If you stand on the bridge wing of a container ship approaching Africa, you can “read” the continent’s economy from the sea. The skyline might be cranes and silos, or oil jetties and bulk loaders, or a queue of trucks stretching into the city. Every one of these scenes tells the same story: Africa’s trade is becoming more connected, more time-sensitive, and more globally strategic.

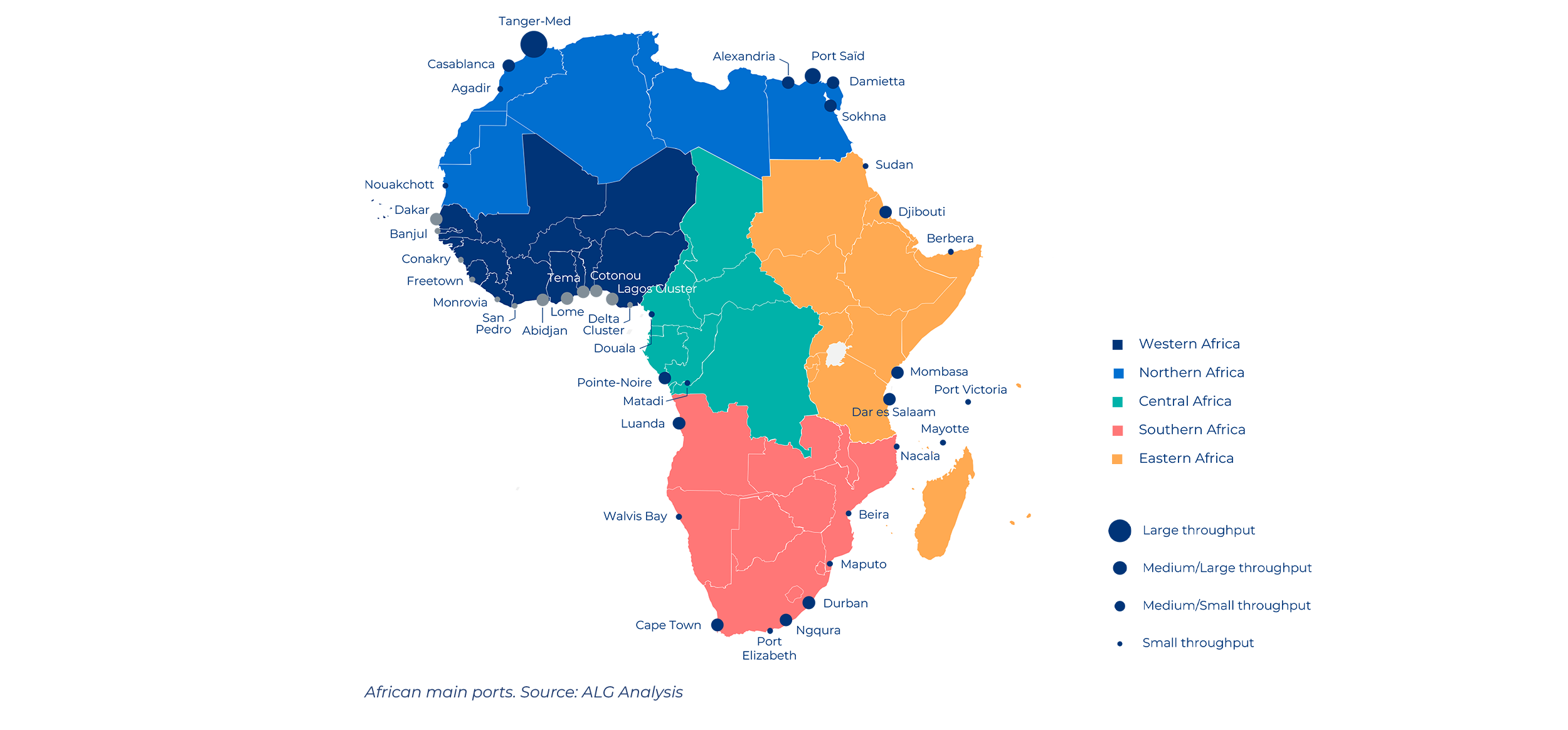

The ports in this article are not simply “big” in one narrow way. Some are the largest by container flows, others by total tonnage, and several are critical because they sit on chokepoints—where global shipping lanes narrow and schedules matter. Together, they form the working map of African commerce: consumer goods arriving, minerals and energy leaving, and regional corridors linking landlocked countries to the ocean.

Why This Topic Matters for Maritime Operations

For shipping lines, freight forwarders, and cargo owners, Africa’s biggest and busiest ports determine real operational outcomes: berth windows, cargo dwell time, inland evacuation reliability, and ultimately cost. For port authorities, these gateways are also national infrastructure—where investment decisions shape job creation, industrial growth, and resilience to shocks such as rerouted trade flows, extreme weather, or security disruptions. Understanding Africa’s top ports helps maritime professionals anticipate where capacity is expanding, where bottlenecks remain, and how trade patterns are shifting across the continent.

How “Biggest” and “Busiest” Are Defined in This Article

Ports are multi-cargo ecosystems, so a single metric rarely tells the whole truth. In this ranking, “biggest and busiest” is assessed using a balanced operational lens, including:

- Container throughput (TEU) where relevant (especially for gateway and transshipment ports)

- Total cargo tonnage for energy and bulk-heavy ports

- Strategic function (transshipment hub vs. domestic gateway vs. resource export terminal)

- Connectivity (shipping services, hinterland corridors, and multimodal integration)

- Recent trajectory (expansions, upgrades, and performance momentum)

This approach reflects how maritime operations work in reality: a port can be “busiest” without being the largest container terminal, and a container hub can matter globally even if its domestic market is smaller.

–

Top 10 Biggest and Busiest Ports in Africa

1) Tanger Med (Morocco) – Africa’s Container and Transshipment Powerhouse

Tanger Med feels like a port designed with a navigator’s compass in mind. It sits near the Strait of Gibraltar, where the Atlantic and the Mediterranean meet and where Europe, Africa, and the Americas are only a short sailing distance apart. That location gives it a natural advantage: ships already pass nearby, so the port can pull in transshipment volumes efficiently—like a major airport hub that thrives because flight routes cross overhead.

In recent years, Tanger Med has grown into one of the world’s most significant transshipment platforms, crossing major milestones in container throughput and overall cargo handling. Its success is strongly tied to high terminal productivity, deep-water capability for large containerships, and a logistics ecosystem that extends beyond the quay—industrial zones, automotive supply chains, and freight distribution links that make the port valuable even beyond transshipment.

For maritime operators, Tanger Med is often a “schedule anchor.” When a hub port runs smoothly, it stabilizes entire service strings. When it doesn’t, delays spread like ripples across a shipping network. That is why Tanger Med’s performance and ongoing expansion matters well beyond Morocco.

2) East Port Said / Port Said (Egypt) – The Suez Gate Between Asia and Europe

If Tanger Med is the hinge of the western Mediterranean, East Port Said is one of the most strategic hinges on the planet. Located at the northern entrance of the Suez Canal, the port sits directly on the main sea lane connecting Asia and Europe. This makes it uniquely positioned for transshipment, relay services, and fast links into Mediterranean and Black Sea markets.

East Port Said’s reputation in recent years has been shaped not only by scale but also by operational efficiency improvements and terminal development. In practical terms, that means better vessel planning, more predictable berthing, and stronger yard performance—factors that reduce waiting time and improve schedule reliability.

For the maritime industry, the Suez region is more than geography; it is a risk-and-resilience story. When global disruptions affect Suez routing, nearby ports feel the shock first—either through volume shifts, congestion pressure, or service reconfiguration. East Port Said’s capacity development and operational maturity therefore matter to carriers planning network flexibility across the Mediterranean.

3) Port of Durban (South Africa) – Sub-Saharan Africa’s Core Container Gateway

Durban is often described as the busiest container port in sub-Saharan Africa, but its importance is broader than container stacks and quay cranes. It is the heart of a national logistics machine—serving South Africa’s industrial base and linking to inland markets through major road and rail corridors.

Durban’s operational reality is complex. High demand meets infrastructure constraints, and the port has faced well-publicized challenges around congestion and reliability. Yet Durban remains central because of scale, location, and the sheer volume of domestic and regional trade it supports. In container logistics, being “important” is not always the same as being “perfect.” Some ports remain dominant simply because the economy around them depends on them.

For shipping lines and cargo owners, Durban’s story is increasingly about modernization and system reform—new equipment, improved terminal operations, and stronger integration between port and rail performance. In other words, Durban is not only a gateway; it is also a test case for how large African ports can upgrade while continuing to operate at full intensity.

4) Richards Bay (South Africa) – Bulk Cargo Giant and Resource Export Engine

Not all “busy ports” look like container terminals. Richards Bay is a bulk powerhouse—deep-water berths, heavy-duty conveyors, and unit trains feeding export terminals. Its importance is tied to South Africa’s role in global commodity flows, especially coal exports through the Richards Bay Coal Terminal ecosystem.

From an operational perspective, Richards Bay is a classic example of port performance being inseparable from rail performance. When inland corridors work well, the port can run at high throughput. When rail capacity is constrained, the port’s potential is underused. That dependency makes Richards Bay a highly instructive port for maritime logistics students: the quay is only one part of the system; the corridor is the rest of the story.

Richards Bay also illustrates why “tonnage” remains a critical metric in African maritime trade. Bulk exports—coal, minerals, and other commodities—still form a major part of the continent’s external trade value and shipping demand.

5) Port of Djibouti / Doraleh (Djibouti) – Red Sea Transshipment and Corridor Port

Djibouti is small as a country, but large in strategic effect. Positioned near the Bab el-Mandeb Strait at the entrance to the Red Sea, it sits on one of the world’s most sensitive maritime corridors. The Doraleh terminal complex and associated port infrastructure have made Djibouti a major hub for both transshipment and regional gateway functions.

The port’s second role is just as important: it is a primary maritime lifeline for Ethiopia, one of Africa’s largest and fastest-growing economies. That creates stable gateway demand, even when transshipment cycles fluctuate.

For maritime operations, Djibouti is the kind of port that matters because it is multifunctional: it combines corridor logistics, regional import-export flows, and strategic sea lane proximity. This blend of roles often supports resilience—if one cargo segment softens, another may sustain terminal activity.

6) Port of Abidjan (Côte d’Ivoire) – West Africa’s Rapidly Scaling Gateway

Abidjan has been climbing the regional league table quickly, driven by infrastructure upgrades and strong demand from both domestic and landlocked hinterlands. It supports trade corridors reaching into Burkina Faso, Mali, and beyond, making it more than a coastal port—it is a regional economic platform.

Recent growth in container volumes has been tied to expanded terminal capability and improved equipment, which enables higher yard density, faster vessel operations, and better service reliability. In West Africa, reliability is often as valuable as raw capacity, because inland evacuation can be the limiting factor. When a port manages to push improvements across both terminal operations and inland logistics partnerships, it tends to gain market share.

For logistics planners, Abidjan’s story also highlights competitive dynamics: West African ports compete in a real market for shipping services, transshipment calls, and corridor cargo. A port that adds capacity and improves performance can reshape regional routing decisions surprisingly fast.

7) Port of Tema (Ghana) – The Modern West African Hub Model

Tema stands out because it represents a deliberate “modern hub” approach: terminal expansion, improved quay infrastructure, and stronger integration into inland distribution. Ghana’s trade profile includes consumer imports, agricultural exports, and regional transit flows, and Tema has positioned itself to serve all three.

For maritime professionals, Tema is a useful example of how a port can expand without trying to become everything at once. The port’s development focus has been strongly oriented toward container flows, logistics services, and system efficiency—features that are attractive to shipping lines and freight forwarders looking for predictable turnaround and stable operations.

Tema also demonstrates the importance of the port-city relationship. As ports grow, so do truck movements, land-use pressures, and environmental expectations. Modernization therefore increasingly includes gate management, traffic planning, and better community impact control—not only cranes and berths.

8) Port of Mombasa (Kenya) – East Africa’s Primary Gateway

Mombasa is East Africa’s classic gateway port. Its importance comes from what it connects: Kenya’s economy, regional trade, and the Northern Corridor serving Uganda, Rwanda, South Sudan, and parts of the Democratic Republic of Congo. In practical terms, Mombasa is the maritime “front door” for a vast inland market.

The port has seen strong cargo growth, supported by improvements in terminal operations and corridor infrastructure. Yet, like many gateway ports, its performance is constrained or enabled by inland logistics. When borders slow down or trucking capacity is tight, cargo dwell time rises. When corridor systems improve, the port’s competitiveness increases immediately.

For students of maritime operations, Mombasa teaches a key lesson: in many African contexts, the port is not the bottleneck by itself. The true bottleneck can be the corridor—roads, rail, customs, inland depots, and regional policy alignment.

9) Ports of Lagos (Nigeria) – Apapa, Tin Can, and the Rise of Lekki

Nigeria’s scale makes its ports unavoidable. Lagos is the country’s commercial engine, and its port system—historically centered on Apapa and Tin Can Island—has long handled the bulk of containerized imports and exports. These ports are vital, but their operational identity has often been shaped by congestion pressure, complex urban interfaces, and heavy truck dependence.

What is changing the Lagos story is the emergence and ramp-up of Lekki Deep Sea Port. Lekki represents an attempt to build a more modern deep-water port ecosystem with improved capacity potential and better corridor planning. For Nigeria, this is not just a port project—it is a logistics rebalancing strategy aimed at easing pressure on legacy terminals and supporting industrial growth zones.

For maritime trade stakeholders, Lagos is a market of high demand and high complexity. It is also a strong reminder that “busiest” can sometimes mean “most stressed,” and that port modernization must include gates, roads, digital processes, and enforcement—not only cranes.

10) Port of Dakar (Senegal) – A Fast-Growing Atlantic Gateway

Dakar’s geographic advantage is simple: it sits on the Atlantic edge of West Africa with strong access to shipping routes and regional markets. In recent years, Dakar has recorded steady growth in container traffic and vessel calls, supported by terminal development and increased operational capability.

For carriers, Dakar can serve both as a national gateway and as a regional relay point, depending on service design. For shippers, it offers a relatively direct Atlantic link that can be attractive for certain trade flows. Dakar’s broader importance also comes from Senegal’s role as a stable regional platform for logistics, services, and corridor development.

As West Africa grows more competitive, Dakar’s performance trajectory will depend on continued terminal efficiency, corridor investment, and how well it can manage increasing volumes without congestion becoming the defining feature of its growth.

–

Key Developments, Technologies, and Practical Applications Shaping Africa’s Busiest Ports

Expansion Is Moving from “More Berths” to “Better Systems”

Across Africa, the most impactful upgrades increasingly combine physical expansion with operational systems: improved terminal operating processes, better gate control, and more structured yard planning. Ports that add capacity without solving evacuation constraints often end up with bigger congestion. Ports that invest in system performance tend to convert capacity into real throughput.

Corridor Logistics Is Becoming the True Competitive Battlefield

The competitiveness of Abidjan, Tema, Mombasa, and Lagos is heavily influenced by their inland corridors. Dry ports, inland container depots, rail links, and border process modernization often deliver greater “real-world throughput” than one more quay crane, because they reduce dwell time and free up yard space.

Transshipment Hubs Are Rising with Network Reconfiguration

Tanger Med and East Port Said show how transshipment hubs thrive when shipping networks concentrate around fewer, more productive relay points. When global services are redesigned—whether due to commercial alliances, disruption-driven rerouting, or fleet upsizing—efficient hubs can grow rapidly.

Challenges and Practical Solutions (Operational Reality, Not Theory)

Africa’s biggest ports operate under pressure from fast-growing demand, urban constraints, and corridor limitations. Congestion often begins where port operations meet city roads: if gates cannot process trucks smoothly, yards fill, vessel operations slow, and the port’s “sea-side efficiency” becomes irrelevant. Solutions are therefore increasingly practical and system-based: appointment systems, stronger enforcement of trucking rules, expanded off-dock storage, and improved data sharing between terminals, customs, and transport operators.

Another challenge is reliability under disruption. Weather extremes, security events along sea lanes, and fluctuating global shipping cycles can shift volumes quickly. Ports that build flexibility—extra yard capacity, adaptable berth planning, multi-cargo capability, and stronger stakeholder coordination—tend to handle shocks better than ports optimized only for peak days.

Finally, workforce and governance capacity remains critical. Technology helps, but it does not replace the need for trained planners, maintenance teams, and transparent operational control. Many African ports are now investing in professionalization and performance management frameworks to sustain growth without losing control of service quality.

Case Studies and Real-World Applications

A useful way to understand Africa’s port landscape is to compare two models: hub transshipment and gateway corridor.

Tanger Med and East Port Said represent the hub model. Their success depends on connecting shipping networks efficiently—fast turnaround, high crane productivity, and consistent yard performance. When these conditions are met, volume tends to follow because global carriers value schedule certainty.

Mombasa and Abidjan represent the gateway corridor model. Their success depends on inland logistics integration: customs systems, regional transport links, inland depots, and corridor security. In these ports, a 10% improvement in corridor flow can sometimes deliver more effective capacity than a major terminal expansion, because it reduces dwell time and keeps the system moving.

Lagos represents a third model: the mega-city interface. Here, port modernization must be understood as a broader urban logistics project. New capacity such as Lekki can help, but only if it is supported by road and enforcement systems that prevent the same bottlenecks from repeating.

Future Outlook and Maritime Trends

Africa’s busiest ports are likely to evolve in three directions simultaneously. First, selective automation and digitalization will grow, not necessarily as full automation, but through practical tools: gate appointment systems, smarter yard management, and better vessel planning. Second, green port measures will expand, especially shore power readiness, cleaner cargo-handling equipment, and better emissions measurement—driven by global shipping decarbonisation expectations and financing requirements. Third, regional competition will intensify, particularly in West Africa, where multiple ports are expanding in parallel and carriers will increasingly choose hubs based on measurable reliability.

Another trend is network resilience. As global shipping continues to face periodic disruptions—whether geopolitical or climate-driven—ports that can absorb volume shifts quickly will gain strategic value. That will reward ports with flexible infrastructure, strong governance, and real-time coordination between sea-side and land-side operations.

FAQ (5–7 Questions)

1) What is the biggest port in Africa today?

By container and overall hub function, Tanger Med is widely recognized as Africa’s leading port complex in recent years.

2) Which African port is most important for the Suez Canal trade lane?

East Port Said/Port Said is among the most strategically positioned ports because it sits at the Mediterranean entrance of the Suez route.

3) Is Durban still the busiest port in sub-Saharan Africa?

Durban remains a central gateway in sub-Saharan Africa with very large container volumes and national economic importance.

4) Why are bulk ports like Richards Bay included in “busiest ports” lists?

Because “busy” can mean total tonnage and export intensity, not only containers. Bulk and energy ports can move enormous volumes.

5) Which ports are fastest growing in West Africa?

Abidjan and Tema have been among the West African ports showing strong growth momentum due to terminal investments and corridor roles.

6) What role do landlocked countries play in port growth?

They are major drivers of throughput in corridor ports. A port serving multiple inland states can grow faster than one serving only a coastal city.

7) Will automation make African ports globally competitive?

Automation helps, but the biggest gains often come from basic operational reliability: gates, corridors, maintenance capacity, and transparent processes.

Conclusion / Takeaway

Africa’s biggest and busiest ports are not only infrastructure assets—they are economic “switchboards” that connect factories, farms, mines, and cities to global markets. Tanger Med and East Port Said show how hub efficiency can reshape maritime networks. Durban and Richards Bay demonstrate how national-scale gateways and bulk terminals remain essential in trade reality. Abidjan, Tema, Mombasa, Djibouti, Lagos, and Dakar show how regional corridors and modernization trajectories can transform port relevance in just a few years.

If your work touches shipping, logistics, port operations, or maritime policy, these ports are worth following closely—because they reveal where Africa’s trade is accelerating, where constraints still shape cost, and where the next wave of investment is likely to land.

References

-

Tanger Med Port Authority. (2025). Port activity report 2024 (press release PDF). https://www.tangermedport.com/wp-content/uploads/2025/01/CP-TMPA-PORT-ACTIVITY-REPORT-IN-2024.pdf

-

Tanger Med. (2024). Tanger Med passes the 10 million container mark. https://www.tangermed.ma/en/tanger-med-passes-the-10-million-container-mark/

-

Lloyd’s List. (2024). Port Said (Egypt) throughput 2023 (analysis page). https://www.lloydslist.com/LL1149218/47-Port-Said-Egypt

-

Kenya Ports Authority. (n.d.). Port of Mombasa achieves a major milestone, surpassing 2 million TEUs (2024 update). https://www.kpa.co.ke/Media/Read/2

-

Transnet (South Africa). (2024). Annual financial statements 2024 (PDF – TEU volumes and performance). https://www.parliament.gov.za/storage/app/media/Docs/ann_rep/63289b0a-5305-4eb9-9cc9-48bfd530503c.pdf

-

SGTD Doraleh Terminal (Djibouti). (2025). Record of 1.2M TEUs in 2024. https://www.sgtd-terminal.com/2025/01/19/record-of-1-2m-teus/

-

Port Autonome de Dakar / industry reporting. (2025). Annual container traffic 2024 (TEU). https://africasupplychainmag.com/en/port-autonome-de-dakar-une-croissance-annuelle-de-6-en-2024-malgre-un-recul-mensuel-en-decembre/

-

Port of Abidjan (official). (2025). Container traffic reaching 1,646,304 TEUs in 2024 (news release). https://www.portabidjan.ci/en/news/abidjan-port-boosts-its-capacity-acquisition-2-ship-shore-cranes-and-9-rubber-tyred-gantry

-

Reuters. (2025). Richards Bay coal exports up in 2024 amid rail improvement. https://www.reuters.com/markets/commodities/safricas-richards-bay-exports-up-10-2024-amid-rail-improvement-2025-01-24/

-

BusinessDay Nigeria. (2025). Nigerian Ports Authority reported total container throughput (2024). https://businessday.ng/maritime/article/apapa-tin-can-ports-missing-from-global-top-100-for-ninth-straight-year/