushehr

A multipurpose port combining commercial trade, naval functions, and logistics support for regional energy and power infrastructure.

United Arab Emirates: The Diversified Logistics Hub

Jebel Ali Port

The Middle East’s flagship port and among the world’s busiest container hubs, with 22.1 million TEUs of annual capacity. Its integration with the Jebel Ali Free Zone (JAFZA)—home to more than 7,000 firms—creates a powerful trade-manufacturing-logistics ecosystem. Ongoing expansion aims to raise capacity to ~30 million TEUs.

Khalifa Port (Abu Dhabi)

A semi-automated deep-water port operated by AD Ports Group, directly linked to the Khalifa Industrial Zone (KIZAD). Designed to handle next-generation container ships, it underpins Abu Dhabi’s diversification strategy.

Port Rashid (Dubai)

Once Dubai’s main commercial port, now repositioned as a cruise tourism hub handling over 500,000 passengers annually, symbolizing the emirate’s economic transition.

Fujairah Port

Strategically located outside the Strait of Hormuz on the Indian Ocean side, Fujairah is the world’s second-largest bunkering hub, offering storage and refueling services that bypass Gulf transit risks.

Saudi Arabia: The Energy Export Powerhouse

King Abdulaziz Port (Dammam)

The principal maritime gateway to Saudi Arabia’s Eastern Province, with expanding container capacity and rail connectivity to Riyadh.

Ras Tanura

The world’s largest oil export terminal, capable of loading ~6.5 million barrels per day, operated by Saudi Aramco and fortified as critical national infrastructure.

Jubail Commercial Port

Serving Jubail Industrial City—the world’s largest petrochemical complex—this port integrates bulk, container, and ro-ro operations.

Qatar: The LNG Export Leader

Hamad Port (Doha)

Opened in 2017, Hamad Port strengthened Qatar’s import resilience and food security while incorporating renewable energy and advanced logistics systems.

Ras Laffan Port

The world’s largest LNG export facility, with 77 million tons per annum (MTPA) capacity, set to expand to 126 MTPA under North Field projects—cementing Qatar’s leadership in global gas markets.

Kuwait: The Northern Gateway

Shuwaikh and Shuaiba Ports

Traditional commercial and industrial ports supporting Kuwait City and adjacent refineries.

Mubarak Al Kabeer Port (Bubiyan Island)

A strategic megaproject aligned with Belt and Road corridors, envisioned as a transshipment hub for the northern Gulf.

Bahrain: The Island Hub

Khalifa bin Salman Port

A landlord-model port operated by APM Terminals, serving as a transshipment and logistics bridge to Saudi Arabia via the King Fahd Causeway.

Sitra Oil Terminal

A VLCC-capable terminal linked to Bahrain’s refinery and regional storage networks.

Iraq: The Recovering Infrastructure

Umm Qasr

Iraq’s primary deep-water port, undergoing phased rehabilitation after decades of conflict and siltation challenges.

Al-Basra Oil Terminal (ABOT) & Khor Al-Amaya (KAAOT)

Together handling ~85% of Iraq’s oil exports, these offshore terminals are critical to national revenues.

Grand Faw Port (Under Construction)

A transformative $7-billion project planned to host 99 berths and ~5 million TEUs, potentially reshaping regional trade flows.

–

Specialized Port Functions

The ports lining the Persian Gulf are not generic harbors but a coordinated network of highly specialized maritime hubs, each engineered to fulfill a distinct and critical role in the global economy. This specialization transforms the coastline into a powerhouse of logistics, industry, and energy, unmatched in its concentrated capability.

At the core of the region’s geopolitical and economic might is its unparalleled concentration of energy export terminals. This coastline functions as the primary outlet for the Arabian Peninsula’s vast hydrocarbon wealth, hosting a dense cluster of infrastructure dedicated to crude oil, liquefied natural gas (LNG), and petrochemicals. The scale and technological sophistication of these facilities, from the sprawling tanker terminals of Ras Tanura and the offshore platforms of Qatar’s North Field to the integrated refining and export complexes in Jubail and Ruwais, are without parallel globally, anchoring the world’s energy supply chains.

Alongside this energy dominance, the Gulf has strategically established itself as a premier nexus for container transshipment. The region’s ports capitalize on their geographic position at the crossroads of Asia, Europe, and Africa. Dubai’s Jebel Ali Port, a man-made marvel and for decades the undisputed leader, operates as a massive relay station for global trade. Its dominance now faces spirited competition from ambitious rivals like Abu Dhabi’s Khalifa Port and Qatar’s Hamad Port, which are investing heavily in automation and capacity to capture a greater share of the world’s rerouted cargo.

This port strategy extends beyond mere cargo handling into integrated industrial port complexes. The most successful ports are physically and administratively fused with vast adjacent zones like the Jebel Ali Free Zone (JAFZA), Khalifa Industrial Zone Abu Dhabi (KIZAD), and Saudi Arabia’s Jubail Industrial City. This deep integration creates powerful economic ecosystems where raw materials imported by ship move directly to on-site factories, and finished goods are loaded onto vessels just meters away, streamlining production and export in a single, seamless circuit.

Finally, mirroring the region’s economic diversification, cruise tourism has emerged as a targeted specialization. Recognizing the value of the “blue economy,” destinations like Dubai, Abu Dhabi, and Bahrain have made significant investments in glamorous, purpose-built cruise terminals. These facilities are designed as gateways, welcoming millions of visitors annually and channeling them directly into urban shopping, entertainment, and cultural districts, consciously expanding the region’s identity from a purely commercial crossroads to a world-class leisure destination.

-

Energy Export Terminals: Dense concentration of crude oil, LNG, and petrochemical facilities unmatched globally.

-

Container Transshipment: Jebel Ali dominates, with emerging competition from Khalifa and Hamad.

-

Industrial Port Complexes: Deep integration with free zones and industrial cities (JAFZA, Jubail, KIZAD).

-

Cruise Tourism: Dubai, Abu Dhabi, and Bahrain investing in purpose-built terminals.

Technology, Sustainability, and Security

Gulf ports are leaders in automation, digitalization, and green initiatives—from automated guided vehicles and blockchain-based trade documentation to shore power, solar energy, and digital twins. At the same time, geopolitical tensions necessitate multilayered security regimes compliant with the ISPS Code, supported by regional and international naval cooperation.

Economic Impact and Trade Patterns

Persian Gulf ports underpin eastward energy flows to Asia, westward container trade to Europe and Africa, and regional redistribution to South Asia and East Africa. Collectively, the port sector directly employs over 200,000 people, with extensive multiplier effects across logistics, manufacturing, and services. Port-led development remains central to diversification agendas such as Saudi Vision 2030 and the UAE’s post-oil strategy.

Future Outlook: Megaprojects and Integration

Major initiatives—including NEOM/OXAGON, LNG expansion in Qatar, GCC railway integration, and China’s Digital Silk Road—signal deeper multimodal connectivity and technological convergence. These developments point toward a more integrated, resilient, and sustainable regional logistics system.

The ports of the Persian Gulf represent one of the most concentrated and strategically vital maritime systems on the planet. Their evolution—from ancient dhow harbors to automated megahubs—mirrors the region’s broader economic transformation. As energy markets evolve and global supply chains prioritize resilience, these ports will remain indispensable, adapting through digitalization, sustainability, and regional cooperation while continuing their historic role as crossroads of global trade.