The glittering city-states of the Gulf Cooperation Council (GCC)—Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman—project an image of unassailable wealth and futuristic stability. Yet, beneath this facade of skyscrapers and sovereign wealth funds lies a profound and systemic vulnerability: a near-total reliance on imported food. With less than 1% of arable land and agriculture contributing a negligible portion to GDP, these nations have built societies in one of the planet’s most inhospitable climates. An event that disrupts their maritime supply lines—be it a blockade of the Strait of Hormuz, a regional conflict damaging port infrastructure, or the destruction of the oil and gas revenues that pay for these imports—would not merely cause shortages. It would risk triggering a catastrophic unraveling of the very social, economic, and political fabric of these states, exposing them as profoundly fragile societies built on a precarious foundation.

The Foundations of Fragility: Extreme Dependence and Environmental Limits

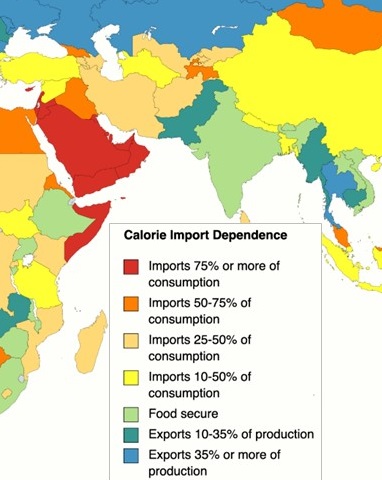

The food security of the Gulf Arab states is an artificial construct, meticulously engineered but inherently vulnerable. The region’s environmental reality is stark: hyper-arid climates, negligible rainfall, and severely depleted groundwater resources make conventional large-scale agriculture economically and ecologically unsustainable. In the Abu Dhabi emirate, for instance, groundwater withdrawal exceeds natural recharge by a factor of 25. This has led to a situation where 85% to 90% of all food consumed in the GCC is imported. This dependence climbs to 90% for cereals and nearly 100% for staples like rice.

Table: Persian Gulf State Food Import Dependence and Agricultural Limits

| Country | Food Import Dependency | Arable Land (% of total) | Key Vulnerability |

|---|---|---|---|

| UAE, Qatar, Kuwait | ~90% | <1% (UAE) | Total reliance on seaborne imports via Hormuz. |

| Saudi Arabia | ~85% | ~1.6% | Massive population; major ports on both Gulf and Red Sea. |

| Bahrain | ~90% | 2.7% | Island nation with no alternative to Gulf ports. |

| Oman | High (exact % n/a) | 0.3% | Has ports outside Hormuz but limited storage. |

This import model functions seamlessly only under conditions of absolute geopolitical stability and open global trade routes. The food supply chain is a complex, just-in-time system where disruptions are not easily absorbed. As one analyst notes, “The GCC is experiencing notable increases in demand for foods, in particularly fresh foods, due to a growing population, wealth, and consumer preferences”. This growing demand, projected against a population expected to rise from 60 million to 83.5 million by 2050, only deepens the structural dependency.

The Choke Point: The Strait of Hormuz as a Single Point of Failure

The Strait of Hormuz, a narrow waterway between Iran and Oman, is the linchpin of Gulf Arab survival—and its greatest strategic vulnerability. It is the maritime artery through which the lifeblood of these economies (oil and gas) and the sustenance of their populations (food) must flow.

-

Economic Lifeline: Approximately 20 million barrels of oil per day, representing about 20% of global oil consumption, transit the strait. For some GCC states, this is their only export route; Kuwait, Bahrain, Qatar, and Iraq have zero alternative pipelines for crude oil. The revenues from these hydrocarbon exports are what finance the entire food import regime.

-

Food Corridor: Crucially, the same passage is used for inbound food shipments. Estimates suggest that 80-100% of the wheat destined for Qatar, Kuwait, and Bahrain transits through the Strait of Hormuz. A closure would not only cripple state revenues but would also physically block the delivery of groceries to supermarket shelves.

The threat of closure is not hypothetical. Iran has repeatedly threatened to block the strait in response to international pressure or conflict. While a complete, long-term shutdown is considered a last resort for Tehran due to the self-inflicted damage to its own economy, even a temporary disruption, mining campaign, or heightened military threat can have immediate, dramatic effects. Insurance premiums for shipping would skyrocket, major container lines would suspend service, and the flow of goods would slow to a trickle. The region’s heavy dependence on importing agricultural products through the Strait of Hormuz puts regional food security at direct risk.

The Architecture of a Fragile Society: Demographics and the Social Contract

The food import dependency is woven into the GCC’s unique and delicate social architecture, making a supply shock a potential catalyst for societal breakdown.

The Expatriate Majority: GCC societies are characterized by a stark demographic imbalance. In Qatar and the UAE, nationals constitute only about 10-12% of the population. The rest are expatriate workers, ranging from highly paid Western professionals to millions of low-income laborers from South Asia and Africa. For these migrant populations, their presence is purely transactional—tied to employment with few social safety nets, limited rights, and no path to citizenship. In a crisis, their loyalty to the host state is precarious.

The Fragile Social Contract: For citizens, the ruling bargain is based on the distributive largesse of the hydrocarbon state: tax-free life, generous subsidies, government jobs, and abundant, cheap food and water. A failure to provide basic sustenance would represent a fundamental breach of this contract, eroding the primary source of political legitimacy for these regimes.

Inequality as a Fault Line: A food crisis would magnify existing inequalities. Wealthier citizens and expatriates could hoard or pay black-market prices, while the vast low-income labor force would face immediate hunger. As one report starkly notes, disruptions “can and will impact the GCC’s most vulnerable populations, who exist with few rights and little semblance of a social safety net”. The resulting social unrest would likely first manifest within labor camps and low-income districts, threatening public order and potentially leading to violent clashes or a mass, desperate exodus that the state would be ill-equipped to manage.

The Limits of Resilience: Strategic Stockpiles, Overseas Farms, and Technological Fixes

Aware of these vulnerabilities, Gulf states have launched ambitious, multi-billion-dollar strategies to build resilience. However, each of these measures has significant limitations, especially in the face of a major, protracted crisis.

-

Strategic Reserves: Countries have built up grain silos and water storage facilities. Qatar, for example, has invested in tanks to hold a strategic water reserve. Saudi Arabia and the UAE have developed major grain storage ports on the Red Sea (Jeddah) and Gulf of Oman (Fujairah), respectively. However, these are buffers, not solutions. Most reserves are estimated to last three to six months. If the Strait of Hormuz were closed and alternative land-based logistics from these ports proved inadequate, the clock would start ticking loudly.

-

Overseas Agricultural Investment (Agro-Imperialism): GCC sovereign wealth funds and state-owned enterprises have purchased or leased millions of hectares of farmland in Africa (Sudan, Ethiopia), Asia (Pakistan, Indonesia), and Eastern Europe (Ukraine, Romania). While this secures potential supply, it does not solve the logistics problem. Food grown in Sudan must still be shipped through the Red Sea and potentially the Suez Canal—another chokepoint subject to regional instability. Furthermore, these investments can be politically sensitive and are vulnerable to expropriation or export bans by host countries during their own crises.

-

Domestic Agri-Tech: Massive investments are flowing into controlled-environment agriculture, hydroponics, and seawater farming. Projects like Saudi Arabia’s NEOM and the UAE’s “GigaFarm” aim to produce fresh vegetables, dairy, and poultry locally. This is promising for nutrition and reducing waste, but it is technologically complex, energy- and capital-intensive, and incapable of replacing calorie-dense staple imports like wheat, rice, and cooking oil on a meaningful scale. As an investor succinctly put it, “Local only is a fallacy… If you are only local and regional, you increase the impact of events that disrupt food production”.

Scenario: The Cascading Catastrophe !

A major regional conflict that triggers a Hormuz closure or widespread infrastructure damage would unleash a cascading failure across Gulf societies.

-

Week 1-2: Economic and Logistical Collapse. Oil exports halt, crashing government revenues. Maritime insurers withdraw coverage; global shipping lines cancel routes into the Gulf. Port activity slows dramatically. Supermarket shelves begin to empty, especially of perishables. Panic buying commences.

-

Month 1-2: Food Inflation and Rationing. With seaborne imports stalled, prices for remaining food stocks skyrocket. Governments activate strategic reserves and impose strict rationing. The social contract is tested as inequalities in access become glaringly obvious. Low-wage migrant workers, dependent on employer-provided meals or cheap staples, face acute hunger.

-

Month 3-6: Societal Fracturing and Humanitarian Crisis. If the disruption persists, reserves dwindle. Social unrest grows among desperate populations. The state’s security apparatus, itself potentially affected by the crisis, may struggle to maintain control. The risk of inter-communal violence between different nationalities or between citizens and non-citizens escalates. A mass humanitarian crisis unfolds among the migrant underclass, for whom repatriation may be impossible.

-

Geopolitical Repercussions: Internally weakened Gulf states would become pawns in a wider struggle. Global powers would be drawn in, either to secure energy flows or to manage a humanitarian disaster and prevent state collapse. The regional balance of power would be violently upended.

Conclusion

In the Persian Gulf region, the Gulf Arab states have achieved a remarkable feat of modern engineering, creating thriving urban centers in the desert. However, their food security model is a masterpiece of complexity and interdependency, not of resilience. It is a system that functions perfectly under optimal global conditions but contains a single, glaring point of failure: the maritime supply chain through the Persian Gulf. Their societies, built on a delicate balance of extreme wealth, imported labor, and a distributive social contract, are uniquely ill-suited to withstand the shock of sustained food scarcity. While national strategies and technological innovation provide valuable shock absorbers, they are ultimately insufficient to mitigate the risk of a full-scale blockade or war. Therefore, the specter of famine is not an archaic threat but a modern geopolitical vulnerability—one that reveals the Gulf’s glittering metropolises to be, in essence, fragile societies living on borrowed time and imported calories.