How Saudi Arabia’s NEOM reshape regional trade and logistics and challenge Dubai’s dominance? A maritime, port, and geopolitics analysis.

For more than three decades, Dubai has functioned as the Middle East’s most influential commercial gateway—an entrepôt where ports, aviation, finance, and logistics converged into a single, highly efficient ecosystem. Today, however, Saudi Arabia’s ambitious NEOM project signals a strategic attempt to reshape that regional order. Anchored on the Red Sea and embedded within Saudi Arabia’s Vision 2030, NEOM is not merely a city-building exercise; it is a systemic rethinking of how ports, industrial clusters, energy systems, and digital governance can be integrated at scale.

This article examines whether and how NEOM—particularly its industrial-port district, Oxagon—could assume roles traditionally associated with Dubai, and what that shift would mean for maritime operations, shipping corridors, and port-centric supply chains across West Asia.

Dubai’s rise was inseparable from maritime logistics. The emergence of a Saudi alternative of comparable scale would affect shipping routes, hub-and-spoke models, port competition, fleet deployment strategies, and regional risk diversification for shipowners and cargo interests. Understanding NEOM’s trajectory is therefore essential for maritime professionals assessing future port calls, terminal investments, and Red Sea versus Persian Gulf routing decisions.

Dubai’s Established Role as a Regional Maritime and Logistics Hub

How Dubai Built Its Maritime Dominance

Dubai’s ascent as a logistics powerhouse was neither accidental nor resource-driven. Lacking oil reserves comparable to its neighbors, the Emirate focused early on trade facilitation, regulatory predictability, and port-led development. The Port of Jebel Ali, developed in the late 1970s, became the cornerstone of this strategy. With deep drafts, early containerization, and a business-friendly free zone, Jebel Ali evolved into the Middle East’s largest container port and a primary transshipment hub linking Asia, Europe, and Africa.

Dubai complemented port infrastructure with integrated logistics zones, efficient customs processes, and a strong maritime services ecosystem. Classification societies, ship agencies, P&I correspondents, and maritime arbitration all found a predictable operating environment. This “soft infrastructure” often mattered as much as quay length or crane capacity.

Limits of the Dubai Model Today

While Dubai remains dominant, its model faces constraints. Spatial limitations, higher operating costs, and congestion risks in the Strait of Hormuz create strategic vulnerabilities. Moreover, the concentration of regional trade flows into a single Gulf-based hub exposes ship operators to geopolitical chokepoints and insurance volatility. These pressures create room for an alternative node—particularly one located outside the Arabian Gulf.

–

What NEOM Is—and Why It Is Different

NEOM Within Saudi Arabia’s Vision 2030

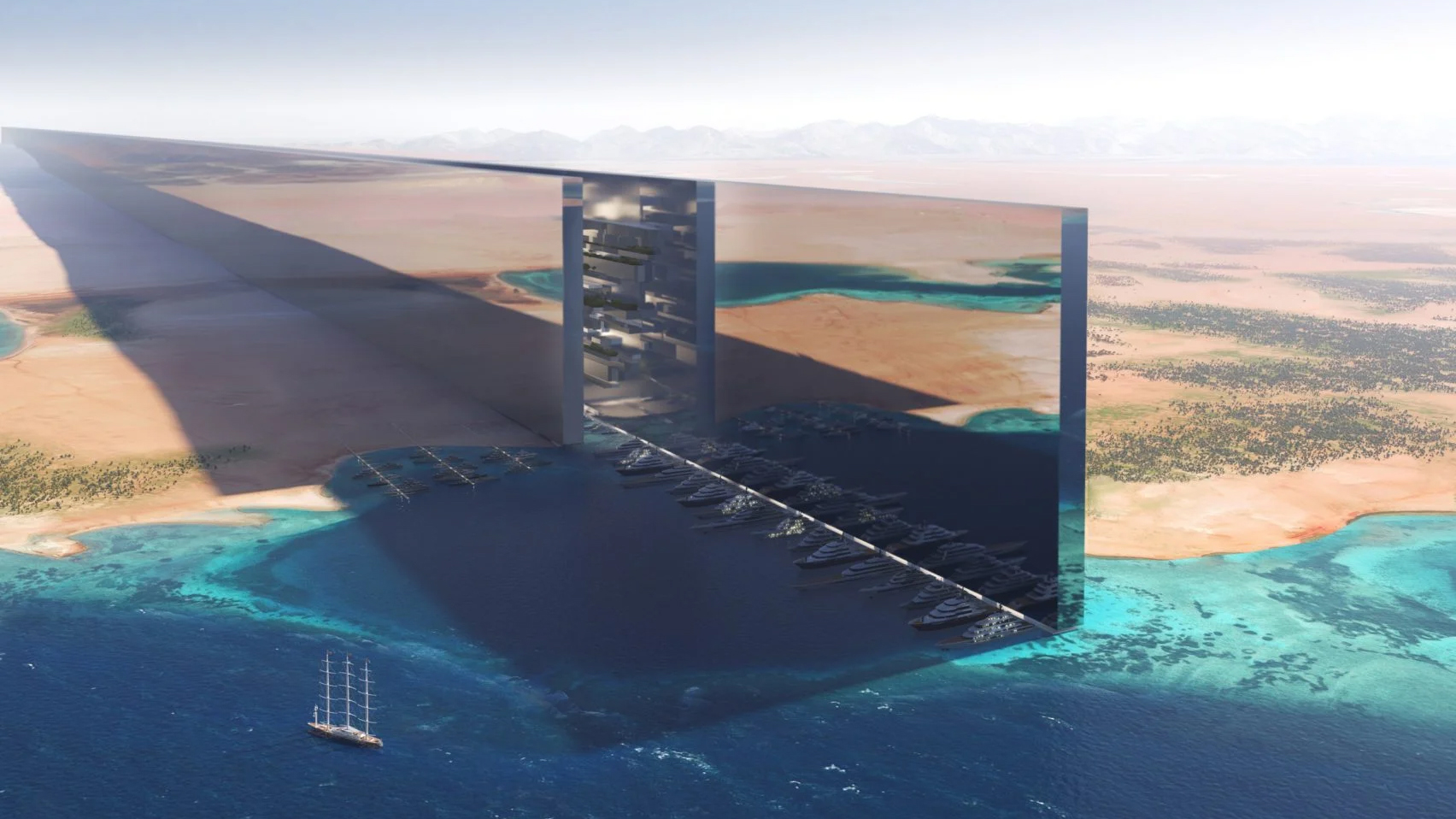

NEOM is a flagship initiative of Saudi Arabia, designed to diversify the national economy away from hydrocarbons while repositioning the Kingdom as a global logistics, energy, and technology leader. Unlike incremental port expansions elsewhere, NEOM is planned as a greenfield system, integrating port infrastructure, advanced manufacturing, renewable energy, and digital governance from inception.

Its Red Sea location places it directly along one of the world’s most critical shipping corridors, connecting the Indian Ocean to the Mediterranean via the Suez Canal. Approximately 12–15% of global seaborne trade passes through this axis, making proximity a structural advantage rather than a marketing claim.

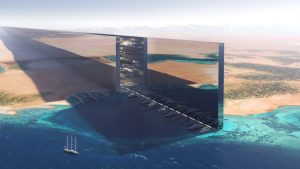

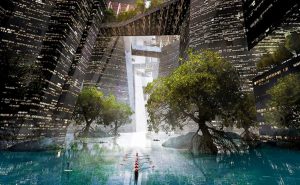

Oxagon: A Port-Industrial Paradigm

At the heart of NEOM’s maritime ambition lies Oxagon, envisioned as a next-generation industrial port city. Unlike traditional ports that retro-fit sustainability or automation, Oxagon is designed around them. The concept emphasizes automated terminals, net-zero energy systems, and digitally synchronized supply chains. Manufacturing facilities are planned adjacent to berths, minimizing inland transport and reducing logistics friction.

From a maritime economics perspective, this configuration aims to collapse the distance between production and export, shortening dwell times and improving schedule reliability—metrics that increasingly matter to liner operators facing volatile freight markets.

Future of NEOM city by 2023

–

Strategic Geography: Red Sea Versus Arabian Gulf

Why Location Matters More Than Ever

Dubai’s maritime strength is anchored in the Arabian Gulf, which requires all deep-sea traffic to transit the Strait of Hormuz. While historically manageable, this chokepoint has become a strategic liability during periods of regional tension. By contrast, NEOM’s Red Sea frontage bypasses Hormuz entirely, offering a route that many shipowners increasingly view as lower-risk from an insurance and operational standpoint.

This geographic distinction has practical implications. For Asia–Europe services, a Red Sea hub can function as a natural transshipment point before or after Suez, reducing deviation distances and potentially lowering bunker consumption. In an era of tight emissions regulations and FuelEU Maritime requirements, such efficiencies translate directly into compliance and cost advantages.

Implications for Shipping Networks

If Oxagon achieves its planned capacity, liner networks may gradually rebalance, allocating more transshipment volumes to the Red Sea. This does not imply an immediate decline for Gulf ports, but rather a diversification of hub functions. Dubai may retain strengths in regional distribution and value-added logistics, while NEOM positions itself as a manufacturing-export gateway tied to global liner services.

Technology, Sustainability, and Port Governance

Digital-First Port Operations

NEOM’s planners emphasize end-to-end digitalization, from berth allocation to customs clearance. Smart port concepts—already promoted by organizations such as the International Maritime Organization and industry groups like International Chamber of Shipping—are embedded into NEOM’s design rather than layered onto legacy systems. For ship operators, this could mean faster port stays, more reliable turnaround times, and reduced administrative overhead.

Sustainability as a Core Economic Driver

Where Dubai’s model prioritized speed and scale, NEOM places sustainability at the center of its value proposition. Renewable energy, green hydrogen, and low-emission logistics are not peripheral features; they are intended to define the port’s industrial identity. This aligns closely with emerging requirements from cargo owners, financiers, and classification societies such as DNV and Lloyd’s Register, which increasingly link port choice to ESG performance.

For maritime stakeholders, a port that supports alternative fuels and low-carbon operations could become strategically preferable, especially as charterers begin to factor port emissions into voyage calculations.

–

Can NEOM Realistically Replace Dubai?

Complementarity Versus Displacement

It is unlikely that NEOM will “replace” Dubai in a simplistic sense. Dubai’s strength lies in its mature services ecosystem, global connectivity, and business culture built over decades. However, NEOM does not need to replicate these features to be impactful. By specializing in large-scale industrial exports, energy-intensive manufacturing, and Red Sea transshipment, NEOM could absorb functions that Dubai was never designed to host.

In this sense, the relationship may evolve toward functional differentiation rather than zero-sum competition. Maritime history offers parallels: Singapore and Hong Kong coexisted for decades by serving overlapping yet distinct roles in Asian shipping networks.

Time Horizons and Execution Risk

Dubai’s advantage is time-tested reliability. NEOM’s challenge lies in execution—delivering complex infrastructure, regulatory clarity, and workforce capability simultaneously. For shipowners and terminal operators, confidence will depend on demonstrated performance rather than master plans. Early adopters may benefit from incentives and strategic positioning, but widespread network shifts will occur only after operational proof.

–

Future Outlook and Maritime Trends

Looking ahead to the 2030s, the Middle East’s maritime map is likely to become more polycentric. Red Sea ports—including NEOM—are positioned to gain prominence as global trade rebalances and sustainability constraints tighten. Dubai, meanwhile, may increasingly emphasize high-value logistics, maritime services, and regional distribution.

For maritime professionals, the strategic imperative is flexibility. Fleet deployment, port partnerships, and digital integration strategies must account for a future in which Red Sea hubs play a larger role in global liner and bulk networks.

–

Frequently Asked Questions

Will NEOM immediately divert traffic from Dubai ports?

No. Any shift will be gradual and driven by operational performance, cost efficiency, and shipowner confidence rather than political intent alone.

Why is the Red Sea location so important?

It allows ships to avoid the Strait of Hormuz and sit directly on the Asia–Europe trade lane, reducing risk and voyage deviation.

Is Oxagon designed mainly for containers?

Containers are important, but the emphasis is equally on industrial exports, energy products, and integrated manufacturing logistics.

How does sustainability influence port competition?

Ports supporting low-emission operations and alternative fuels are increasingly favored by cargo owners, financiers, and regulators.

Can Dubai adapt to NEOM’s rise?

Yes. Dubai has repeatedly demonstrated adaptability and may reposition toward services and advanced logistics rather than heavy industry.

What should shipowners watch most closely?

Actual terminal performance, regulatory clarity, and hinterland connectivity once Oxagon becomes operational.

–

Conclusion: A Regional Rebalancing, Not a Simple Replacement

NEOM represents Saudi Arabia’s most ambitious attempt to reshape regional trade geography. While it is unlikely to erase Dubai’s role, it has the potential to redefine how maritime value is distributed across West Asia. For the shipping industry, this evolution offers both opportunity and complexity—demanding informed, forward-looking decisions grounded in operational realities rather than headlines.

–

References

-

International Maritime Organization – Port digitalization and maritime sustainability frameworks

-

International Chamber of Shipping – Global shipping and port trends

-

UNCTAD – Review of Maritime Transport (latest edition)

-

World Bank – Port reform and logistics performance indicators

-

DNV – Green ports and alternative fuels guidance

-

Lloyd’s Register – Port sustainability and ESG reporting

-

The Maritime Executive; Marine Log – Industry analysis on Red Sea trade and Middle East ports

Thanks !