Discover the top U.S. ports by tonnage and TEUs, what they handle, and how 2024–2025 disruptions, upgrades, and clean-port funding reshape U.S. trade.

The United States does not have “a port system”—it has many port systems operating in parallel: coastal container gateways handling Asia–U.S. trade; Gulf Coast energy ports moving crude oil, refined products, and LNG; Great Lakes and inland river ports moving iron ore, coal, aggregates, grain, and chemicals; plus dedicated Ro/Ro and cruise hubs for vehicles and passengers. When these systems are measured together, the result is a national network of ports that is both globally connected and domestically indispensable.

This article provides a website-ready, SEO-optimised reference for the top U.S. ports by cargo tonnage, explains what the numbers mean (and what they do not mean), and highlights how 2024–2025 operational shocks and investment cycles have influenced U.S. port performance and strategy.

How U.S. port rankings are measured (and why “biggest port” depends on the metric)

Before looking at rankings, it is essential to clarify the three most common “size” measures:

1) Total cargo tonnage (short tons)

This is the broadest measure of throughput. It captures bulk commodities (e.g., petroleum, chemicals, grain, coal) and containerised cargo by weight. Because petroleum and bulk trades are heavy, tonnage rankings often favour Gulf Coast and river ports more than container gateways.

The tonnage rankings in this article come from the U.S. Department of Transportation’s Bureau of Transportation Statistics (BTS) Port Performance Freight Statistics Program, which publishes consistent national port statistics and annual reporting.

2) Container volume (TEUs)

A TEU (twenty-foot equivalent unit) is a standard container measure used to compare container port activity. TEU rankings are the key indicator for container supply chains, retail imports, and time-sensitive manufactured goods.

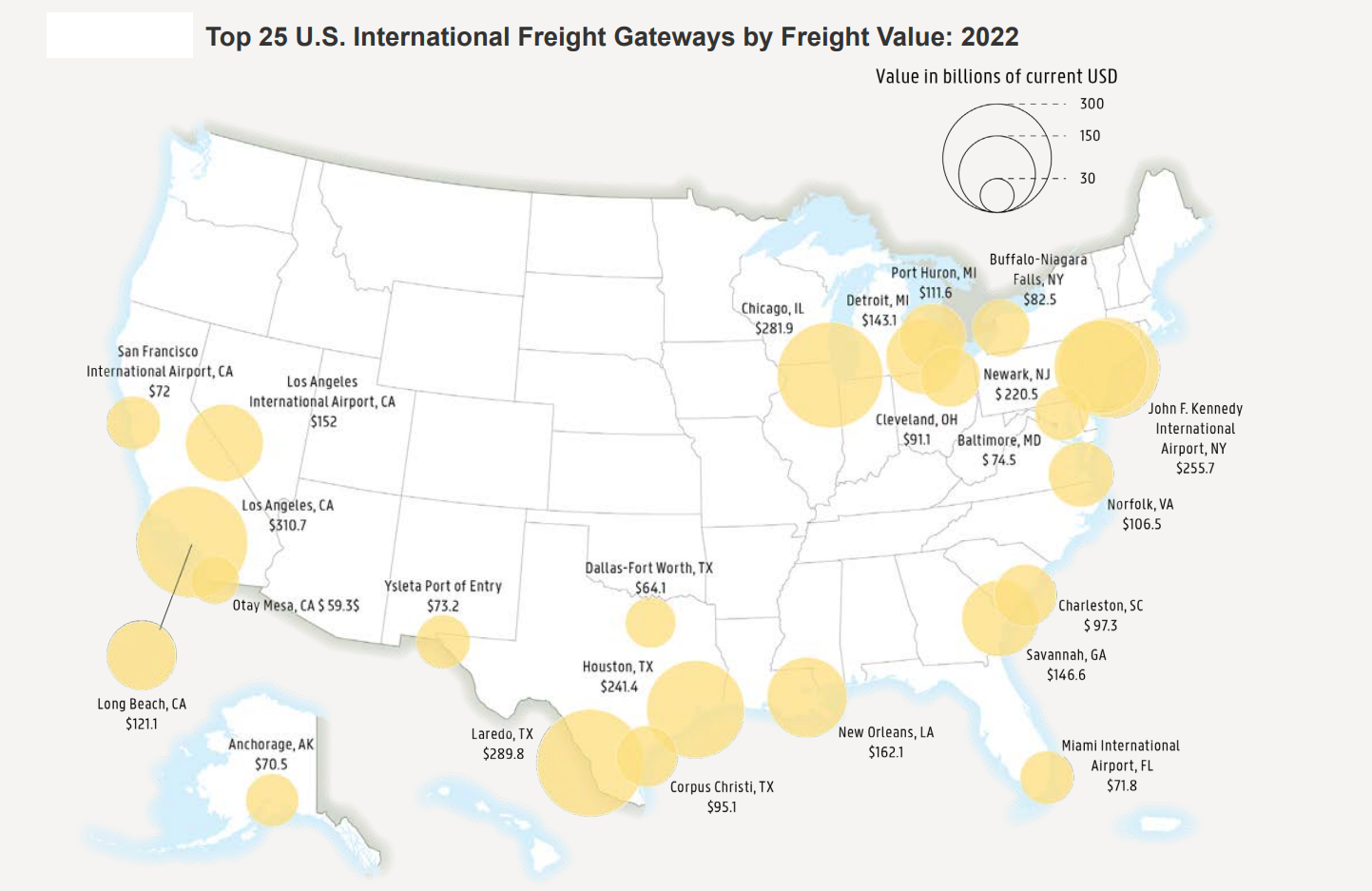

3) Value, passengers, or specialised cargo (Ro/Ro, cruise, LNG)

Some ports are “top” because they specialise: a port can dominate vehicles (Ro/Ro), cruise passengers, LNG exports, or project cargo without ranking at the top by tonnage.

Top 50 U.S. ports by total cargo tonnage (BTS dataset)

The tables below list the Top 50 U.S. ports by total tons using BTS’s published series (showing both 2023 totals and 2022 totals for context). Use these rankings when you want to understand where the heaviest cargo flows concentrate across energy, bulk, and containerised freight.

Ranks 1–25

| 2023 Rank | Port (State) | 2023 total (million tons) | 2022 Rank | 2022 total (million tons) |

|---|---|---|---|---|

| 1 | Houston, TX | 309.5 | 1 | 296.2 |

| 2 | South Louisiana, LA | 248.1 | 2 | 240.0 |

| 3 | Corpus Christi, TX | 196.0 | 3 | 183.1 |

| 4 | New York, NY/NJ | 141.3 | 4 | 141.3 |

| 5 | Long Beach, CA | 93.0 | 5 | 93.0 |

| 6 | New Orleans, LA | 83.3 | 6 | 83.3 |

| 7 | Beaumont, TX | 79.5 | 9 | 72.5 |

| 8 | Baton Rouge, LA | 73.4 | 8 | 73.4 |

| 9 | Virginia, VA | 69.5 | 10 | 69.5 |

| 10 | Lake Charles, LA | 64.8 | 7 | 77.6 |

| 11 | Los Angeles, CA | 59.0 | 11 | 59.0 |

| 12 | Mobile, AL | 54.8 | 12 | 54.8 |

| 13 | Plaquemines, LA | 48.1 | 13 | 48.1 |

| 14 | Savannah, GA | 46.2 | 14 | 46.2 |

| 15 | Port Arthur, TX | 41.7 | 15 | 41.7 |

| 16 | Freeport, TX | 39.1 | 16 | 39.1 |

| 17 | Texas City, TX | 34.1 | 17 | 34.1 |

| 18 | Cincinnati, OH/KY/IN | 34.0 | 18 | 34.0 |

| 19 | Mid-Ohio Valley, WV/OH | 33.7 | 19 | 33.7 |

| 20 | St. Louis, MO/IL | 30.8 | 20 | 30.8 |

| 21 | Huntington, WV/OH/KY | 29.9 | 21 | 29.9 |

| 22 | Philadelphia, PA | 28.8 | 22 | 28.8 |

| 23 | Tampa, FL | 28.8 | 23 | 28.8 |

| 24 | Valdez, AK | 25.3 | 24 | 25.3 |

| 25 | Duluth-Superior, MN/WI | 25.1 | 25 | 25.1 |

Ranks 26–50

| 2023 Rank | Port (State) | 2023 total (million tons) | 2022 Rank | 2022 total (million tons) |

|---|---|---|---|---|

| 26 | Charleston, SC | 24.9 | 26 | 24.9 |

| 27 | Northern Indiana, IN | 24.7 | 27 | 24.7 |

| 28 | Pascagoula, MS | 23.1 | 28 | 23.1 |

| 29 | Seattle, WA | 23.0 | 29 | 23.0 |

| 30 | Tacoma, WA | 21.6 | 30 | 21.6 |

| 31 | Richmond, CA | 21.1 | 31 | 21.1 |

| 32 | Portland, OR | 20.7 | 32 | 20.7 |

| 33 | Everglades, FL | 20.4 | 33 | 20.4 |

| 34 | South Jersey, NJ | 20.3 | 34 | 20.3 |

| 35 | Oakland, CA | 19.4 | 35 | 19.4 |

| 36 | Kalama, WA | 18.1 | 36 | 18.1 |

| 37 | Jacksonville, FL | 16.7 | 37 | 16.7 |

| 38 | Pittsburgh, PA | 15.5 | 38 | 15.5 |

| 39 | New Bourbon, MO | 15.5 | 39 | 15.5 |

| 40 | Mid-America, IA/IL/MO | 15.0 | 40 | 15.0 |

| 41 | Illinois Waterway, IL | 14.9 | 41 | 14.9 |

| 42 | Boston, MA | 13.3 | 42 | 13.3 |

| 43 | Two Harbors, MN | 13.2 | 44 | 13.5 |

| 44 | Honolulu, HI | 12.3 | 43 | 13.3 |

| 45 | Galveston, TX | 11.9 | 45 | 11.9 |

| 46 | Longview, WA | 11.1 | 46 | 11.1 |

| 47 | Vancouver, WA | 10.2 | 47 | 10.2 |

| 48 | Cleveland, OH | 9.4 | 48 | 9.4 |

| 49 | San Juan, PR | 9.3 | 49 | 9.3 |

| 50 | Anchorage, AK | 9.2 | 50 | 9.2 |

How to interpret this list intelligently

-

Energy and petrochemicals heavily influence tonnage, which helps explain the dominance of Texas and Louisiana at the top.

-

Several “ports” are multi-state river systems or port districts (e.g., Ohio Valley, Huntington Tri-State). That is not an error—it reflects how the federal dataset defines reporting geographies.

-

If your focus is retail imports, e-commerce, and time-sensitive cargo, you should pair this tonnage list with the TEU list below.

–

Top U.S. container ports by TEU (2024 port-reported figures)

Because TEUs are typically reported by port authorities (sometimes on a calendar-year basis, sometimes fiscal-year), always read the “basis” note. The ports below consistently appear as the leading U.S. container gateways in published port statistics and releases.

| Rank (indicative) | Port | 2024 TEUs (reported) | Practical significance |

|---|---|---|---|

| 1 | Port of Los Angeles | ~10.3 million | Largest U.S. container gateway; primary Asia import hub |

| 2 | Port of Long Beach | ~9.65 million | Paired with LA as the San Pedro Bay complex |

| 3 | Port of New York & New Jersey | ~8.7 million | Largest East Coast container hub |

| 4 | Port of Savannah | port-reported 2024 figures vary by reporting basis | Fast-growing Southeast gateway; major distribution focus |

| 5 | Port Houston | ~4.14 million | Gulf Coast container leader plus petrochemical complex |

| 6 | Port of Virginia | port-reported 2024 figures vary by reporting basis | Deep-water East Coast option with strong rail connectivity |

| 7 | Northwest Seaport Alliance (Seattle–Tacoma) | ~3.4 million | Main Pacific Northwest container gateway |

| 8 | Port of Charleston | port-reported 2024 figures vary by reporting basis | Southeast manufacturing and distribution hub |

| 9 | Port of Oakland | port-reported 2024 figures vary by reporting basis | Key U.S. agricultural export gateway |

| 10 | PortMiami | ~1.0–1.1 million (order of magnitude) | Mixed role: cruise leader plus growing container niche |

Editorial note for your website: If you want, I can reformat this TEU table to use a single consistent basis (calendar year only, where available) and add a short footnote per port clarifying the reporting period shown.

–

Why official port data often “lags” by 18–24 months

Port activity data is complex: ports and terminals report movements, agencies verify, and nationwide datasets are consolidated. This is why it is common to see ports publishing “latest” figures while federal consolidated statistics appear later. BTS and related federal reporting products are designed to provide nationally consistent comparisons, even if publication trails the reporting year.

Big picture: What the top U.S. ports collectively handled

Using the BTS Top 50 U.S. Ports by Total Tons dataset, the top 25 ports handled about 1.875 billion tons in 2023 (total waterborne tonnage captured in the BTS series). This illustrates how concentrated heavy freight flows are at the top of the ranking—especially energy, petrochemicals, and bulk.

2024–2025 developments that reshaped U.S. port risk and planning

East & Gulf Coast labour disruption risk (ILA strike and negotiations)

In early October 2024, reporting widely covered a major East and Gulf Coast longshore labour disruption and the high stakes for containerised imports and exports. The subsequent negotiation timeline and terms became central to U.S. port planning because labour stability influences carrier scheduling, peak-season performance, and diversion strategies.

Baltimore’s Key Bridge collapse: a reminder that “single points of failure” are real

The collapse of the Francis Scott Key Bridge in March 2024 disrupted access and operations around the Port of Baltimore until navigation channels were progressively restored. For shippers, it reinforced a practical lesson: port resilience depends on channels, bridges, terminals, and hinterland links—not only quay cranes.

Panama Canal constraints and rerouting logic

Low water levels and operational restrictions in and around Panama Canal operations became a major strategic variable for cargo routing, especially for trades linking Asia with the U.S. East and Gulf coasts. In practice, constraints encourage a mix of responses: West Coast discharge + rail, Suez routings, or different service strings depending on commodity and time sensitivity.

Infrastructure investment: deeper channels, more rail, and inland nodes

Multiple large projects advanced or completed in this period, focusing on:

-

Channel deepening and widening (to accept larger vessels and enable safer two-way traffic)

-

On-dock rail and inland connectors (to reduce truck congestion and expand hinterland reach)

Examples frequently cited in public reporting include Corpus Christi’s channel project, Virginia’s deep-water competitiveness, and Long Beach’s Pier B rail expansion.

Decarbonisation: “clean ports” funding moves from policy to hardware

U.S. port decarbonisation accelerated with large grant programs supporting shore power, zero-emission cargo-handling equipment, and related infrastructure. The EPA’s Clean Ports initiative is often referenced as a watershed because it scaled funding to levels that change procurement decisions, not just pilot projects.

–

Which regions dominate—and what they tend to move

Gulf Coast: the tonnage powerhouse (energy + chemicals + bulk)

Ports such as Houston, South Louisiana, Corpus Christi, Beaumont, Lake Charles, Port Arthur, Freeport, and Texas City sit at the intersection of U.S. energy production, refining, petrochemicals, and export logistics. The tonnage reflects not only exports (crude/LNG/chemicals) but also domestic barge and coastal movements that carry heavy cargo.

West Coast: the container gateway for transpacific trade

Los Angeles and Long Beach remain the most influential container complex in the country, with major rail corridors linking the terminals to inland hubs. The Pacific Northwest (Seattle–Tacoma) is also strategically relevant for certain trade lanes and commodities.

East and Southeast: distribution-driven growth

New York–New Jersey, Savannah, Virginia, Charleston, Jacksonville, and Port Everglades reflect the Southeast’s growing role in distribution networks and manufacturing supply chains. These ports compete by combining vessel access, terminal capacity, and inland reach.

Inland rivers and Great Lakes: the “quiet giants”

Entries like St. Louis, Cincinnati, Huntington Tri-State, Mid-Ohio Valley, Pittsburgh, Duluth-Superior, and Northern Indiana demonstrate how inland waterway freight can be enormous in weight even if it is less visible to the public than container ships.

–

Sustainability and compliance: why ports are investing differently in 2024–2025

Port sustainability is no longer limited to “green statements.” With large-scale funding and regulatory pressure, many ports are now implementing:

-

Shore power / cold ironing to reduce at-berth emissions

-

Zero-emission cargo handling equipment (battery-electric and hydrogen pilots)

-

Grid upgrades and microgrids to support electrification at scale

The U.S. EPA’s Clean Ports initiative is often referenced as a catalytic push in this direction, because it supports deployment-scale investments rather than only demonstration projects.

–

Practical FAQs

What is the biggest port in the U.S. by tonnage?

By total tonnage in the BTS series, Houston ranks #1 (2023).

What is the biggest container port in the U.S.?

By port-reported TEUs, the Port of Los Angeles is typically the largest U.S. container port, with Long Beach close behind as part of the same regional complex.

Why do river ports rank so high by tonnage?

Bulk cargo (coal, aggregates, grain, chemicals) is heavy, and inland barge systems move enormous weight efficiently. That is why river systems and inland districts appear prominently in tonnage rankings.

Is U.S. port ranking data current?

Federal datasets aim for national consistency and verification, which can introduce publication delays. For “latest” performance, combine federal series with port authority releases and operational dashboards.

References

-

BTS Port Performance Freight Statistics Program and Top Ports datasets

-

BTS Data Spotlight on Gatun Lake / Panama Canal low water levels

-

Reporting on East/Gulf longshore labour actions and negotiations

-

USACE and official information on Baltimore channel restoration context

-

EPA Clean Ports Program announcements and major port awards