At sunrise, a loaded VLCC clears its berth somewhere along the Persian Gulf coastline. Pilot disembarked, engines steady, radar clean. The ship’s destination may be a refinery in China, India, Japan, or South Korea—because that is where most of the crude oil, condensate, and LNG exported from the Persian Gulf ultimately ends up. On paper, it is a routine voyage. In reality, it is part of one of the world’s most sensitive supply chains: energy security.

Energy security often sounds like a government or policy term, but for maritime professionals it has an immediate operational meaning. It is the difference between a predictable voyage and a reroute. It is the difference between standard P&I cover and elevated war-risk premiums. It is the difference between stable bunker costs and sudden price spikes. In the Persian Gulf, energy security is built and tested every day through ports, tankers, offshore platforms, pipelines, naval patrols, and—most critically—the narrow sea lanes of the Strait of Hormuz, a maritime chokepoint with limited alternatives if disrupted.

This article explains what energy security in the Persian Gulf really means in practical maritime terms. It outlines the opportunities created by Persian Gulf energy exports and infrastructure investment, the risks that threaten shipping and supply continuity, and the concrete measures shipowners, charterers, ports, and regulators can take to manage exposure. The aim is to connect geopolitical headlines to everyday decisions made on the bridge, in the chartering office, and at the terminal gate.

Why Energy Security in the Persian Gulf Matters for Maritime Operations

Energy security in the Persian Gulf matters because the region is not simply an energy-producing zone; it is a tightly integrated energy-export logistics system anchored in shipping. Tens of millions of barrels of oil per day, along with substantial LNG volumes, move from Persian Gulf ports through the Strait of Hormuz toward Asian markets. When a single maritime corridor carries such a high proportion of global energy supply, shipping itself becomes part of the world’s energy insurance mechanism.

From a commercial shipping perspective, energy security shocks translate rapidly into market effects. Rising risk premiums can drive tanker earnings upward; delays and rerouting change ton-mile demand; and altered routes affect bunker consumption and scheduling. During periods of heightened regional tension in the Persian Gulf, vessels have adjusted tracks, increased standoff distances, and operated under enhanced reporting regimes. Energy security therefore manifests not as abstract policy, but as voyage planning, bridge workload, and operational risk management.

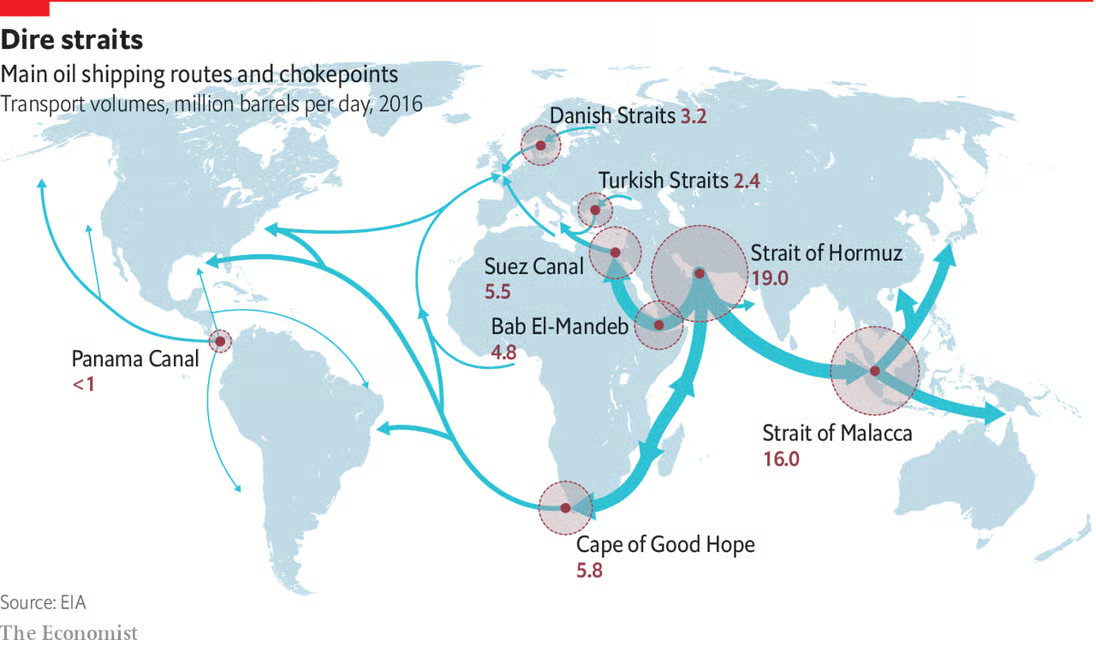

Energy security in the Persian Gulf also matters because the region is interconnected with other global maritime chokepoints. Disruptions elsewhere can push additional pressure onto Persian Gulf routes, while instability in the Persian Gulf can ripple outward into global freight markets. For operators already navigating elevated threat environments, this interconnectedness amplifies both risk and complexity.

Finally, energy security is increasingly influenced by regulation and environmental compliance. Tanker operations in the Persian Gulf are subject to strict oil pollution prevention standards. In such a politically sensitive and environmentally constrained sea area, compliance failures can escalate rapidly into diplomatic, legal, and commercial consequences. Environmental performance is therefore inseparable from operational security.

What “Energy Security” Means in the Persian Gulf

Energy security in the Persian Gulf can be understood through three interlinked layers.

First: supply security.

This involves the reliable production and export of oil and gas from Persian Gulf states. It includes offshore platforms, onshore processing, pipelines, storage facilities, and export terminals.

Second: route security.

This is the maritime layer—safe passage for merchant vessels, freedom of navigation, manageable insurance exposure, and continuity of shipping services through the Strait of Hormuz and adjacent waters of the Persian Gulf.

Third: system resilience.

This refers to the ability of the overall system to absorb shocks such as geopolitical escalation, cyber incidents, navigational interference, accidents, extreme weather, or market volatility—and then return to stable operations. Ports, naval coordination, emergency response frameworks, and industry guidance all play decisive roles here.

A useful way to visualise energy security in the Persian Gulf is as a three-stage chain:

production → export interface → sea lane

What makes the Persian Gulf unique is that the final link is exceptionally narrow. The Strait of Hormuz is constrained in width, with traffic separation schemes that concentrate movements into limited lanes. As a result, relatively small disruptions can have outsized global consequences.

THE STRAIT of Hormuz, a narrow stretch of water connecting the Persian Gulf to the rest of the world’s oceans, has long been recognised as the most important choke-point for global oil supplies. Accounting for about a third of the world’s sea-borne oil (and a fifth of the world’s total oil exports), the strait links oil and gas producers in the Middle East with consumers around the globe, including those in Europe, Asia and America. In 2016, according to America’s Energy Information Administration, the waterway carried some 19m barrels of crude and other petroleum products a day. Were it to be blocked, the world’s supply of oil would fall, and prices would spike.

Key Developments, Technologies, and Principles Supporting Energy Security

The Strait of Hormuz: Chokepoint Physics and Operational Reality

The Strait of Hormuz is physically capable of accommodating the world’s largest crude oil tankers, which is why ultra-large vessels routinely transit it. At the same time, this capacity concentrates extremely high-value cargoes into a confined maritime space linking the Persian Gulf to the open ocean.

For shipmasters and operators, this chokepoint imposes a distinct operating discipline. Traffic density is high, margins for navigational error are small, and coordination with coastal authorities is essential. When electronic interference or degraded navigation signals are present, a routine Persian Gulf transit can quickly become a high-workload bridge operation, requiring redundancy, vigilance, and disciplined bridge resource management.

Industry Security Guidance: From Awareness to Standardised Procedures

Energy security in the Persian Gulf is not managed by governments alone. Over time, industry organisations have developed practical guidance specifically tailored to operations in the Persian Gulf, the Strait of Hormuz, and adjacent waters. This guidance focuses on reporting procedures, situational awareness, risk mitigation, and coordination with maritime security authorities.

The value of such guidance lies in standardisation. When all ships follow consistent reporting and operating practices, uncertainty is reduced. In high-risk maritime environments like the Persian Gulf, reducing uncertainty is itself a critical safety measure.

Environmental Protection as a Component of Energy Security

Environmental compliance is often treated as separate from security, but in the Persian Gulf the two are closely linked. A serious oil spill or illegal discharge in this semi-enclosed sea can trigger port restrictions, international disputes, and long-term reputational damage that undermines export reliability.

Oil pollution prevention standards, including tanker design and operational requirements, have progressively strengthened environmental protection. For operators in the Persian Gulf, strong environmental management is not just regulatory compliance—it is a form of operational insurance that protects access to ports and markets.

Market Intelligence and Data: Visibility as Resilience

Modern energy security also depends on information. AIS monitoring, voyage analytics, and port call data improve predictability and situational awareness for shipping in the Persian Gulf. However, visibility can be degraded intentionally or unintentionally, which is why resilient navigation practices and disciplined reporting remain essential.

At a system level, improved maritime visibility supports faster response to disruptions and helps limit the cascading effects of incidents in the Persian Gulf on global supply chains.

Opportunities: Why the Persian Gulf Remains a Global Energy Security Hub

Despite its risks, the Persian Gulf offers substantial and enduring opportunities for maritime trade.

The first is scale and continuity of demand. Even as the global energy transition progresses, oil and LNG exports from the Persian Gulf remain central to global energy supply, particularly for Asian markets. This sustains long-haul tanker demand and high port throughput.

The second opportunity is infrastructure intensity. Persian Gulf states have invested heavily in deep-water ports, offshore loading systems, storage hubs, and integrated industrial zones. For shipping operators, this often translates into efficient port services and strong marine support sectors.

The third opportunity is energy portfolio diversification. Alongside crude oil, LNG exports from the Persian Gulf have become a major pillar of energy security, reinforcing the region’s maritime importance.

The fourth opportunity is institutional maturity. Decades of operating under elevated risk have driven the development of robust naval coordination mechanisms, reporting centres, and industry guidance specific to the Persian Gulf. When properly applied, these reduce operational uncertainty.

Challenges and Practical Solutions

Challenge 1: Geopolitical Escalation and Vessel Risk

Geopolitical escalation remains the most visible threat to energy security in the Persian Gulf. Incidents involving merchant vessels can rapidly raise threat levels and alter shipping behaviour.

Practical response:

Treat Persian Gulf transits as managed operations, with dedicated risk assessments, conservative passage planning, and strict bridge discipline.

Challenge 2: Navigational Hazards and Electronic Interference

Electronic interference increases positional uncertainty and collision risk in narrow Persian Gulf sea lanes.

Practical response:

Build redundancy into navigation, strengthen cross-checking, and rehearse loss-of-confidence scenarios at both ship and company level.

Challenge 3: Insurance, War Risk, and Commercial Continuity

Rising tension in the Persian Gulf often leads to higher insurance costs and operational expenses.

Practical response:

Ensure charter-party clauses clearly address security deviations and cost allocation, and maintain active communication with insurers.

Challenge 4: Chokepoint Spillover Effects

Energy security in the Persian Gulf is affected by disruptions elsewhere in the global maritime network.

Practical response:

Use scenario planning, maintain scheduling flexibility, and prepare alternative logistics options where feasible.

Challenge 5: Environmental Incidents and Regulatory Fallout

In the Persian Gulf, environmental incidents can escalate into strategic disruptions.

Practical response:

Integrate pollution prevention and compliance into overall security and continuity planning.

Case Studies and Operational Lessons

Hormuz and Asian Dependency

Most energy exports transiting the Strait of Hormuz are destined for Asian markets. As a result, instability in the Persian Gulf disproportionately affects those economies and shapes tanker demand patterns.

Security Advisories and Route Adaptation

During periods of heightened risk, ships modify routes and reporting behaviour. Operational adjustments precede market reactions.

Chokepoint Concentration

The Strait of Hormuz exemplifies how chokepoints magnify risk. For the Persian Gulf, this concentration defines the entire energy security equation.

Future Outlook

Energy security in the Persian Gulf will remain a defining issue for global shipping.

Risk management will become more procedural and data-driven.

LNG will continue to complement oil as a core export.

Regulatory and climate pressures will reshape shipping economics.

Institutional coordination will matter as much as naval presence.

In a dense, high-value maritime system like the Persian Gulf, institutional maturity and operational discipline are competitive advantages.

Energy security in the Persian Gulf is not only about geopolitics or production volumes. It is about the daily reliability of a complex maritime system—ports, terminals, ships, crews, insurers, and regulators operating under constant pressure. The opportunities are significant: scale, infrastructure, sustained demand, and a mature maritime ecosystem. The challenges are equally real: geopolitical risk, navigational hazards, insurance volatility, chokepoint concentration, and environmental sensitivity. The most resilient maritime actors treat energy security in the Persian Gulf as a managed operational reality, not an unpredictable external shock. That mindset—combined with disciplined procedures and strong compliance—is what keeps energy moving and shipping viable in one of the world’s most strategically important seas.