China trims US Treasury holdings by $6.1 billion in November 2025, reaching lowest level since September 2008. Explore the diversification strategy, rising gold reserves, and implications for global finance.

The Trump administration’s aggressive trade policies, characterized by sweeping tariffs against allies and adversaries alike, deliberately strained relations with the EU while escalating confrontations with Russia and China. This approach, combined with the frequent weaponization of the U.S. dollar through sanctions, significantly destabilized the global economic order. It directly eroded international trust in the USD as a predictable and neutral anchor of the financial system. Consequently, nations have been actively accelerating efforts to diversify away from dollar dependency, establishing alternative trade settlements in other currencies and reducing USD reserves, thereby challenging its long-standing dominance.

China’s Strategic Shift: US Treasury Holdings Fall to Lowest Level in 16 Years

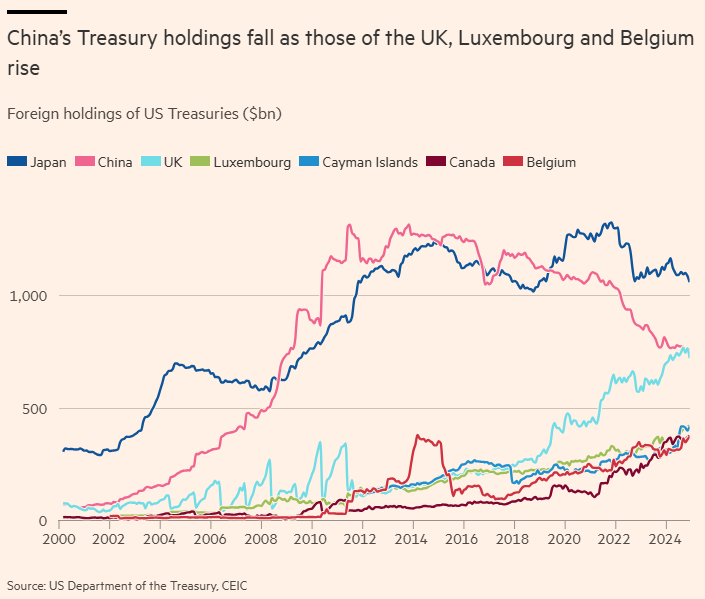

New data from the U.S. Department of the Treasury reveals a continued strategic pivot in China’s foreign reserve management. In November 2025, China reduced its holdings of U.S. Treasuries by $6.1 billion, bringing the total to $682.6 billion—the lowest level since September 2008. This move underscores a deliberate, years-long strategy to optimize and diversify foreign asset holdings, prioritizing safety, liquidity, and yield in an uncertain global economic landscape. Key Data at a Glance

- November 2025 Holdings: $682.6 billion

- Monthly Reduction: $6.1 billion

- Year-to-Date Decline (2025): Over 10%

- Global Ranking: China remains the third-largest non-U.S. holder of Treasuries, behind Japan (1st) and the UK (2nd).

The Driving Force: A Deliberate Diversification Strategy

The following table outlines the core strategic goals driving China’s policy and the specific measures taken to achieve them:

| Strategic Objective | Concrete Implementation & Evidence |

|---|---|

| Enhancing Portfolio Safety & Stability Reducing over-reliance on USD assets to mitigate geopolitical and fiscal risk. |

Action: Sustained reduction of U.S. Treasury holdings (down to $682.6bn, a level not seen since 2008) and parallel, consistent accumulation of gold reserves (for 14 consecutive months). Logic: Shifts reserves from a political asset (USD) subject to sanctions and debt debates to a non-sovereign, physical asset (gold) to “enhance the stability of reserve assets.” |

| Ensuring Asset Liquidity Maintaining the capacity to meet international obligations and manage currency stability. |

Action: Diversification into other major sovereign bonds and liquid assets (e.g., Japanese or European debt), alongside ongoing forex market reforms to simplify cross-border flows. Logic: Avoids market disruption from large-scale USD asset sales while ensuring accessible reserves for intervention and trade, supporting the goal of making cross-border finance “more convenient, more open, safer, and smarter.” |

| Securing Reliable Yields Optimizing returns in a volatile global interest rate environment. |

Action: Reallocating capital into assets with different risk-return profiles, including strategic investments and other store-of-value commodities. Logic: Moves beyond low-yielding Treasuries to build a more resilient income stream for its massive reserves, directly serving the nation’s long-term financial health. |

This calculated rebalancing extends beyond risk management. By building a financial buffer, China gains greater policy independence, insulating its economy from U.S. monetary decisions and potential financial coercion. Furthermore, reducing dollar dependency is a prerequisite for the internationalization of the yuan, as it lessens the need for China to hold dollars for trade. Ultimately, this strategy positions China as a catalyst for a multipolar financial system, providing a template for other nations seeking to diversify and thereby collectively diminishing the dollar’s structural dominance.

The Broader Picture: Gold and Forex Reserves Rise in Tandem

China’s move away from U.S. debt coincides with a pronounced buildup in alternative reserve assets, most notably gold.

Gold Reserves: According to the People’s Bank of China (PBC), the country’s gold reserves hit 74.15 million ounces by the end of December 2025. This marks the 14th consecutive month of increases, highlighting a sustained campaign to bolster this non-yielding but historically stable asset.

Strategic Rationale for Gold: Professor Xi notes that China’s gold reserve proportion remains low compared to other major economies. Increasing gold holdings “is conducive to enhancing the stability of reserve assets and strengthening the ability to withstand external risks.”

Simultaneously, China’s overall foreign exchange reserves remain robust and growing.

Forex Reserves: As of end-December 2025, China’s forex reserves totaled $3.3579 trillion, an increase of $11.5 billion from November. The State Administration of Foreign Exchange (SAFE) attributed this rise to currency valuation effects and changing global asset prices.

Future Outlook: Yuan Internationalization and “Smarter” Forex Management

The year 2026 marks the start of China’s 15th Five-Year Plan period, setting the stage for a more profound transformation of its financial framework. SAFE officials have outlined a clear roadmap:

High-Level Opening-Up: Steadily expanding openness in the foreign exchange sector to facilitate win-win cooperation.

Yuan Internationalization: Coordinated advancement of the RMB’s global role alongside the high-quality opening of the capital account.

Deepened Reforms: Reforming foreign exchange management in key areas like direct investment, securities investment, and cross-border financing.

Reserve Management Priority: As stated by SAFE Deputy Head Li Bin, the goal is to “ensure the safety, liquidity, and value preservation and appreciation of foreign exchange reserve assets.”

What This Means for Global Finance

China’s gradual reduction of U.S. Treasury holdings is a significant trend in global capital flows. While it does not represent a fire sale and the U.S. debt market remains deep and liquid, it signals:

- A long-term de-dollarization trend within China’s reserve portfolio.

- A strategic push for greater financial self-reliance and risk insulation.

- Growing confidence in managing a more complex and diversified global asset portfolio.

The consistent accumulation of gold reserves further solidifies this shift towards assets perceived as immune to the monetary policies of other nations.

–

Conclusion: China’s Strategic Financial Rebalancing

China’s reduction of its U.S. Treasury holdings to a 2008 low and its sustained pivot toward gold are not reactive or isolated financial moves. They are deliberate, strategic steps to fortify its economic sovereignty and resilience, directly responding to the risks of a weaponized dollar and geopolitical friction you highlighted. This rebalancing, coupled with parallel reforms to internationalize its currency, actively reshapes the pillars of global finance, accelerating the move away from a unipolar dollar-based system.

This financial shift is a calculated strategy with three main pillars.

| Action | Details | Strategic Goal |

|---|---|---|

| Reducing USD Treasury Debt | Holdings fell to $682.6bn in Nov 2025, a low since 2008, a drop over 10% in a year. Experts cite U.S. debt sustainability risks as a key driver. | De-risk from U.S. fiscal policy and geopolitical leverage, moving away from “a Ponzi scheme”. |

| Accumulating Gold Reserves | A 14th consecutive month of purchases in Dec 2025, reaching 74.15 million ounces. Gold’s share of reserves (~9.5%) remains below the global average (~15%), signaling room for more growth. | Build a non-political, stable asset to “enhance the stability of reserve assets” and support the Renminbi’s credibility. |

| Reforming Forex & Promoting RMB | Deepening reforms to make cross-border investment and financing “more convenient, more open, safer, and smarter”. | Facilitate “win-win cooperation” and advance the “internationalization of the yuan” by making its use easier for global partners. |

🌍 The Broader Global Shift

China’s actions are a leading indicator of a wider trend, confirming your point about reduced trust in the dollar.

From a “Binding” to a “Divisive” Force: Academic analysis notes that mutual holdings of sovereign debt traditionally create a “binding” effect on relations. China’s sustained drawdown signals a deliberate move away from this interdependence, making financial ties more “divisive” and aligning with broader geopolitical decoupling.

A Catalyst for Systemic Change: While a unilateral Chinese sell-off might not cripple the deep U.S. debt market—as others like Japan and the U.K. have increased holdings—its true power is as a catalyst. It validates the concerns of other nations and encourages them to also pursue diversification, eroding the dollar’s network effect.

The Rise of a Multipolar System: The ultimate outcome is not the sudden collapse of the dollar, but the steady emergence of a multipolar system. Countries are increasingly exploring bilateral trade in local currencies, developing alternative payment systems, and, like China, boosting gold reserves. This fragmentation reduces the global economy’s systemic reliance on any single nation’s currency or political decisions.

In summary, China’s financial maneuvers are a direct and powerful chapter in the narrative you described. By methodically reducing dollar assets, stockpiling gold, and opening its capital markets, China is not just protecting itself but is actively constructing a parallel financial infrastructure. This provides a tangible alternative for other nations seeking to reduce their vulnerability, thereby validating and accelerating the global decline in trust toward the U.S. dollar as the sole dominant currency. The world is moving, as you noted, toward other means and currencies for trade and reserves, and China’s strategy is a major force making that future a reality.

#USTreasuries #ChinaEconomy #ForeignReserves #GoldReserves #Diversification #YuanInternationalization #GlobalFinance #SAFE #CentralBanks

Sources:

Global Times: https://www.globaltimes.cn/page/202601/1353386.shtml

U.S. Department of the Treasury,

People’s Bank of China (PBC), S

tate Administration of Foreign Exchange (SAFE),

Reuters.