12/27/2025

The Global Chokepoint

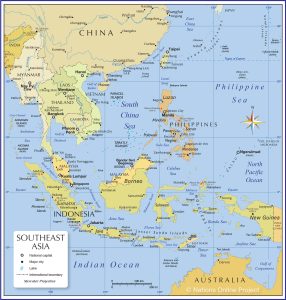

The Strait of Malacca is one of the world’s most critical maritime arteries. This narrow passage between the Malay Peninsula and the Indonesian island of Sumatra funnels nearly one-third of global traded goods, including vast quantities of oil, manufactured goods, and raw materials moving between the factories of East Asia and markets in Europe, the Middle East, and beyond. Its strategic importance is matched only by its vulnerability. Congestion, piracy risks, geopolitical tensions, and environmental concerns have long prompted shipping lines, logistics planners, and national governments to consider viable alternatives. In today’s dynamic landscape—shaped by the Red Sea crisis, shifting alliances, and new infrastructure—exploring these substitute routes is not an academic exercise but a commercial imperative for resilient supply chains.

This guide provides a comprehensive, multi-faceted analysis of the substitute routes for shipping in Southeast Asia, offering logistics professionals the insights needed to navigate a complex and evolving maritime map.

The Imperative for Alternatives: Why Look Beyond Malacca?

The search for alternatives is driven by a confluence of persistent and emerging challenges:

-

Capacity and Congestion: The strait is approaching its practical vessel capacity, leading to delays.

-

Geopolitical Risks: Tensions in surrounding waters add a layer of uncertainty to transit.

-

Security Concerns: While reduced, piracy remains a threat.

-

Economic Sovereignty: Nations seek to reduce dependency on this single point of failure.

-

Cascading Disruptions: Recent global events prove that regional conflicts can trigger global rerouting. For instance, the Red Sea crisis has caused a “wave of new traffic” at western Mediterranean ports like Malaga, as ships divert around the Cape of Good Hope, demonstrating how disruption in one chokepoint alters global shipping patterns.

Analysis of Primary Geographic Alternative Routes

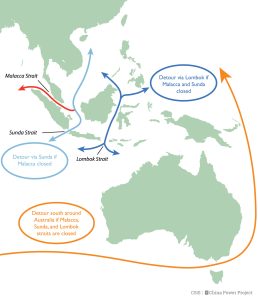

1. The Sunda Strait & Lombok-Makassar Route

Located between Java and Sumatra, the Sunda Strait is the most direct alternative for vessels coming from the Indian Ocean heading to Jakarta or North Asian ports wanting to avoid the southern Malacca squeeze. However, it is shallower and less developed for ultra-large container ships. For very large crude carriers (VLCCs) and bulk carriers coming from Western Australia, the deeper Lombok and Makassar straits in Indonesia offer a more viable, albeit longer, pathway into the Java Sea and South China Sea.

Comparative Analysis:

-

Advantages: Reduces Malacca congestion; Lombok offers deep-water access.

-

Disadvantages: Adds significant distance (1,000+ nautical miles) and transit time (3-4 days) from the Indian Ocean to East Asia; limited port infrastructure for major transshipment along the route.

2. The Rise of the Kra Canal Concept

The centuries-old idea of a canal across the Isthmus of Kra in southern Thailand promises the most dramatic reshaping of regional logistics. A canal would allow vessels to bypass the Strait of Malacca entirely, sailing directly from the Andaman Sea to the Gulf of Thailand.

-

Strategic Impact: Would create a new global shipping lane, potentially turning ports like Songkhla and Phuket into major hubs.

-

Current Reality: Despite periodic discussion, the project faces monumental financial, environmental, and political hurdles, making it a long-term possibility rather than a near-term solution.

3. Overland & Land Bridge Corridors

These are not sea routes but multimodal alternatives that combine short-sea shipping with rail or road transport across a landmass.

-

China-Europe Rail Links: While not a direct sea substitute, these rail corridors from China to Europe offer an alternative for time-sensitive cargo, pulling some volume from the all-water Asia-Europe route via Malacca.

-

Thai Land Bridge Proposals: Similar to the canal concept but involving linked seaports on either coast connected by dedicated rail/road infrastructure. This is a more modular and potentially feasible project being actively studied by the Thai government.

4. The Northern Sea Route (NSR)

For a truly paradigm-shifting alternative, the melting Arctic ice is opening the NSR along Russia’s northern coast. This route connects Northeast Asia to Northern Europe and can slash voyage times by up to 40% compared to the Suez/Malacca route.

-

Southeast Asia Relevance: Primarily benefits North Asian ports (Busan, Shanghai, Ningbo), but its growth could alter global shipping networks and the relative importance of Southeast Asian transshipment hubs.

-

Challenges: Limited operational window, high insurance costs, need for ice-class vessels, and geopolitical complexities.

Table: Comparative Overview of Key Alternative Routes

| Route | Key Advantage | Primary Disadvantage | Suitable For |

|---|---|---|---|

| Lombok/Makassar | Deep water, avoids Malacca congestion | Adds significant distance/time | VLCCs, bulk carriers to/from Australia |

| Sunda Strait | Most direct alternative | Shallow, limited for ULCS | Smaller vessels, regional traffic |

| Kra Canal (Concept) | Complete bypass, massive time savings | Immense cost & political hurdles | Future potential for all vessel types |

| Northern Sea Route | Shortest Asia-Europe link | Seasonal, icy, politically sensitive | Growing niche for non-perishables |

Carrier Network Analysis: How Shipping Alliances Are Adapting

Major carriers are constantly optimizing their service networks in response to market demands and disruptions. The recent Ocean Alliance DAY9 product announcement reveals how alliances structure complex route portfolios. For example, their Far East-Northwest Europe and Far East-Mediterranean services are explicitly offered in two versions: “Cape of Good Hope” and “Suez,” allowing for flexibility amid Red Sea instability. This network-level agility indirectly affects Southeast Asia, as major hubs like Singapore and Port Klang remain pivotal in these global rotations.

Specific service adjustments highlight this dynamism:

-

New Intra-Asia Services: Carriers are bolstering regional networks. OOCL launched the Indonesia Vietnam Straits Express (IVS), connecting Singapore, Ho Chi Minh City, Surabaya, and Semarang. This enhances feeder options that can connect to alternative trunk routes.

-

Revised Mediterranean Rotations: Hapag-Lloyd’s SE3 service now includes Malaga in its revised rotation (Qingdao – Port Said – Izmit – Istanbul – Singapore – Qingdao), indicating the port’s growing role as a western Mediterranean hub for diverted traffic.

-

Transpacific Focus: The dense network of services from Southeast Asia to North America, such as the Ocean Alliance’s AWE3 service (which includes Klang and Cai Mep), offers shippers multiple gateway options to the US, allowing cargo to bypass potential chokepoints later in the journey.

Cost, Time, and Operational Considerations

Choosing an alternative route involves a fundamental trade-off between reliability, cost, and speed.

-

Transit Time: The most direct route is often the fastest. Diverting via Lombok or around the Cape of Good Hope adds days or weeks. For example, a container ship from Algeciras to Singapore takes approximately 28-29 days on a direct route, while a diversion around Africa would extend this significantly. As a reference, shipping from Spain to Vietnam by sea can take over 35 days.

-

Freight Costs: Longer routes mean higher fuel consumption (bunker) costs, which are often passed on as fuel adjustment factors. Port calls at less mainstream terminals may also incur different handling fees. During peak seasons or disruptions, carriers implement General Rate Increases (GRIs) and peak season surcharges, which can affect all routes.

-

Operational Flexibility: Alternative routes often involve different port sequences and feeder connections. Using the LCL (Less than Container Load) option on these routes may involve more complex transshipment, impacting cargo integrity and final delivery windows.

-

Hidden Expenses: Shippers must account for cargo insurance (typically 0.3%-0.5% of cargo value), potential detention and demurrage charges at alternative ports, and the inventory carrying costs of goods in transit for longer periods.

Strategic Outlook and Recommendations for Shippers

The future of Southeast Asian shipping is multipolar. No single route will replace the Strait of Malacca, but a portfolio of options will gain prominence.

Key trends shaping the future:

-

Infrastructure Investment: Look for increased investment in ports along alternative corridors, such as those in Eastern Indonesia (e.g., Bitung) or on the Indian Ocean coast of Thailand.

-

Alliance Agility: Carrier alliances will continue to design redundant and flexible service loops that can switch between Suez, Cape of Good Hope, and other passages as conditions demand.

-

Digital Integration: Tools for real-time route optimization, carbon emission tracking, and multi-modal booking will become essential for managing complex routings.

Actionable Recommendations for Logistics Planners:

-

Diversify Your Portfolio: Avoid over-reliance on a single lane or port. Develop relationships with carriers that offer diverse service strings.

-

Leverage Data Tools: Use platforms that provide comparative transit times, costs, and schedule reliability for different route options.

-

Build in Buffer Time: When using longer alternative routes, adjust your supply chain lead times and inventory models accordingly.

-

Secure Comprehensive Insurance: Ensure your cargo insurance policy is robust and clearly defines coverage for chosen routes, especially those deemed higher risk.

-

Stay Informed: Monitor geopolitical and operational updates. Subscribing to carrier service updates from partners like Kuehne+Nagel is crucial.

Conclusion: Embracing a Multi-Route Future

The search for substitute routes to the Strait of Malacca is a clear indicator of a global shipping industry building resilience through diversification. From the deep waters of Lombok to the digital planning tools that map new corridors, the options are expanding. For businesses, understanding these alternatives is no longer about contingency planning alone; it’s about gaining competitive advantage. By strategically evaluating the trade-offs between cost, time, and reliability across this new maritime landscape, shippers can build more robust, efficient, and future-proof supply chains. The era of single-point dependency is ending, and the future belongs to those who can navigate the complexities of a multi-route world.

Disclaimer: This article is for informational purposes. Freight rates, transit times, and service details are subject to constant change. Always consult with your logistics provider or a freight forwarder for the latest information and specific planning.